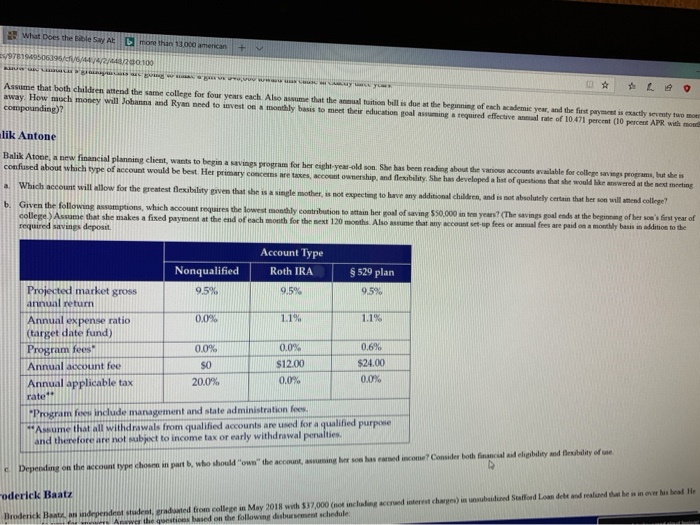

s! What Does the 11000 can 07014/2 Asume that both children a nd the same college for four years each Also assume that the mouton billis due at the beginnt of each wcademic yes, and the first part is exactly away How much money will Johanna and Ryan need to mesto & monthly basis to meet the ion roa m ing required effective me of 10.1 (10 pc compounding)? t APR o me lik Antone Balik Atone, financial planning client want to be a program for her year-old son. She has been reading about the wable for college programs, but she is confused about which type of account would be best. Her primary concerns are taxes, account ownership, and flexibility. She has developed a t of questions that he would l owered the next meeting a Which account will allow for the greatest flexibility even that has a single mother is not expecting to have my additional children, and is absolutely that he will college b. Geven the following ptions, which account requires the lowest monthly contribution to t he pool of saving $50,000 in ten years? (The wavings old at the beging of h e 's first year of college Assume that she makes a fixed payment at the end of each month for the next 120 monthsAlon e that my account set up fees or malfees are paid on a moly basis in lition to the required savings deposit Account Type Roth IRA 529 plan Nonqualified 9.5% 9.5% 95 0.0% 1.1% 1.1% Projected market gross annual return Annual expense ratio (target date fund) Program fees Annual account fee Annual applicable tax 0.0% 0.0% 0.6% $24.00 0.0% $12.00 0.0% SO 20.0% rate "Program fees include management and state administration fees **Asume that all withdrawals from qualified accounts are used for a qualified purpose and therefore are not subject to income tax or early withdrawal penalties play ers of so has earned income? Consider both financial w type che in part, who should own the scent, assuming a l d Suled o d e d oderick Baatz weetch ed from college in May 2018 with 537,000 (no inclong es the following des c hedule s! What Does the 11000 can 07014/2 Asume that both children a nd the same college for four years each Also assume that the mouton billis due at the beginnt of each wcademic yes, and the first part is exactly away How much money will Johanna and Ryan need to mesto & monthly basis to meet the ion roa m ing required effective me of 10.1 (10 pc compounding)? t APR o me lik Antone Balik Atone, financial planning client want to be a program for her year-old son. She has been reading about the wable for college programs, but she is confused about which type of account would be best. Her primary concerns are taxes, account ownership, and flexibility. She has developed a t of questions that he would l owered the next meeting a Which account will allow for the greatest flexibility even that has a single mother is not expecting to have my additional children, and is absolutely that he will college b. Geven the following ptions, which account requires the lowest monthly contribution to t he pool of saving $50,000 in ten years? (The wavings old at the beging of h e 's first year of college Assume that she makes a fixed payment at the end of each month for the next 120 monthsAlon e that my account set up fees or malfees are paid on a moly basis in lition to the required savings deposit Account Type Roth IRA 529 plan Nonqualified 9.5% 9.5% 95 0.0% 1.1% 1.1% Projected market gross annual return Annual expense ratio (target date fund) Program fees Annual account fee Annual applicable tax 0.0% 0.0% 0.6% $24.00 0.0% $12.00 0.0% SO 20.0% rate "Program fees include management and state administration fees **Asume that all withdrawals from qualified accounts are used for a qualified purpose and therefore are not subject to income tax or early withdrawal penalties play ers of so has earned income? Consider both financial w type che in part, who should own the scent, assuming a l d Suled o d e d oderick Baatz weetch ed from college in May 2018 with 537,000 (no inclong es the following des c hedule