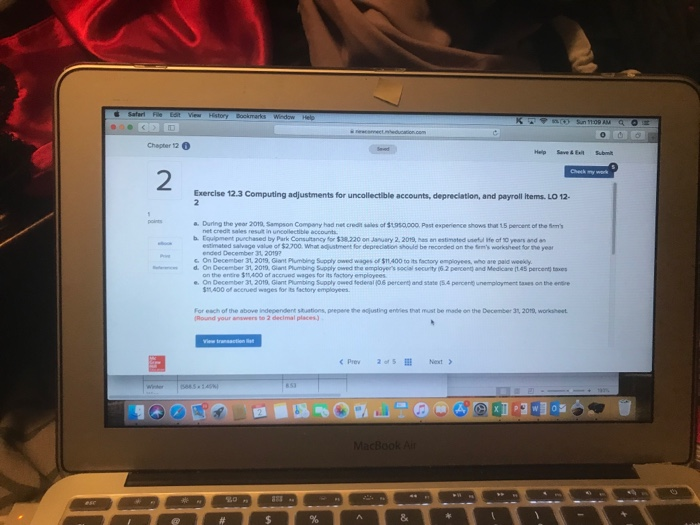

Safar Chepter 12 0 2 Exercise 12.3 Computing adjustments for uncollectible accounts, depreciation, and payroll ltems. LO 12- a. During the year 2019, Sampson Company had net credit sales of $1.050000 Past expenience shows thi 15 pencene of the Sems net credit sales b. Equipment punchased by Park Consultancy for $38,220 on January 2, 2019, thes en estimated unetul life of 10 years and an G. On December 31 2019, Gliant Plumbing Supply owed wages of $11,400 to its factory employees, who are paid weekly e. On December 3t 2019, Glant Plumbing Supply owed federal 106 percen) and state (5.4 percent) unemployment taxes on the endre estimated salvage value of $2700 What adjustment for deprecidtion should be reconded on the ' worksheet for he year ended December 31 2019 on the entire $11,400 of accrued wages for its factory enployees 11,400 off acerued wages for its factory employees For each of the above independere stations, prepere Round your answers to 2 declmal places e edisting emies mat must be made on thg Decerber 31, 2019, woksheet. on the December 31 Safar Chepter 12 0 2 Exercise 12.3 Computing adjustments for uncollectible accounts, depreciation, and payroll ltems. LO 12- a. During the year 2019, Sampson Company had net credit sales of $1.050000 Past expenience shows thi 15 pencene of the Sems net credit sales b. Equipment punchased by Park Consultancy for $38,220 on January 2, 2019, thes en estimated unetul life of 10 years and an G. On December 31 2019, Gliant Plumbing Supply owed wages of $11,400 to its factory employees, who are paid weekly e. On December 3t 2019, Glant Plumbing Supply owed federal 106 percen) and state (5.4 percent) unemployment taxes on the endre estimated salvage value of $2700 What adjustment for deprecidtion should be reconded on the ' worksheet for he year ended December 31 2019 on the entire $11,400 of accrued wages for its factory enployees 11,400 off acerued wages for its factory employees For each of the above independere stations, prepere Round your answers to 2 declmal places e edisting emies mat must be made on thg Decerber 31, 2019, woksheet. on the December 31