Answered step by step

Verified Expert Solution

Question

1 Approved Answer

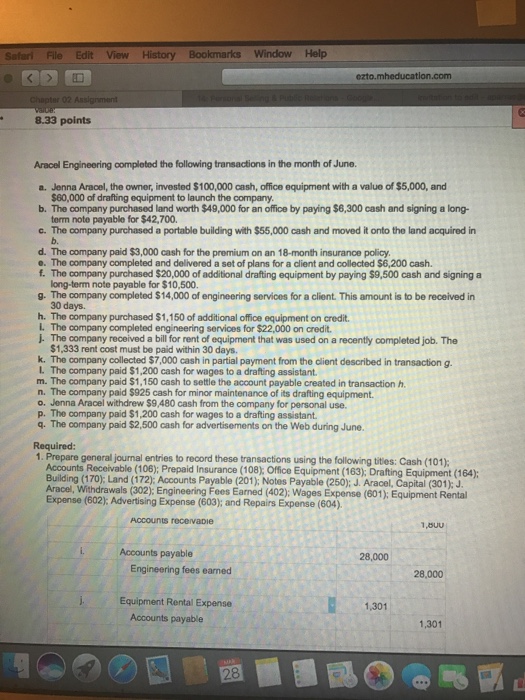

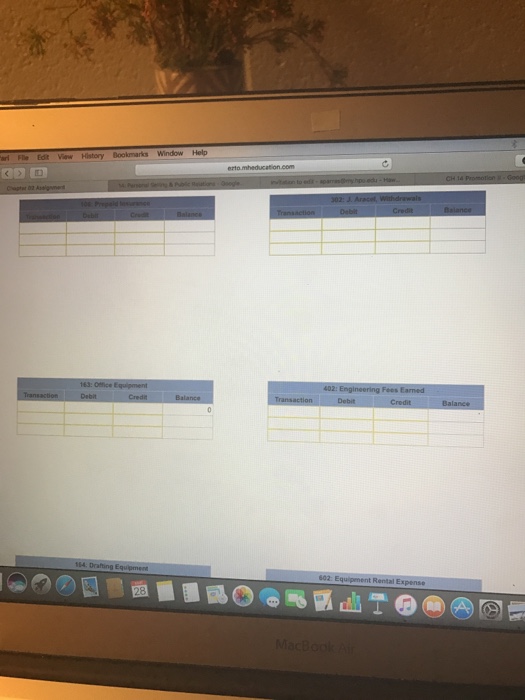

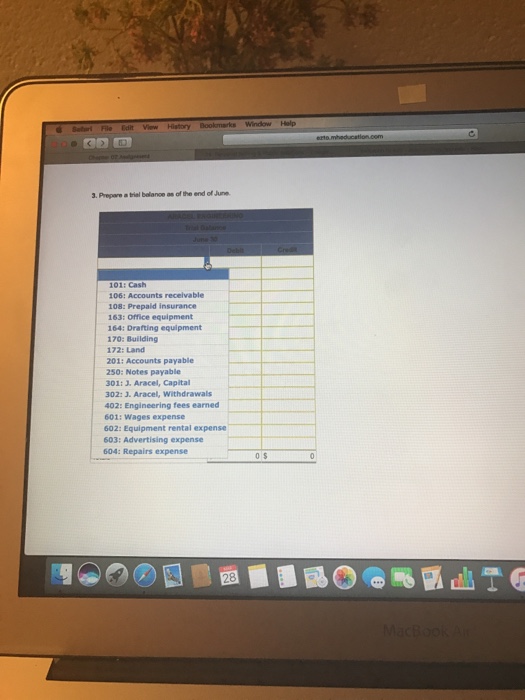

Safari File Edit View History Bookmarks Window Help ezta,mheducatlan.com points transactions in the month of June Aracel Engineering oompleted the following a. Jenna Aracel, the

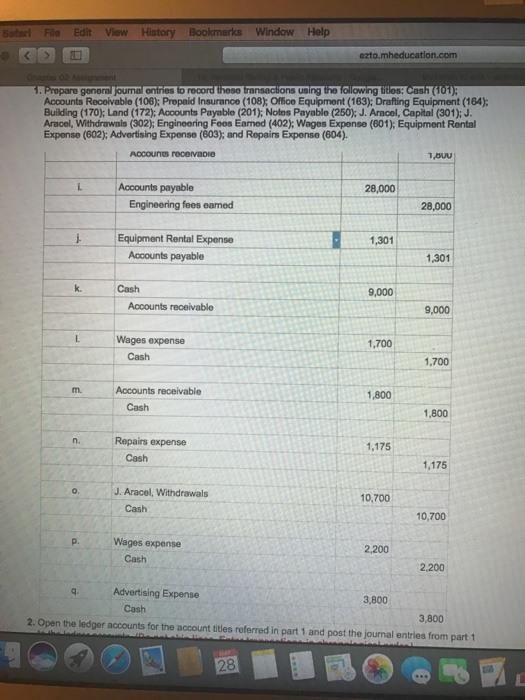

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

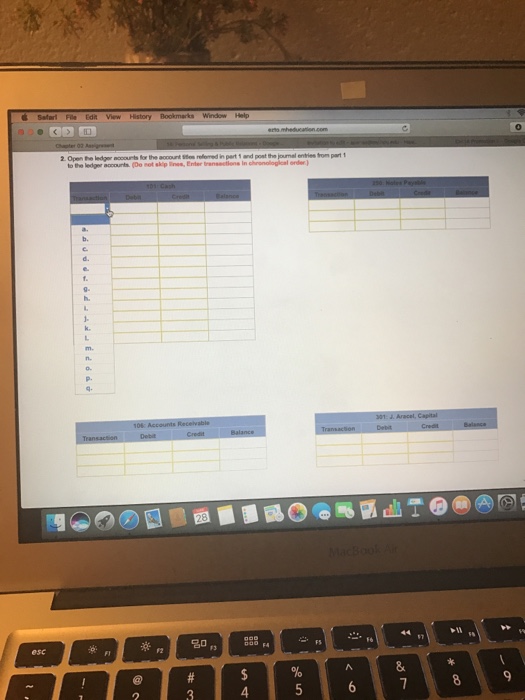

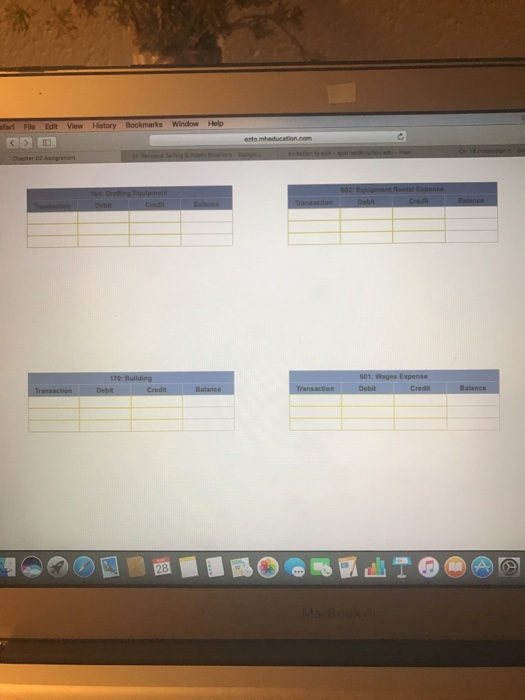

Step: 2

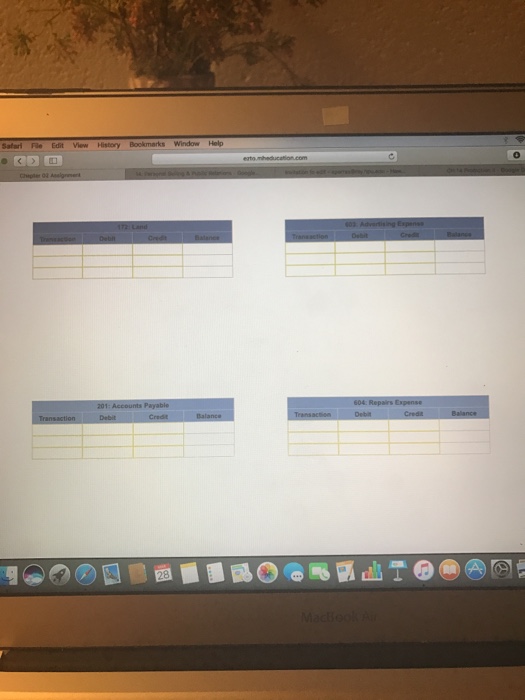

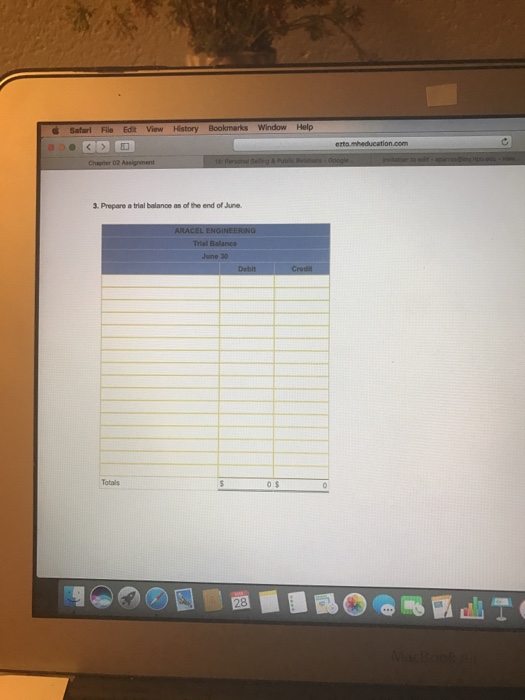

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started