Salem his budget is 3000 dollars help him to buy his dream car

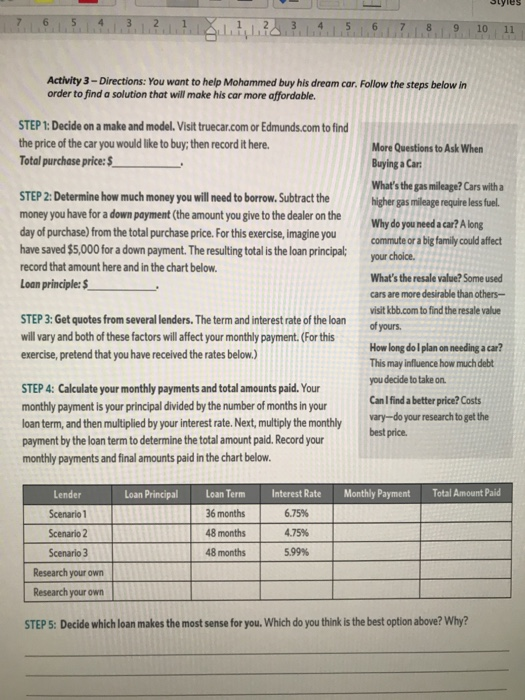

styles 7 6 5 4 3 2 1 LLL? 3.1.4.1.5 6 7 8 9 10 11 Activity 3 - Directions: You want to help Mohammed buy his dream cor. Follow the steps below in order to find a solution that will make his car more affordable. STEP 1: Decide on a make and model. Visit truecar.com or Edmunds.com to find the price of the car you would like to buy; then record it here. Total purchase price: $ STEP 2: Determine how much money you will need to borrow. Subtract the money you have for a down payment (the amount you give to the dealer on the day of purchase) from the total purchase price. For this exercise, Imagine you have saved $5,000 for a down payment. The resulting total is the loan principal; record that amount here and in the chart below. Loan principle: $ More Questions to Ask When Buying a Car What's the gas mileage? Cars with a higher gas mileage require less fuel. Why do you need a car? A long commute or a big family could affect your choice. What's the resale value? Some used cars are more desirable than others- visit kbb.com to find the resale value of yours. How long do I plan on needing a car? This may influence how much debt you decide to take on Can I find a better price? Costs vary-do your research to get the best price STEP 3: Get quotes from several lenders. The term and interest rate of the loan will vary and both of these factors will affect your monthly payment. (For this exercise, pretend that you have received the rates below.) STEP 4: Calculate your monthly payments and total amounts paid. Your monthly payment is your principal divided by the number of months in your loan term, and then multiplied by your interest rate. Next, multiply the monthly payment by the loan term to determine the total amount pald. Record your monthly payments and final amounts paid in the chart below. Loan Principal Monthly Payment Total Amount Paid Interest Rate 6.75% Lender Scenario 1 Scenario 2 Scenario 3 Loan Term 36 months 48 months 48 months 4.75% 5.99% Research your own Research your own STEP 5: Decide which loan makes the most sense for you. Which do you think is the best option above? Why