Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following Trading and Profit and Loss Account of Fantasy Ltd. for the year 31-3-2000 is given below Calculate: Sales (30% cash sales) Cost

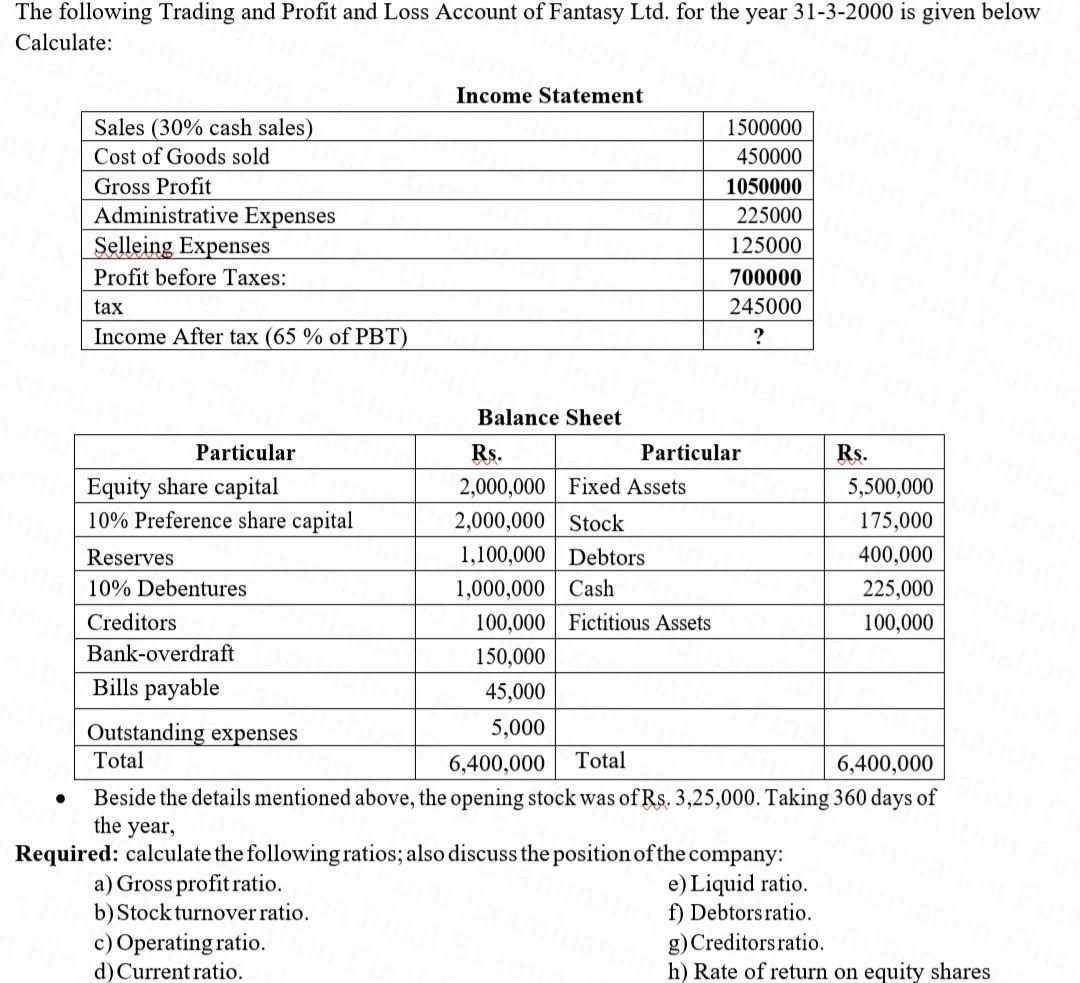

The following Trading and Profit and Loss Account of Fantasy Ltd. for the year 31-3-2000 is given below Calculate: Sales (30% cash sales) Cost of Goods sold Gross Profit Administrative Expenses Selleing Expenses Profit before Taxes: tax Income After tax (65 % of PBT) Particular Equity share capital 10% Preference share capital Reserves 10% Debentures Creditors Bank-overdraft Bills payable Outstanding expenses Total Income Statement a) Gross profit ratio. b) Stock turnover ratio. c) Operating ratio. d) Current ratio. Balance Sheet 15000002 450000 1050000 225000 125000 Rs. 2,000,000 Fixed Assets 2,000,000 Stock 1,100,000 Debtors 1,000,000 Cash 100,000 Fictitious Assets 150,000 45,000 5,000 700000 245000 ? Particular Rs. 6,400,000 Total 6,400,000 Beside the details mentioned above, the opening stock was of Rs. 3,25,000. Taking 360 days of the year, Required: calculate the following ratios; also discuss the position of the company: e) Liquid ratio. f) Debtors ratio. 5,500,000 175,000 400,000 225,000 100,000 g) Creditors ratio. h) Rate of return on equity shares

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The answer below provides step by step manner a gross profit quantitative relation Gross Profit Sales x a hundred 1050000 1500000 x 100 70 The companys margin as compared to Cost is higher and it show...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started