Question

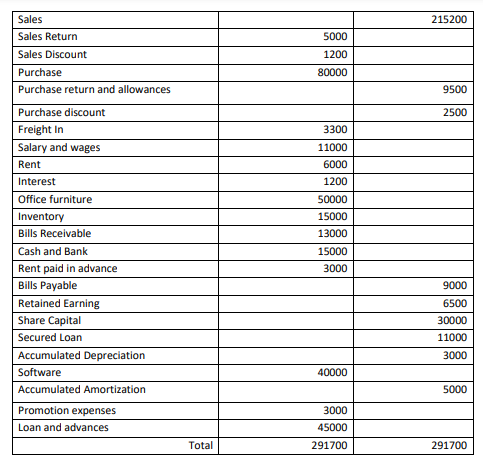

Sales 215200 Sales Return 5000 Sales Discount 1200 Purchase 80000 Purchase return and allowances 9500 Purchase discount 2500 Freight In 3300 Salary and wages 11000

Sales 215200 Sales Return 5000 Sales Discount 1200 Purchase 80000 Purchase return and allowances 9500 Purchase discount 2500 Freight In 3300 Salary and wages 11000 Rent 6000 Interest 1200 Office furniture 50000 Inventory 15000 Bills Receivable 13000 Cash and Bank 15000 Rent paid in advance 3000 Bills Payable 9000 Retained Earning 6500 Share Capital 30000 Secured Loan 11000 Accumulated Depreciation 3000 Software 40000 Accumulated Amortization 5000 Promotion expenses 3000 Loan and advances 45000 Total 291700 291700

Prepare the statement of profit and loss and Balance sheet after considering following adjustment

a. Current year depreciation 3000 and amortization 2500 b. Accrued interest on Loan and advances 1700. c. Outstanding salary and wages 1500 d. Estimated income tax, 5000 e. Closing inventory 26000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started