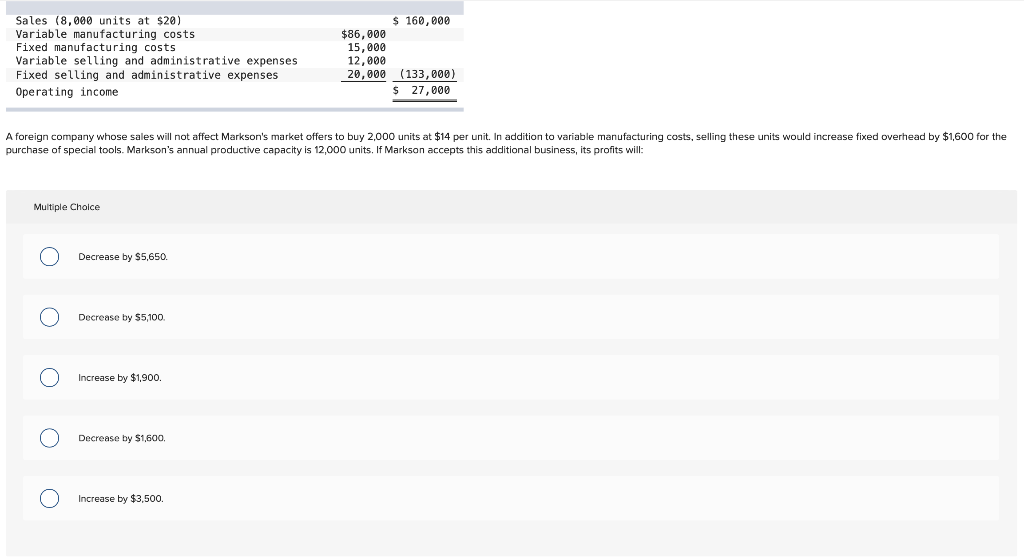

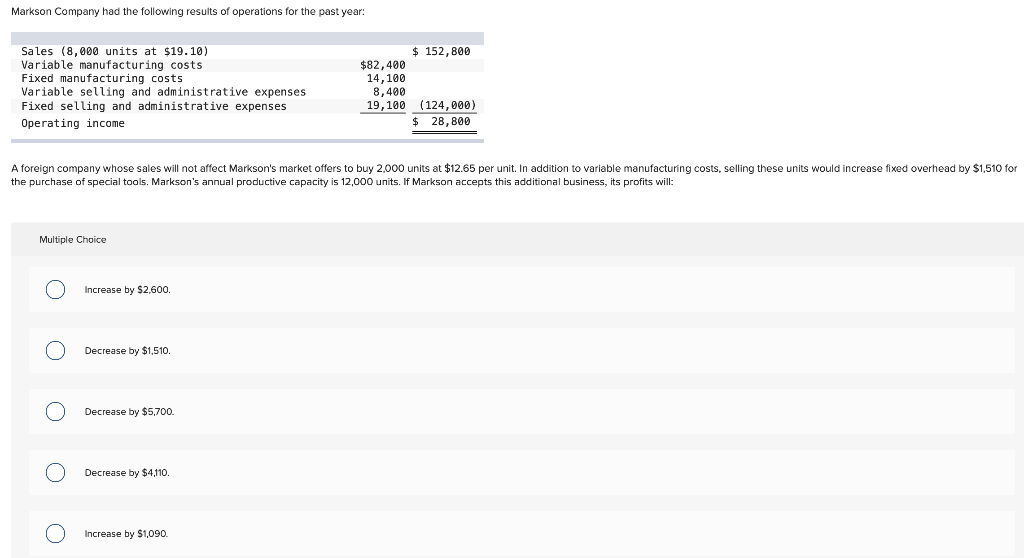

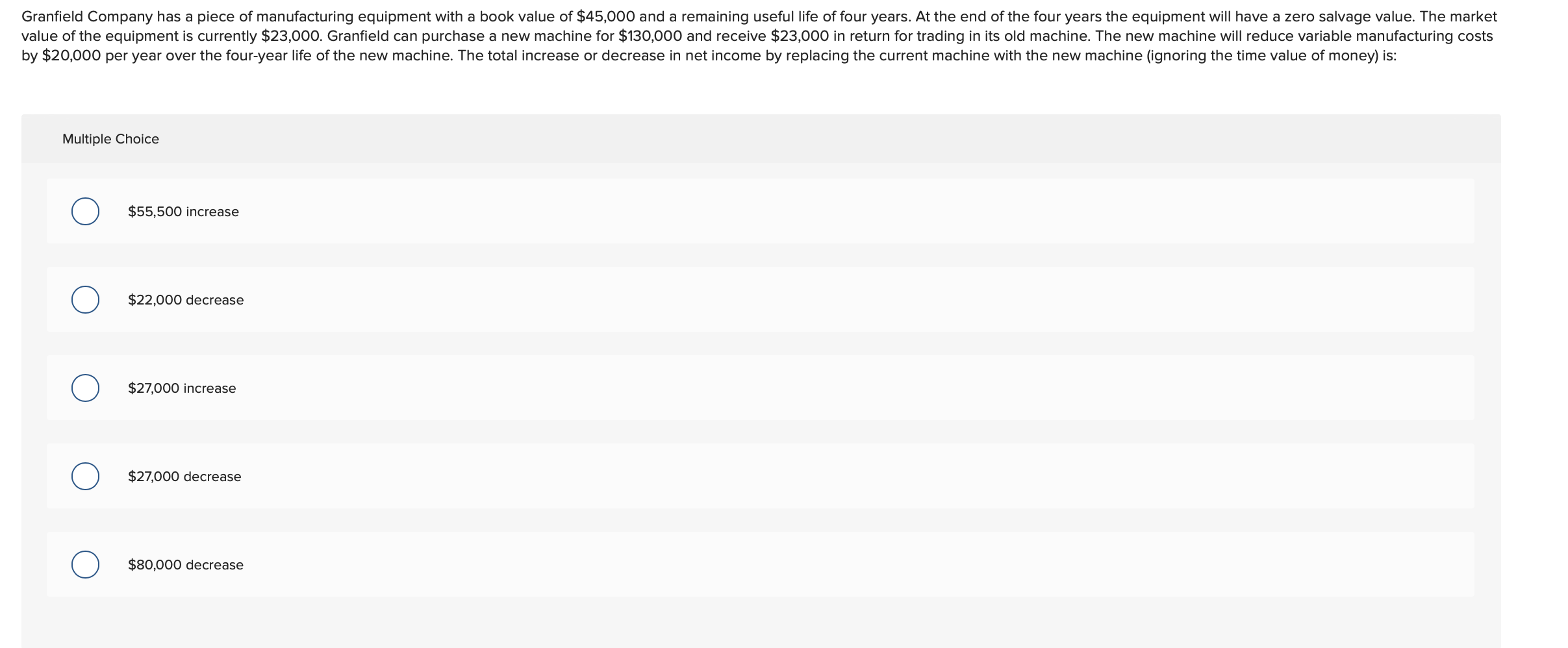

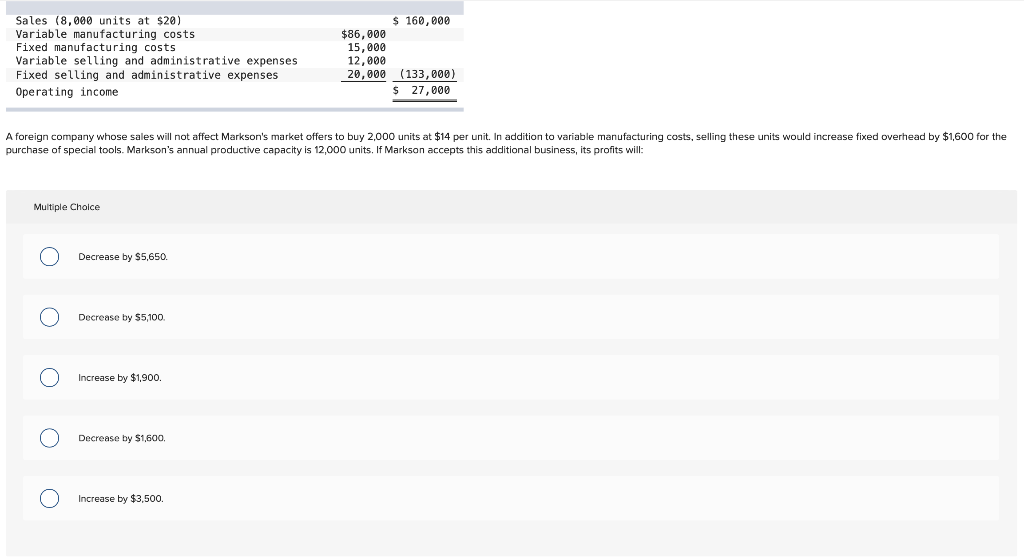

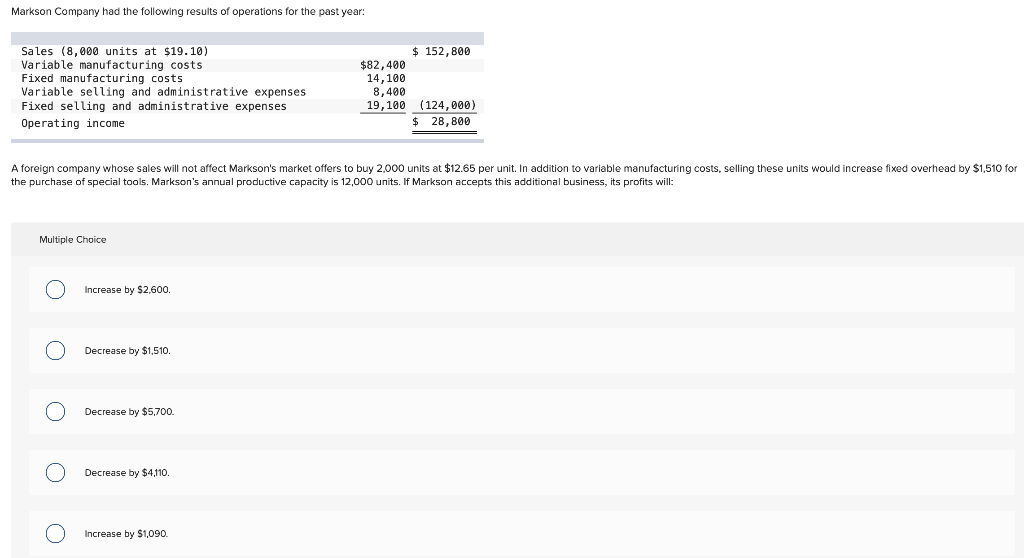

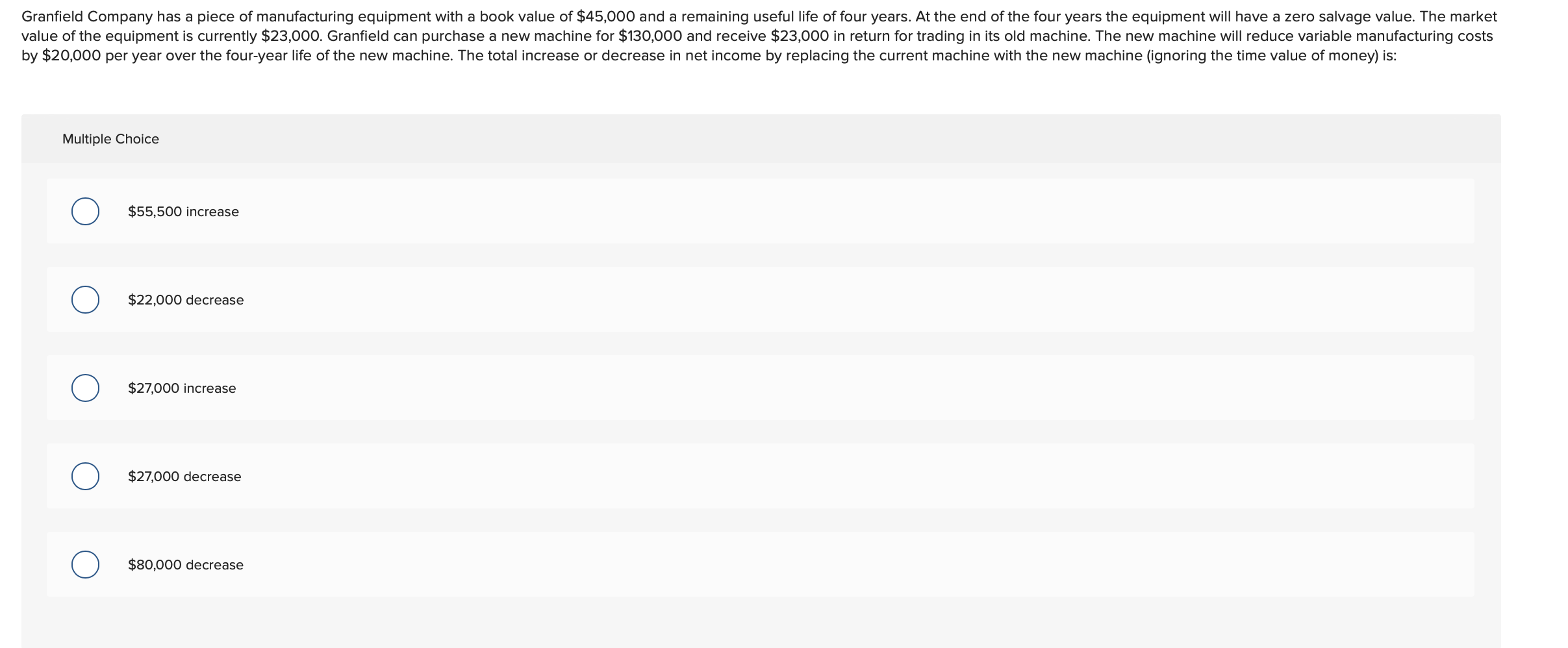

Sales (8,000 units at $20) Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses Operating income $ 160,000 $86,000 15,000 12,000 20,000 (133,000) $ 27,000 A foreign company whose sales will not affect Markson's market offers to buy 2,000 units at $14 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $1,600 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will: Multiple Choice O Decrease by $5,650. Decrease by $5,100. O Increase by $1,900. 0 Decrease by $1,600, Increase by $3,500. Markson Company had the following results of operations for the past year: Sales (8,000 units at $19.10) Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses Operating income $ 152,800 $82,400 14,100 8,400 19,100 (124,000) $ 28,800 A foreign company whose sales will not affect Markson's market offers to buy 2,000 units at $12.65 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $1,510 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will: Multiple Choice Increase by $2,600 O Decrease by $1,510 Decrease by $5,700. O Decrease by $4,110. Increase by $1,090. Granfield Company has a piece of manufacturing equipment with a book value of $45,000 and a remaining useful life of four years. At the end of the four years the equipment will have a zero salvage value. The market value of the equipment is currently $23,000. Granfield can purchase a new machine for $130,000 and receive $23,000 in return for trading in its old machine. The new machine will reduce variable manufacturing costs by $20,000 per year over the four-year life of the new machine. The total increase or decrease in net income by replacing the current machine with the new machine (ignoring the time value of money) is: Multiple Choice $55,500 increase $22,000 decrease $27,000 increase $27,000 decrease $80,000 decrease Sales (8,000 units at $20) Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses Operating income $ 160,000 $86,000 15,000 12,000 20,000 (133,000) $ 27,000 A foreign company whose sales will not affect Markson's market offers to buy 2,000 units at $14 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $1,600 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will: Multiple Choice O Decrease by $5,650. Decrease by $5,100. O Increase by $1,900. 0 Decrease by $1,600, Increase by $3,500. Markson Company had the following results of operations for the past year: Sales (8,000 units at $19.10) Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative expenses Fixed selling and administrative expenses Operating income $ 152,800 $82,400 14,100 8,400 19,100 (124,000) $ 28,800 A foreign company whose sales will not affect Markson's market offers to buy 2,000 units at $12.65 per unit. In addition to variable manufacturing costs, selling these units would increase fixed overhead by $1,510 for the purchase of special tools. Markson's annual productive capacity is 12,000 units. If Markson accepts this additional business, its profits will: Multiple Choice Increase by $2,600 O Decrease by $1,510 Decrease by $5,700. O Decrease by $4,110. Increase by $1,090. Granfield Company has a piece of manufacturing equipment with a book value of $45,000 and a remaining useful life of four years. At the end of the four years the equipment will have a zero salvage value. The market value of the equipment is currently $23,000. Granfield can purchase a new machine for $130,000 and receive $23,000 in return for trading in its old machine. The new machine will reduce variable manufacturing costs by $20,000 per year over the four-year life of the new machine. The total increase or decrease in net income by replacing the current machine with the new machine (ignoring the time value of money) is: Multiple Choice $55,500 increase $22,000 decrease $27,000 increase $27,000 decrease $80,000 decrease