Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales Allowances Fitz - Chivalry Corporation reports the following information on its 2 0 1 9 income statement. Required income statement? Assume the company's combined

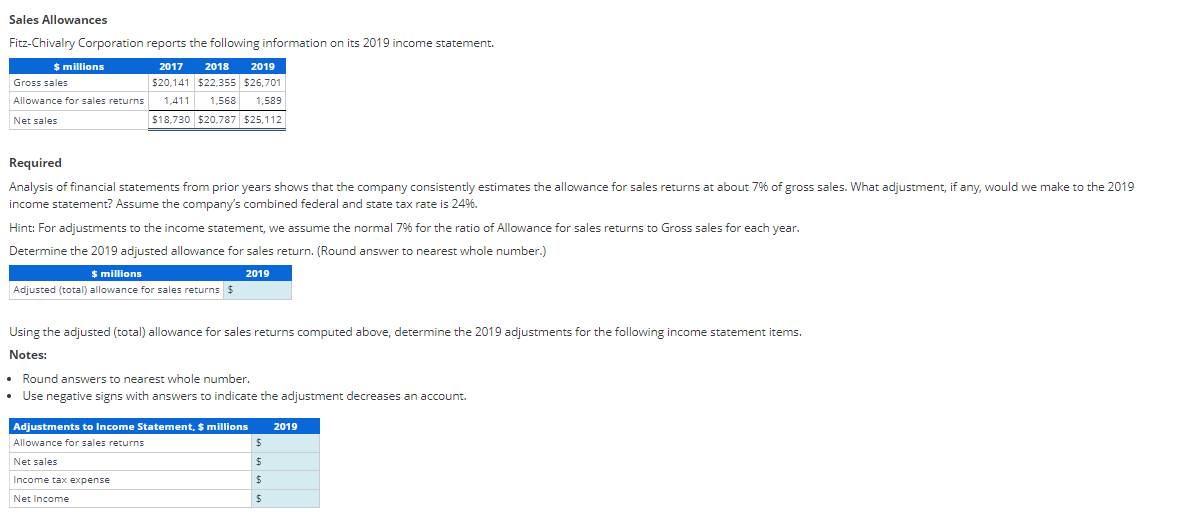

Sales Allowances

FitzChivalry Corporation reports the following information on its income statement.

Required

income statement? Assume the company's combined federal and state tax rate is

Hint: For adjustments to the income statement, we assume the normal for the ratio of Allowance for sales returns to Gross sales for each year.

Determine the adjusted allowance for sales return. Round answer to nearest whole number.

Using the adjusted total allowance for sales returns computed above, determine the adjustments for the following income statement items.

Notes:

Round answers to nearest whole number.

Use negative signs with answers to indicate the adjustment decreases an account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started