SALES COMPARISON VALUATION PROBLEM FIG) is considering investing in an office building in Boston (CBD). Your firm has been engaged to provide an estimate

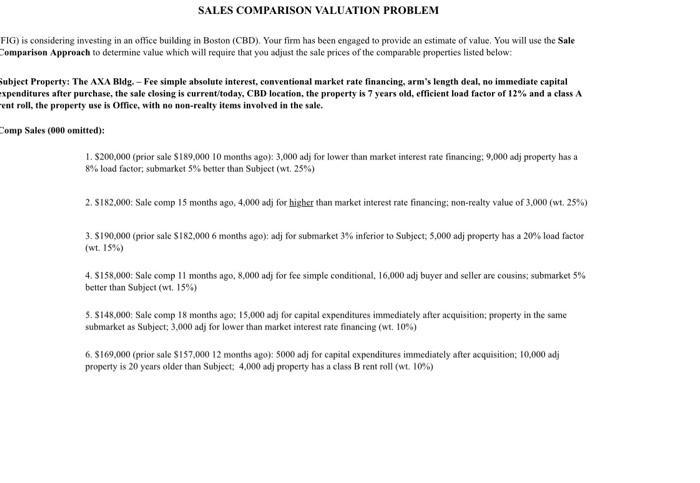

SALES COMPARISON VALUATION PROBLEM FIG) is considering investing in an office building in Boston (CBD). Your firm has been engaged to provide an estimate of value. You will use the Sale Comparison Approach to determine value which will require that you adjust the sale prices of the comparable properties listed below: subject Property: The AXA Bldg.-Fee simple absolute interest, conventional market rate financing, arm's length deal, no immediate capital expenditures after purchase, the sale closing is current/today, CBD location, the property is 7 years old, efficient load factor of 12% and a class A rent roll, the property use is Office, with no non-realty items involved in the sale. Comp Sales (000 omitted): 1. $200,000 (prior sale $189,000 10 months ago): 3,000 adj for lower than market interest rate financing: 9,000 adj property has a 8% load factor; submarket 5% better than Subject (wt. 25%) 2. $182,000: Sale comp 15 months ago, 4,000 adj for higher than market interest rate financing: non-realty value of 3,000 (wt. 25%) 3. $190,000 (prior sale $182,000 6 months ago): adj for submarket 3% inferior to Subject; 5,000 adj property has a 20% load factor (wt. 15%) 4. $158,000: Sale comp 11 months ago, 8,000 adj for fee simple conditional, 16,000 adj buyer and seller are cousins; submarket 5% better than Subject (wt. 15%) 5. $148,000: Sale comp 18 months ago; 15,000 adj for capital expenditures immediately after acquisition; property in the same submarket as Subject; 3,000 adj for lower than market interest rate financing (wt. 10%) 6. $169,000 (prior sale $157,000 12 months ago): 5000 adj for capital expenditures immediately after acquisition: 10,000 adj property is 20 years older than Subject: 4,000 adj property has a class B rent roll (wt. 10%)

Step by Step Solution

3.34 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS 1 200000 x 1003 x 1005 208000 2 182000 x 1004 x 1003 170000 3 190000 x 1003 x 102 188000 4 1...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started