Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales Expenses Net income Retained earnings, January 1, 2024 Net income (from above) Dividends paid Proud $ 360,000 (240,000) $ 120,000 $ 480,000 120,000

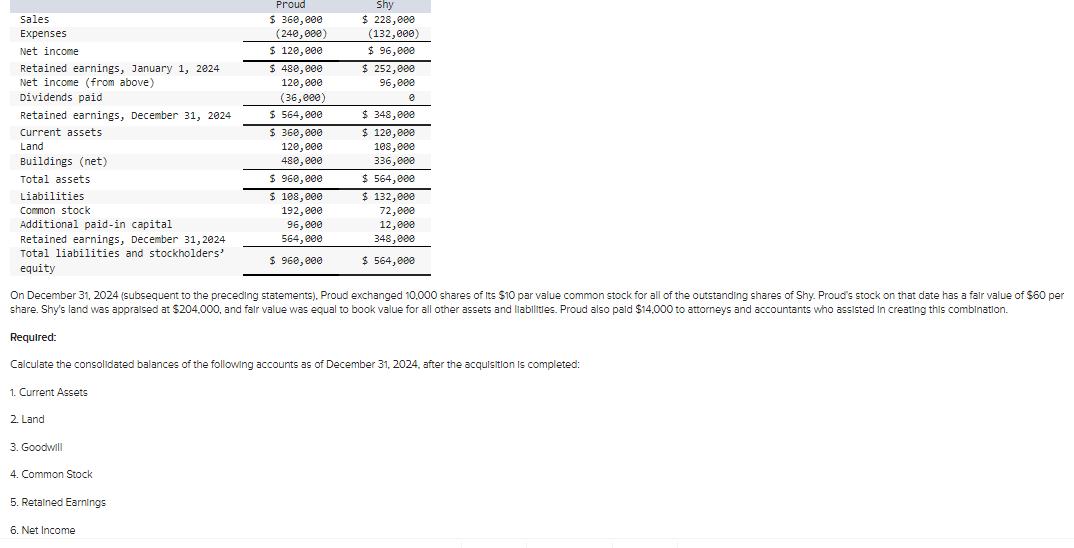

Sales Expenses Net income Retained earnings, January 1, 2024 Net income (from above) Dividends paid Proud $ 360,000 (240,000) $ 120,000 $ 480,000 120,000 (36,000) Retained earnings, December 31, 2024 $ 564,000 Current assets Land Buildings (net) Total assets Liabilities Common stock Retained earnings, December 31, 2024 Additional paid-in capital Total liabilities and stockholders' equity $ 360,000 120,000 480,000 $ 960,000 $ 108,000 192,000 96,000 564,000 Shy $ 228,000 (132,000) $ 96,000 $ 252,000 96,000 $ 348,000 $ 120,000 108,000 336,000 $ 564,000 $ 132,000 72,000 12,000 348,000 $ 960,000 $ 564,000 On December 31, 2024 (subsequent to the preceding statements). Proud exchanged 10,000 shares of Its $10 par value common stock for all of the outstanding shares of Shy. Proud's stock on that date has a fair value of $60 per share. Shy's land was appraised at $204,000, and fair value was equal to book value for all other assets and liabilities. Proud also paid $14,000 to attorneys and accountants who assisted in creating this combination. Required: Calculate the consolidated balances of the following accounts as of December 31, 2024, after the acquisition is completed: 1. Current Assets 2. Land 3. Goodwill 4. Common Stock 5. Retained Earnings 6. Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started