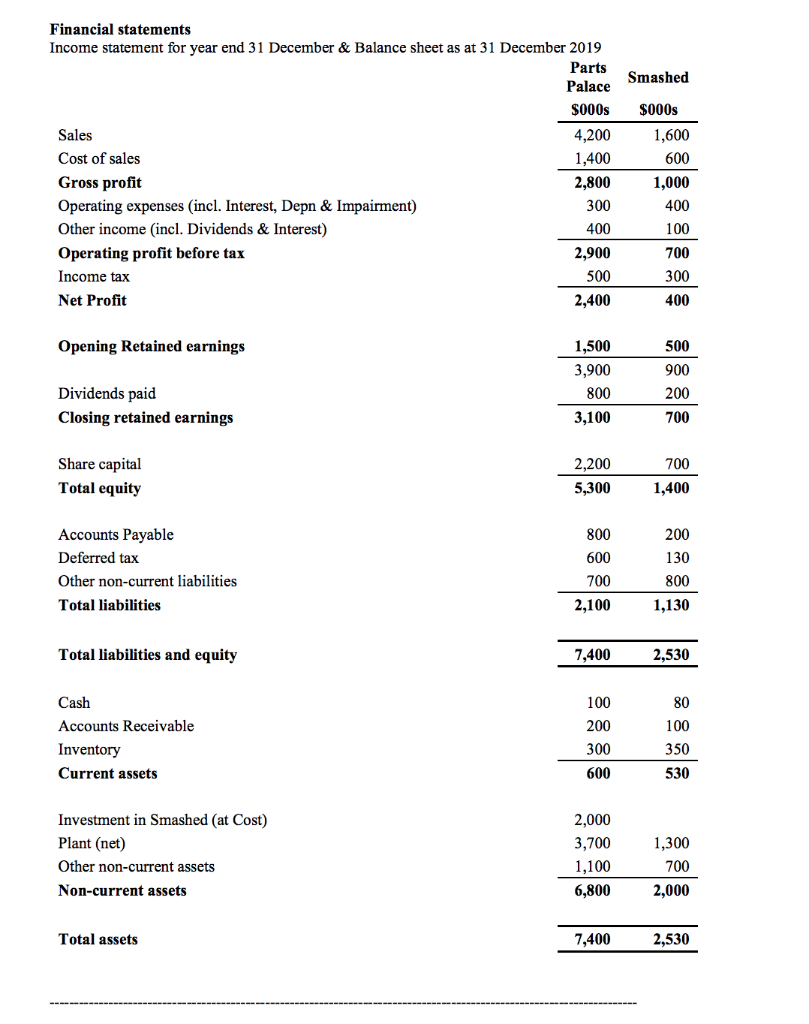

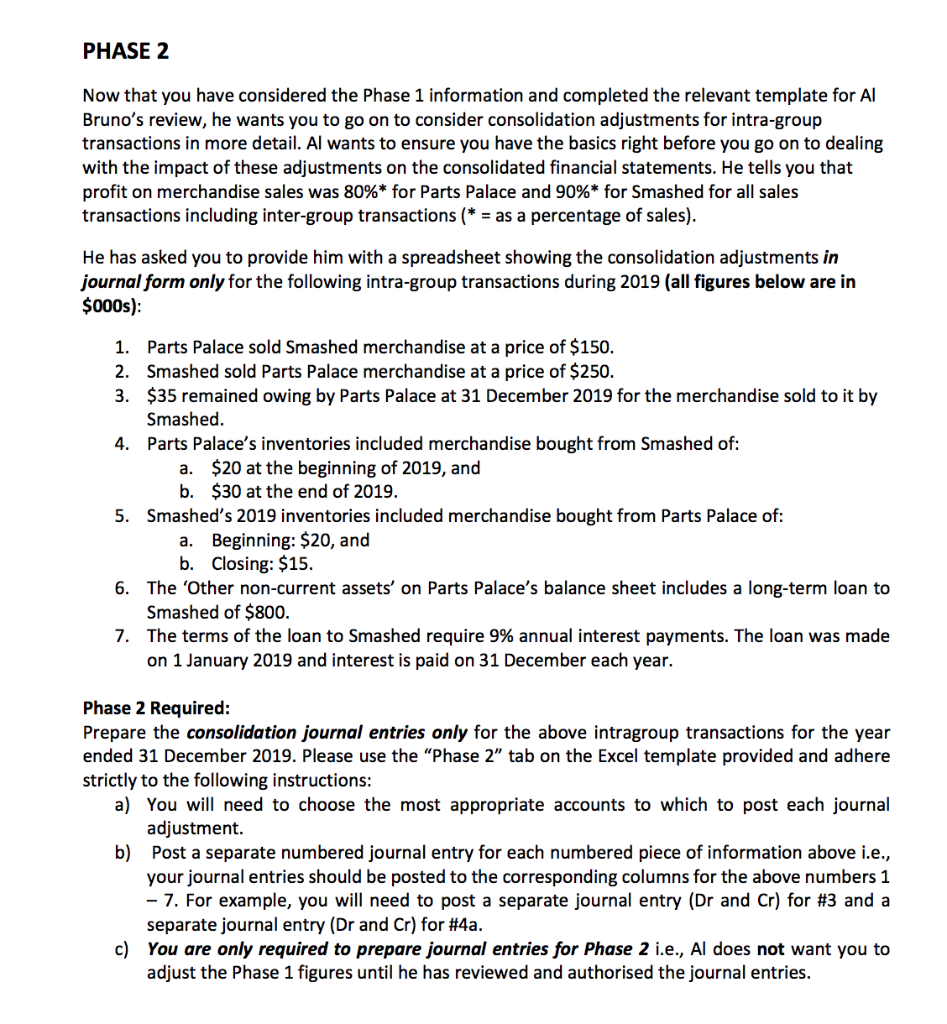

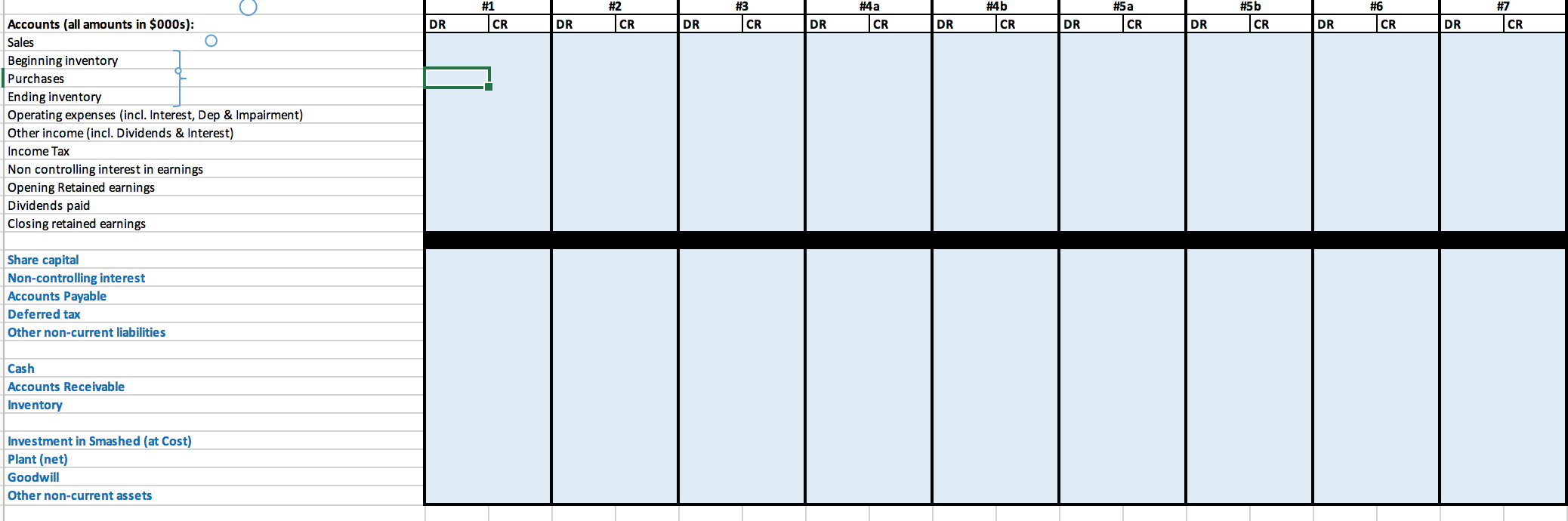

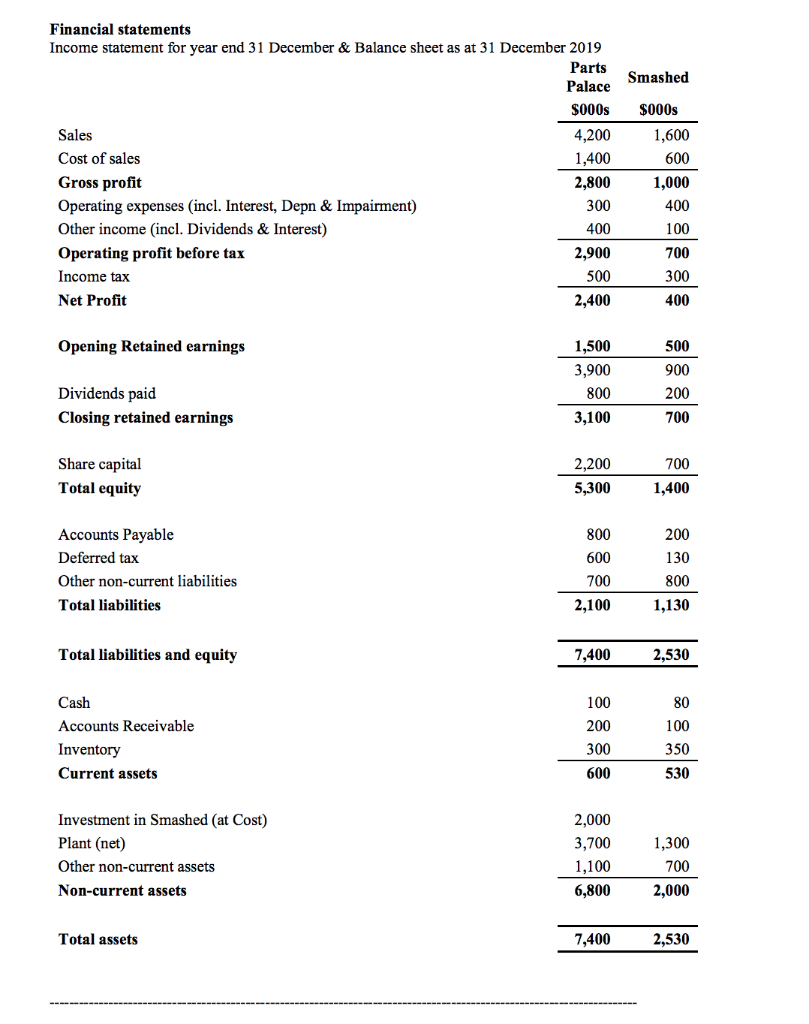

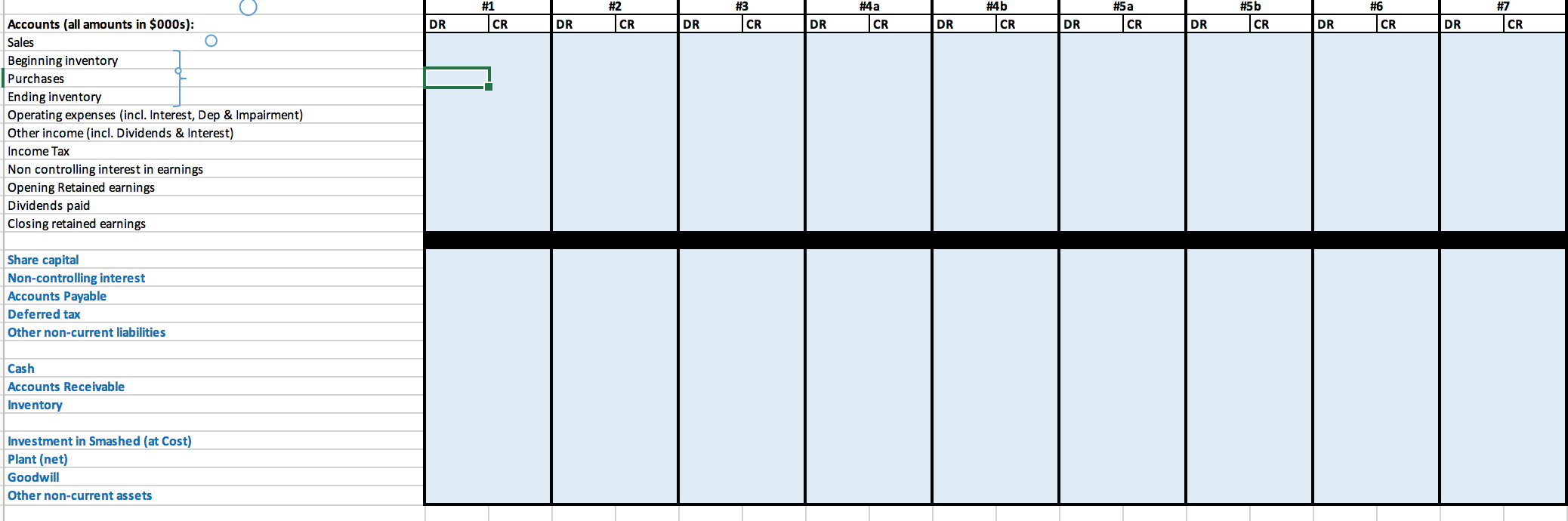

Sales Financial statements Income statement for year end 31 December & Balance sheet as at 31 December 2019 Parts Palace $000 4,200 Cost of sales 1,400 Gross profit 2,800 Operating expenses (incl. Interest, Depn & Impairment) 300 Other income (incl. Dividends & Interest) 400 Operating profit before tax 2,900 Income tax 500 Net Profit 2,400 Smashed $000s 1,600 600 1,000 400 100 700 300 400 Opening Retained earnings 1,500 500 3,900 Dividends paid Closing retained earnings 800 3,100 900 200 700 Share capital Total equity 2,200 5,300 2011 700 1,400 Accounts Payable Deferred tax Other non-current liabilities Total liabilities 800 600 700 2,100 200 130 800 1,130 Total liabilities and equity 7,400 2,530 100 200 Cash Accounts Receivable Inventory Current assets 80 100 350 300 600 530 Investment in Smashed (at Cost) Plant (net) Other non-current assets Non-current assets 2,000 3,700 1,100 6,800 1,300 700 2,000 Total assets 7,400 2,530 PHASE 2 Now that you have considered the Phase 1 information and completed the relevant template for Al Bruno's review, he wants you to go on to consider consolidation adjustments for intra-group transactions in more detail. Al wants to ensure you have the basics right before you go on to dealing with the impact of these adjustments on the consolidated financial statements. He tells you that profit on merchandise sales was 80%* for Parts Palace and 90%* for Smashed for all sales transactions including inter-group transactions (* = as a percentage of sales). He has asked you to provide him with a spreadsheet showing the consolidation adjustments in journal form only for the following intra-group transactions during 2019 (all figures below are in $000s): 1. Parts Palace sold Smashed merchandise at a price of $150. 2. Smashed sold Parts Palace merchandise at a price of $250. 3. $35 remained owing by Parts Palace at 31 December 2019 for the merchandise sold to it by Smashed. 4. Parts Palace's inventories included merchandise bought from Smashed of: a. $20 at the beginning of 2019, and b. $30 at the end of 2019. 5. Smashed's 2019 inventories included merchandise bought from Parts Palace of: a. Beginning: $20, and b. Closing: $15. 6. The 'Other non-current assets' on Parts Palace's balance sheet includes a long-term loan to Smashed of $800. 7. The terms of the loan to Smashed require 9% annual interest payments. The loan was made on 1 January 2019 and interest is paid on 31 December each year. Phase 2 Required: Prepare the consolidation journal entries only for the above intragroup transactions for the year ended 31 December 2019. Please use the "Phase 2" tab on the Excel template provided and adhere strictly to the following instructions: a) You will need to choose the most appropriate accounts to which to post each journal adjustment. b) Post a separate numbered journal entry for each numbered piece of information above i.e., your journal entries should be posted to the corresponding columns for the above numbers 1 -7. For example, you will need to post a separate journal entry (Dr and Cr) for #3 and a separate journal entry (Dr and Cr) for #4a. c) You are only required to prepare journal entries for Phase 2 i.e., Al does not want you to adjust the Phase 1 figures until he has reviewed and authorised the journal entries. #1 #2 #3 #4a #4b DR CRDR CRDR CRDR CRDR CRDRCR #5a DR #5b CRDR #6 CRDR CR Accounts (all amounts in $000s): Sales Beginning inventory Purchases Ending inventory Operating expenses (incl. Interest, Dep & Impairment) Other income (incl. Dividends & Interest) Income Tax Non controlling interest in earnings Opening Retained earnings Dividends paid Closing retained earnings Share capital Non-controlling interest Accounts Payable Deferred tax Other non-current liabilities Cash Accounts Receivable Inventory Investment in Smashed (at Cost) Plant (net) Goodwill Other non-current assets Sales Financial statements Income statement for year end 31 December & Balance sheet as at 31 December 2019 Parts Palace $000 4,200 Cost of sales 1,400 Gross profit 2,800 Operating expenses (incl. Interest, Depn & Impairment) 300 Other income (incl. Dividends & Interest) 400 Operating profit before tax 2,900 Income tax 500 Net Profit 2,400 Smashed $000s 1,600 600 1,000 400 100 700 300 400 Opening Retained earnings 1,500 500 3,900 Dividends paid Closing retained earnings 800 3,100 900 200 700 Share capital Total equity 2,200 5,300 2011 700 1,400 Accounts Payable Deferred tax Other non-current liabilities Total liabilities 800 600 700 2,100 200 130 800 1,130 Total liabilities and equity 7,400 2,530 100 200 Cash Accounts Receivable Inventory Current assets 80 100 350 300 600 530 Investment in Smashed (at Cost) Plant (net) Other non-current assets Non-current assets 2,000 3,700 1,100 6,800 1,300 700 2,000 Total assets 7,400 2,530 PHASE 2 Now that you have considered the Phase 1 information and completed the relevant template for Al Bruno's review, he wants you to go on to consider consolidation adjustments for intra-group transactions in more detail. Al wants to ensure you have the basics right before you go on to dealing with the impact of these adjustments on the consolidated financial statements. He tells you that profit on merchandise sales was 80%* for Parts Palace and 90%* for Smashed for all sales transactions including inter-group transactions (* = as a percentage of sales). He has asked you to provide him with a spreadsheet showing the consolidation adjustments in journal form only for the following intra-group transactions during 2019 (all figures below are in $000s): 1. Parts Palace sold Smashed merchandise at a price of $150. 2. Smashed sold Parts Palace merchandise at a price of $250. 3. $35 remained owing by Parts Palace at 31 December 2019 for the merchandise sold to it by Smashed. 4. Parts Palace's inventories included merchandise bought from Smashed of: a. $20 at the beginning of 2019, and b. $30 at the end of 2019. 5. Smashed's 2019 inventories included merchandise bought from Parts Palace of: a. Beginning: $20, and b. Closing: $15. 6. The 'Other non-current assets' on Parts Palace's balance sheet includes a long-term loan to Smashed of $800. 7. The terms of the loan to Smashed require 9% annual interest payments. The loan was made on 1 January 2019 and interest is paid on 31 December each year. Phase 2 Required: Prepare the consolidation journal entries only for the above intragroup transactions for the year ended 31 December 2019. Please use the "Phase 2" tab on the Excel template provided and adhere strictly to the following instructions: a) You will need to choose the most appropriate accounts to which to post each journal adjustment. b) Post a separate numbered journal entry for each numbered piece of information above i.e., your journal entries should be posted to the corresponding columns for the above numbers 1 -7. For example, you will need to post a separate journal entry (Dr and Cr) for #3 and a separate journal entry (Dr and Cr) for #4a. c) You are only required to prepare journal entries for Phase 2 i.e., Al does not want you to adjust the Phase 1 figures until he has reviewed and authorised the journal entries. #1 #2 #3 #4a #4b DR CRDR CRDR CRDR CRDR CRDRCR #5a DR #5b CRDR #6 CRDR CR Accounts (all amounts in $000s): Sales Beginning inventory Purchases Ending inventory Operating expenses (incl. Interest, Dep & Impairment) Other income (incl. Dividends & Interest) Income Tax Non controlling interest in earnings Opening Retained earnings Dividends paid Closing retained earnings Share capital Non-controlling interest Accounts Payable Deferred tax Other non-current liabilities Cash Accounts Receivable Inventory Investment in Smashed (at Cost) Plant (net) Goodwill Other non-current assets