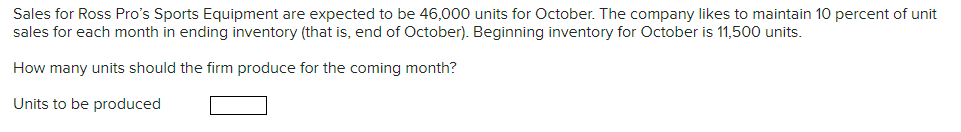

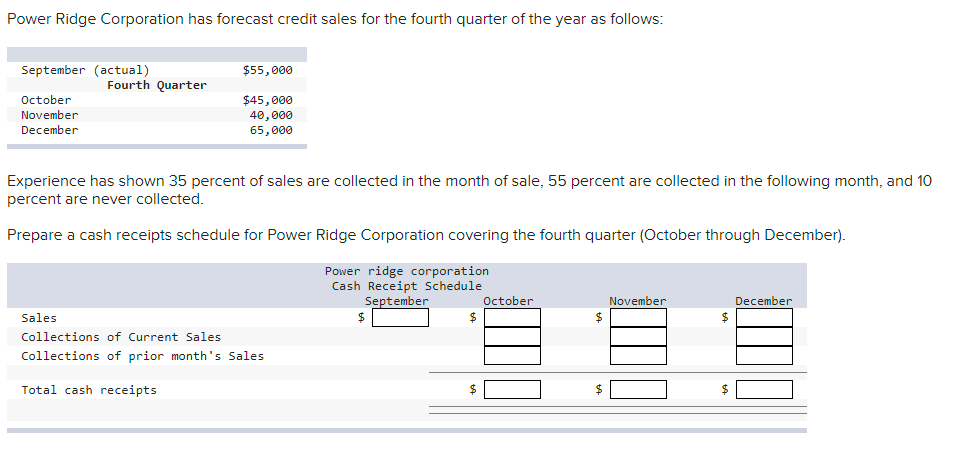

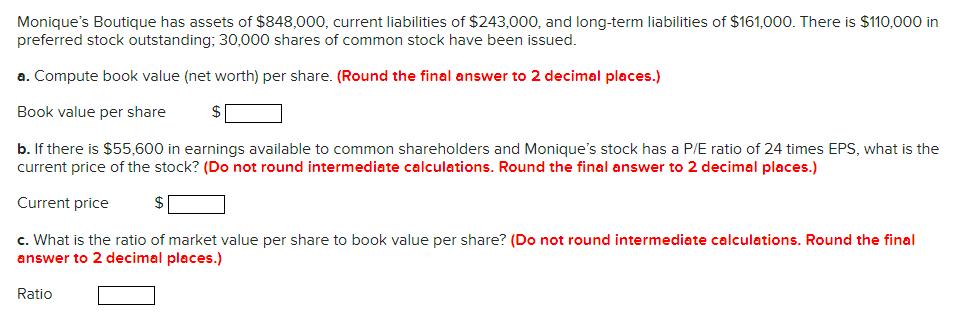

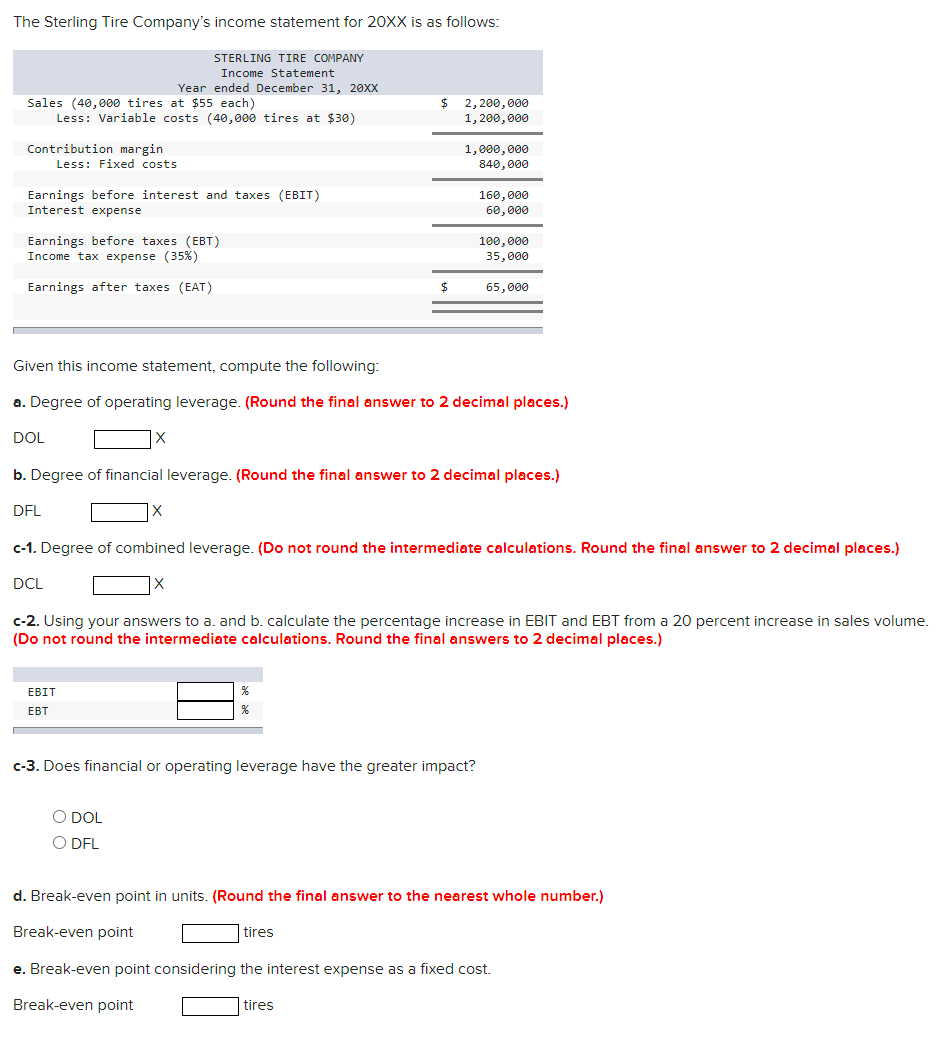

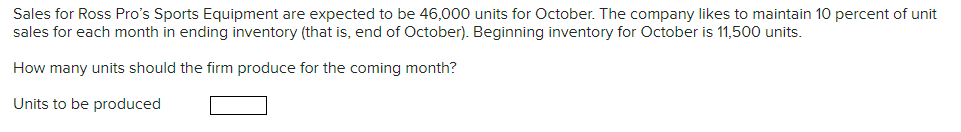

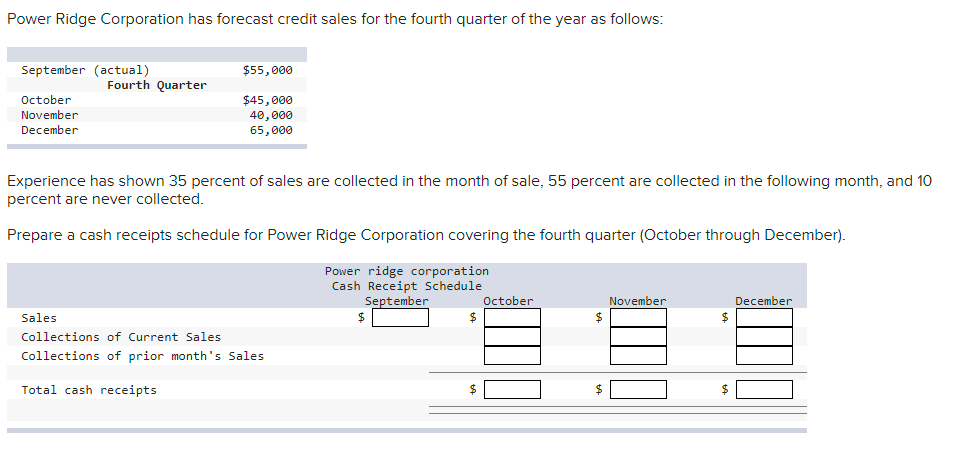

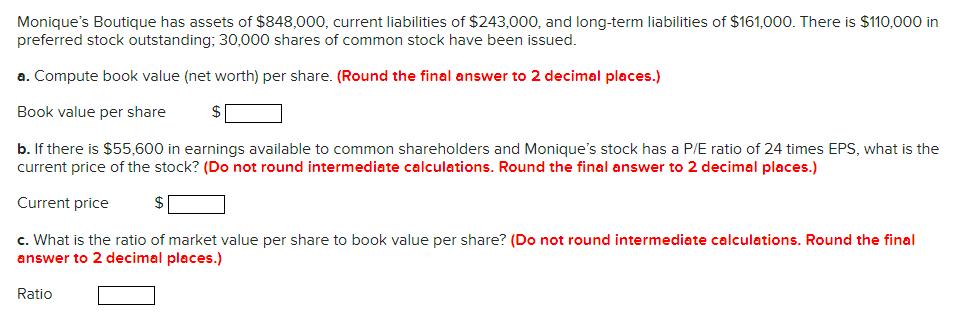

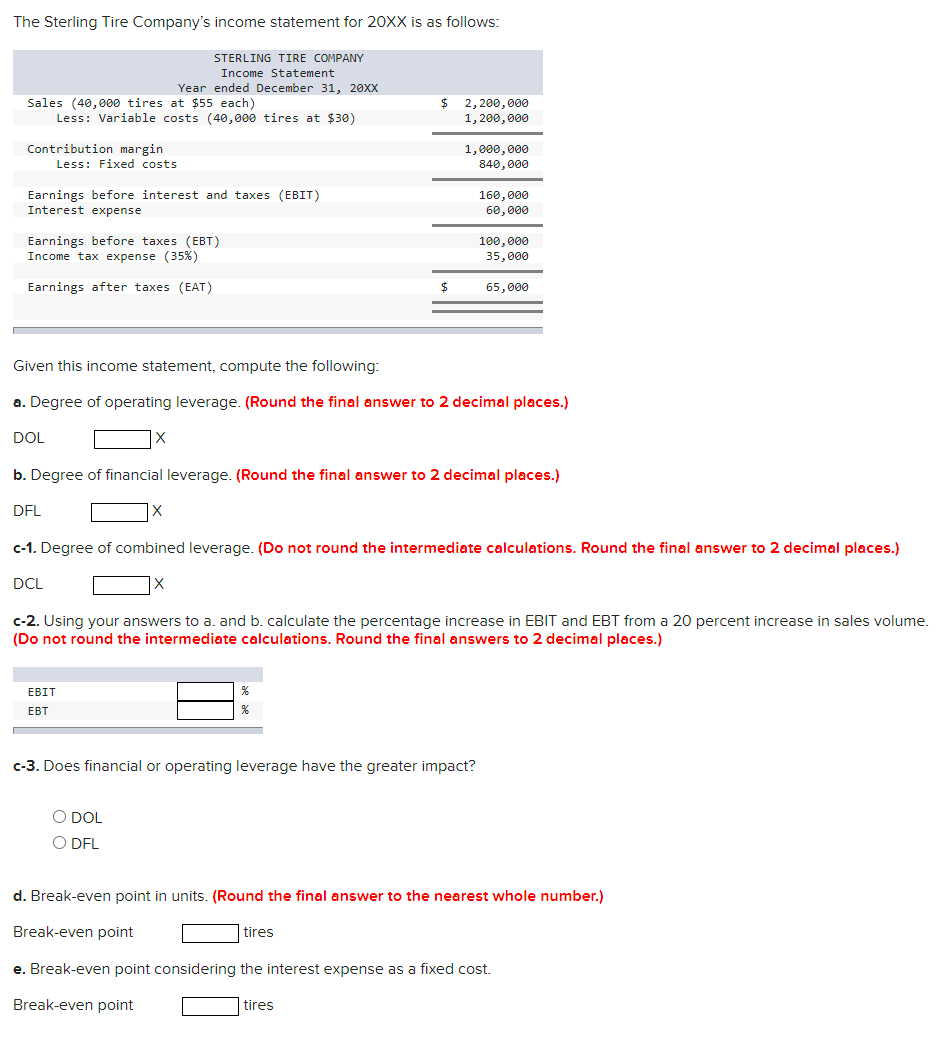

Sales for Ross Pro's Sports Equipment are expected to be 46,000 units for October. The company likes to maintain 10 percent of unit sales for each month in ending inventory (that is, end of October). Beginning inventory for October is 11,500 units. How many units should the firm produce for the coming month? Units to be produced Power Ridge Corporation has forecast credit sales for the fourth quarter of the year as follows: $55,000 September (actual) Fourth Quarter October November December $45,000 40,000 65,000 Experience has shown 35 percent of sales are collected in the month of sale, 55 percent are collected in the following month, and 10 percent are never collected. Prepare a cash receipts schedule for Power Ridge Corporation covering the fourth quarter (October through December). Power ridge corporation Cash Receipt Schedule September October $ $ November December $ $ Sales Collections of Current Sales Collections of prior month's Sales Total cash receipts $ $ $ Monique's Boutique has assets of $848,000, current liabilities of $243,000, and long-term liabilities of $161,000. There is $110,000 in preferred stock outstanding; 30,000 shares of common stock have been issued. a. Compute book value (net worth) per share. (Round the final answer to 2 decimal places.) Book value per share $ b. If there is $55,600 in earnings available to common shareholders and Monique's stock has a P/E ratio of 24 times EPS, what is the current price of the stock? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Current price c. What is the ratio of market value per share to book value per share? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Ratio The Sterling Tire Company's income statement for 20XX is as follows: STERLING TIRE COMPANY Income Statement Year ended December 31, 20XX Sales (40,000 tires at $55 each) Less: Variable costs (40,000 tires at $30) $ 2,200,000 1,200,000 Contribution margin Less: Fixed costs 1,000,000 840,000 Earnings before interest and taxes (EBIT) Interest expense 160,000 60,000 Earnings before taxes (EBT) Income tax expense (35%) 1 100,000 35,000 Earnings after taxes (EAT) $ 65,000 Given this income statement, compute the following: a. Degree of operating leverage. (Round the final answer to 2 decimal places.) DOL b. Degree of financial leverage. (Round the final answer to 2 decimal places.) DFL X c-1. Degree of combined leverage. (Do not round the intermediate calculations. Round the final answer to 2 decimal places.) DCL X c-2. Using your answers to a. and b. calculate the percentage increase in EBIT and EBT from a 20 percent increase in sales volume. (Do not round the intermediate calculations. Round the final answers to 2 decimal places.) % EBIT EBT c-3. Does financial or operating leverage have the greater impact? ODOL O DFL d. Break-even point in units. (Round the final answer to the nearest whole number.) Break-even point tires e. Break-even point considering the interest expense as a fixed cost. Break-even point tires