Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales Gross profit margin Inventory turnover ratio (Cost of goods sold/Inventory) Net profit margin Average collection period Return on equity Accumulated depreciation Return on assets

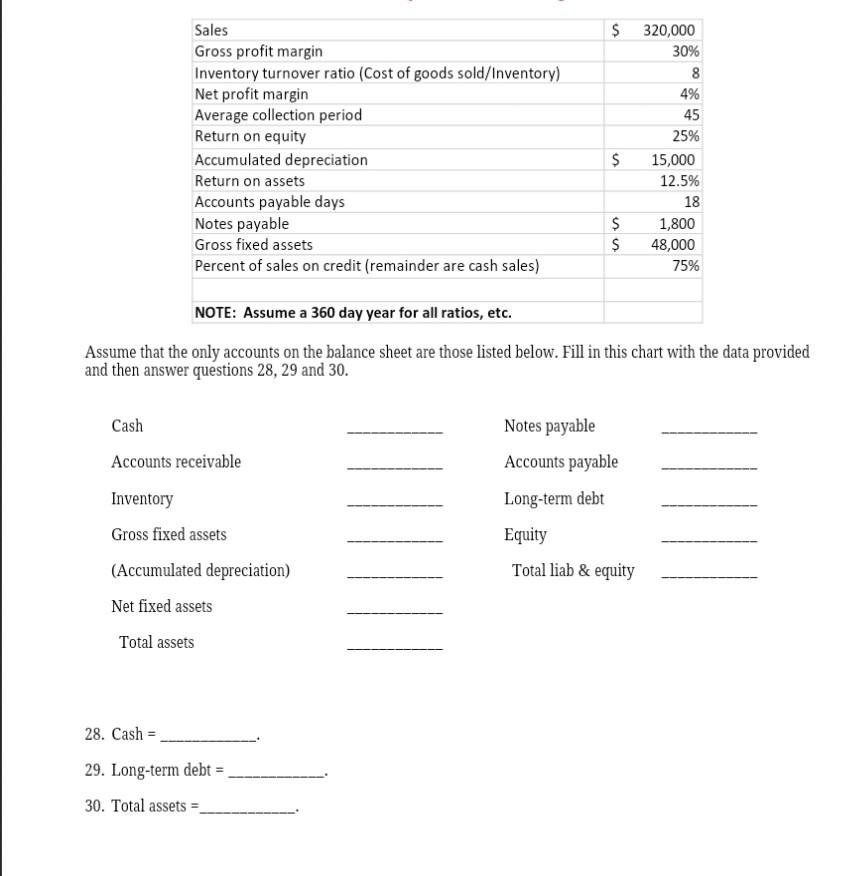

Sales Gross profit margin Inventory turnover ratio (Cost of goods sold/Inventory) Net profit margin Average collection period Return on equity Accumulated depreciation Return on assets Accounts payable days Notes payable Gross fixed assets Percent of sales on credit (remainder are cash sales) $ 320,000 30% 8 4% 45 25% $ 15,000 12.5% 18 $ 1,800 $ 48,000 75% $ NOTE: Assume a 360 day year for all ratios, etc. Assume that the only accounts on the balance sheet are those listed below. Fill in this chart with the data provided and then answer questions 28, 29 and 30. Cash Accounts receivable Notes payable Accounts payable Long-term debt Inventory Gross fixed assets (Accumulated depreciation) Equity Total liab & equity Net fixed assets Total assets 28. Cash = 29. Long-term debt = 30. Total assets =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started