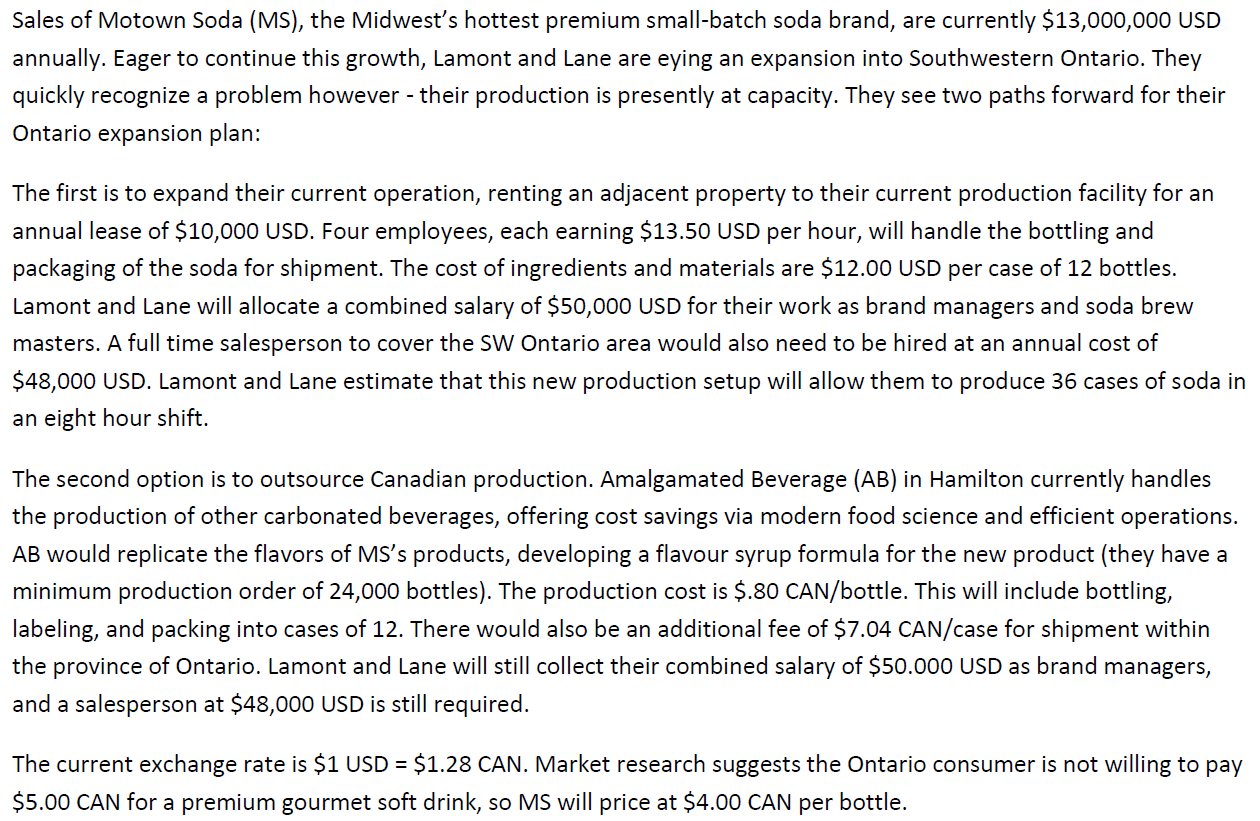

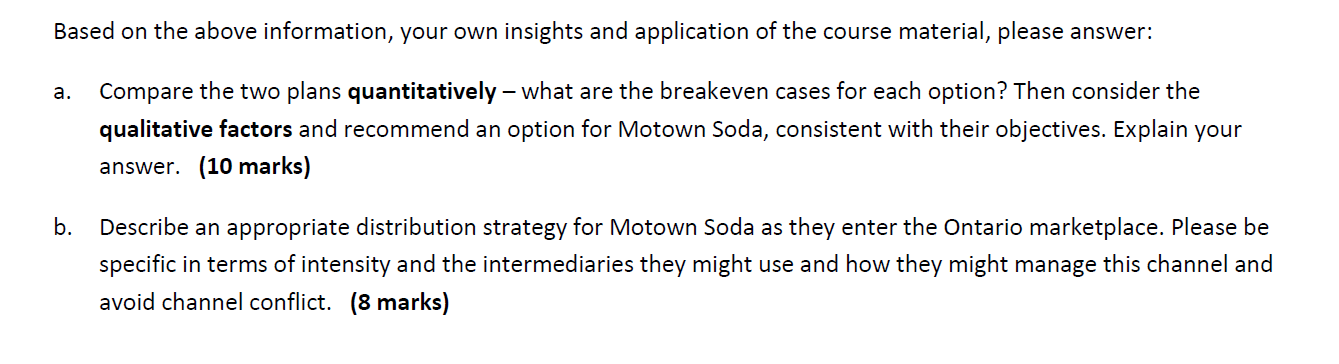

Sales of Motown Soda (M5), the Midwest's hottest premium small-batch soda brand, are currently $13,000,000 USD annually. Eager to continue this growth, Lamont and Lane are eying an expansion into Southwestern Ontario. They quickly recognize a problem however - their production is presently at capacity. They see two paths forward for their Ontario expansion plan: The first is to expand their current operation, renting an adjacent property to their current production facility for an annual lease of $10,000 USD. Four employees, each earning $13.50 USD per hour, will handle the bottling and packaging of the soda for shipment. The cost of ingredients and materials are $12.00 USD per case of 12 bottles. Lamont and Lane will allocate a combined salary of $50,000 USD for their work as brand managers and soda brew masters. A full time salesperson to cover the SW Ontario area would also need to be hired at an annual cost of $48,000 USD. Lamont and Lane estimate that this new production setup will allow them to produce 36 cases of soda in an eight hour shift. The second option is to outsource Canadian production. Amalgamated Beverage (AB) in Hamilton currently handles the production of other carbonated beverages, offering cost savings via modern food science and efficient operations. AB would replicate the flavors of MS's products, developing a flavour syrup formula for the new product (they have a minimum production order of 24,000 bottles). The production cost is $.80 CAN/bottle. This will include bottling, labeling, and packing into cases of 12. There would also be an additional fee of $7.04 CAN/case for shipment within the province of Ontario. Lamont and Lane will still collect their combined salary of $50.000 USD as brand managers, and a salesperson at $48,000 USD is still required. The current exchange rate is 51 USD = $1.28 CAN. Market research suggests the Ontario consumer is not willing to pay $5.00 CAN for a premium gourmet soft drink, so MS will price at $4.00 CAN per bottle. Based on the above information, your own insights and application of the course material, please answer: a. Compare the two plans quantitatively what are the breakeven cases for each option? Then consider the qualitative factors and recommend an option for Motown Soda, consistent with their objectives. Explain your answer. (10 marks) b. Describe an appropriate distribution strategy for Motown Soda as they enter the Ontario marketplace. Please be specific in terms of intensity and the intermediaries they might use and how they might manage this channel and avoid channel conflict. (8 marks)