Answered step by step

Verified Expert Solution

Question

1 Approved Answer

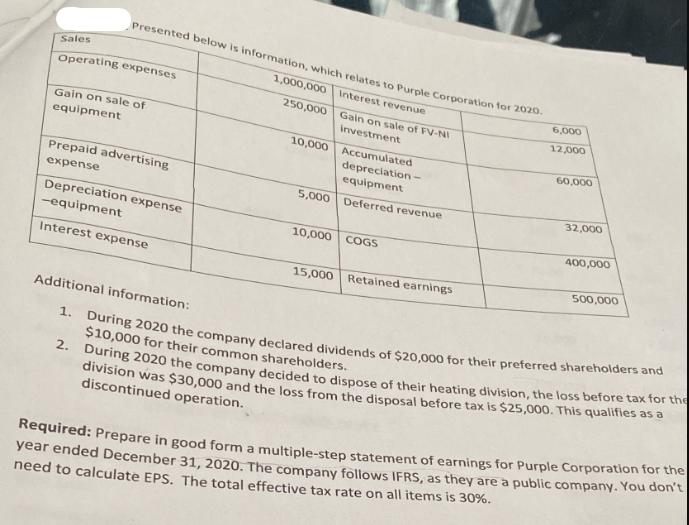

Sales Presented below is information, which relates to Purple Corporation for 2020. 1,000,000 Interest revenue 250,000 Operating expenses Gain on sale of equipment Prepaid

Sales Presented below is information, which relates to Purple Corporation for 2020. 1,000,000 Interest revenue 250,000 Operating expenses Gain on sale of equipment Prepaid advertising expense Depreciation expense -equipment Interest expense 10,000 Accumulated depreciation- equipment 5,000 Deferred revenue 10,000 Gain on sale of FV-NI investment 15,000 COGS 6,000 12,000 Retained earnings 60,000 32,000 400,000 Additional information: 1. During 2020 the company declared dividends of $20,000 for their preferred shareholders and $10,000 for their common shareholders. 2. During 2020 the company decided to dispose of their heating division, the loss before tax for the division was $30,000 and the loss from the disposal before tax is $25,000. This qualifies as a discontinued operation. 500,000 Required: Prepare in good form a multiple-step statement of earnings for Purple Corporation for the year ended December 31, 2020. The company follows IFRS, as they are a public company. You don't need to calculate EPS. The total effective tax rate on all items is 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a multiplestep statement of earnings for Purple Corporation for the year ended December 31 2020 and applying a 30 tax rate the statement is as follows Purple Corporation Statement of Earnin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started