Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sales unit 60000 Laraxin Co is appraising an investment project which has an expected life of four years and which will not be repeated. The

sales unit 60000

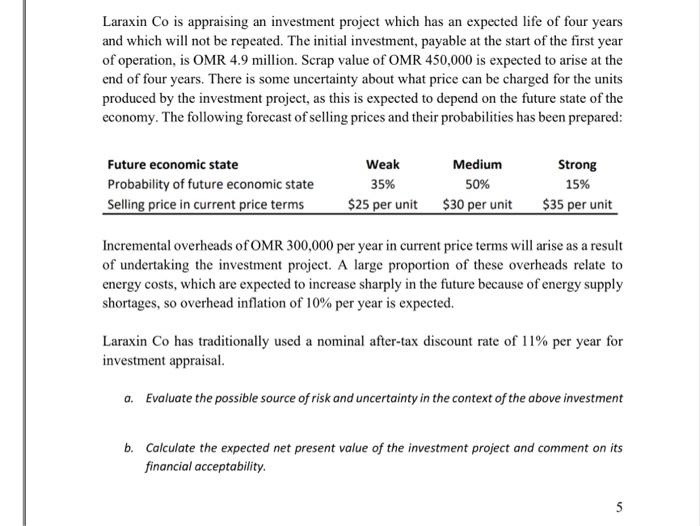

Laraxin Co is appraising an investment project which has an expected life of four years and which will not be repeated. The initial investment, payable at the start of the first year of operation, is OMR 4.9 million. Scrap value of OMR 450,000 is expected to arise at the end of four years. There is some uncertainty about what price can be charged for the units produced by the investment project, as this is expected to depend on the future state of the economy. The following forecast of selling prices and their probabilities has been prepared: Incremental overheads of OMR 300,000 per year in current price terms will arise as a result of undertaking the investment project. A large proportion of these overheads relate to energy costs, which are expected to increase sharply in the future because of energy supply shortages, so overhead inflation of 10% per year is expected. Laraxin Co has traditionally used a nominal after-tax discount rate of 11% per year for investment appraisal. a. Evaluate the possible source of risk and uncertainty in the context of the above investment b. Calculate the expected net present value of the investment project and comment on its financial acceptability. c. Explain significance of Net Present value to make such decisions. d. Explain how your decision would impact if the cashflows are expected to arise for infinity instead of four year span Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started