Answered step by step

Verified Expert Solution

Question

1 Approved Answer

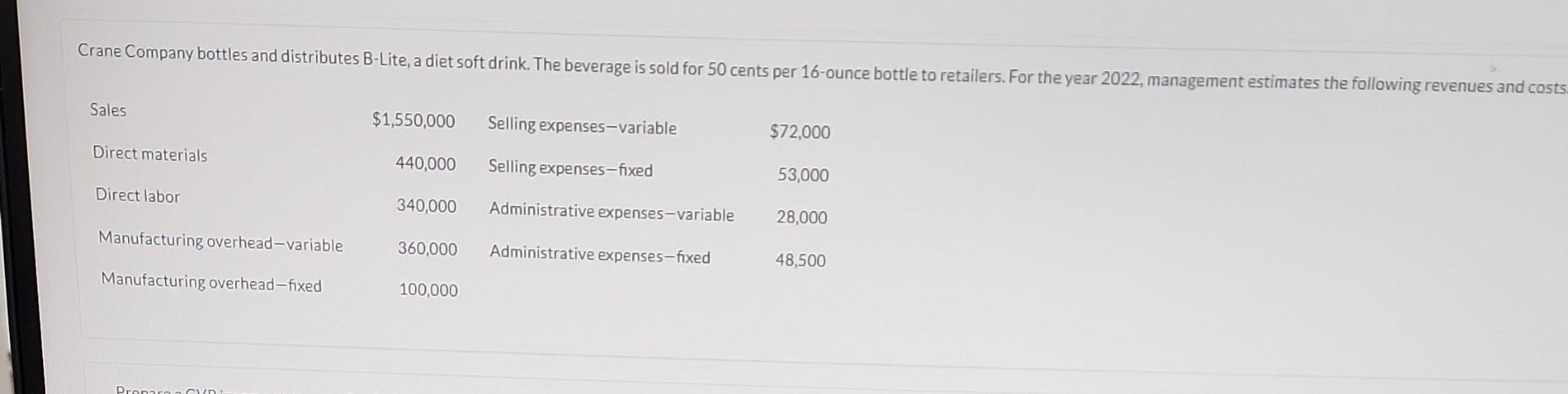

SalesDirectmaterialsDirectlaborManufacturingoverhead-variableManufacturingoverhead-fixed$1,550,000440,000340,000360,000100,000Sellingexpenses-variableSellingexpenses-fixedAdministrativeexpenses-variableAdministrativeexpenses-fixed$72,00053,00028,00048,500 Prepare a CVP income statement for 2022 based on management's estimates. (Round per unit answers to 3 decimal places, eg. 0.251.) Calculate variable cost

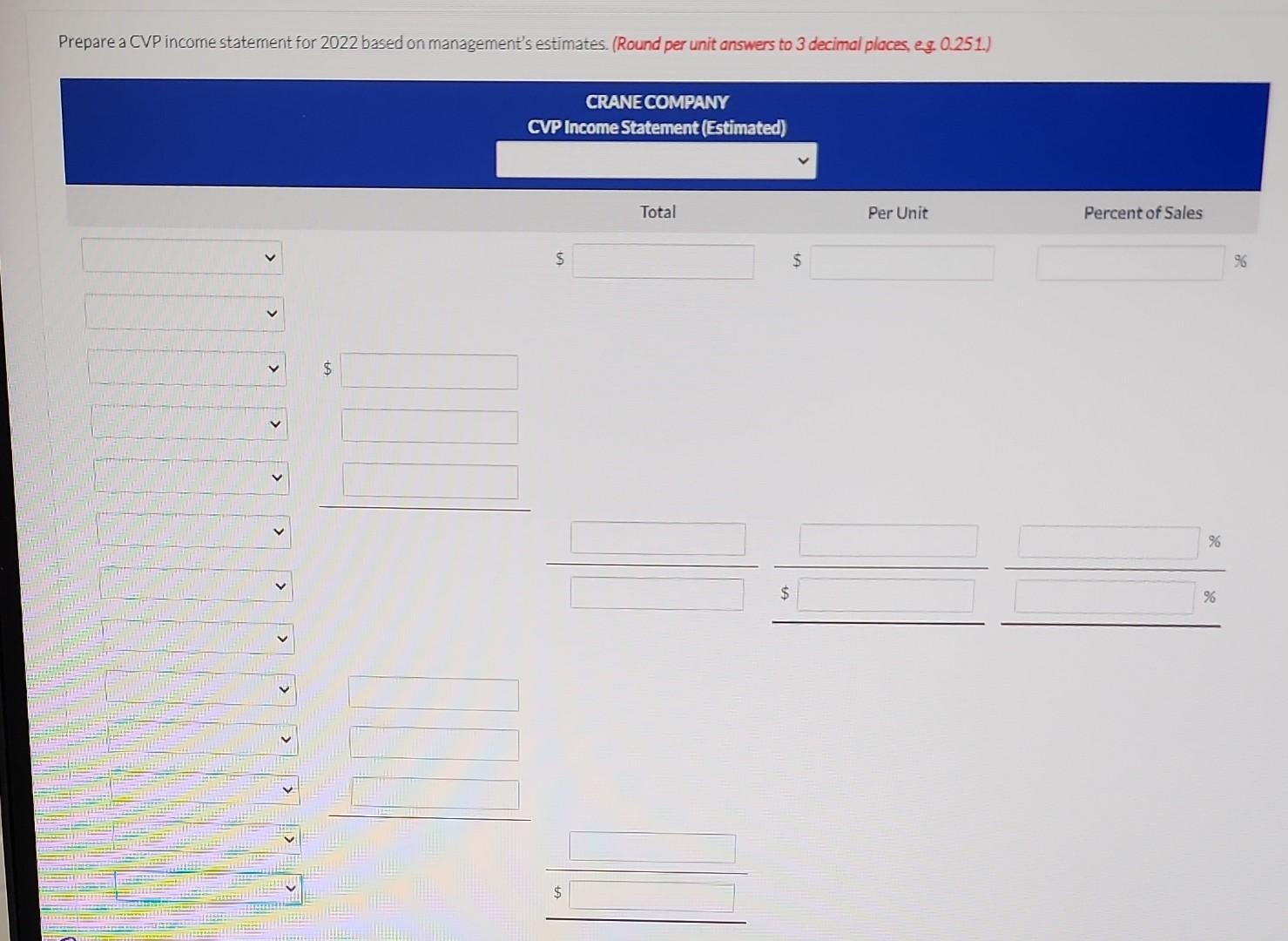

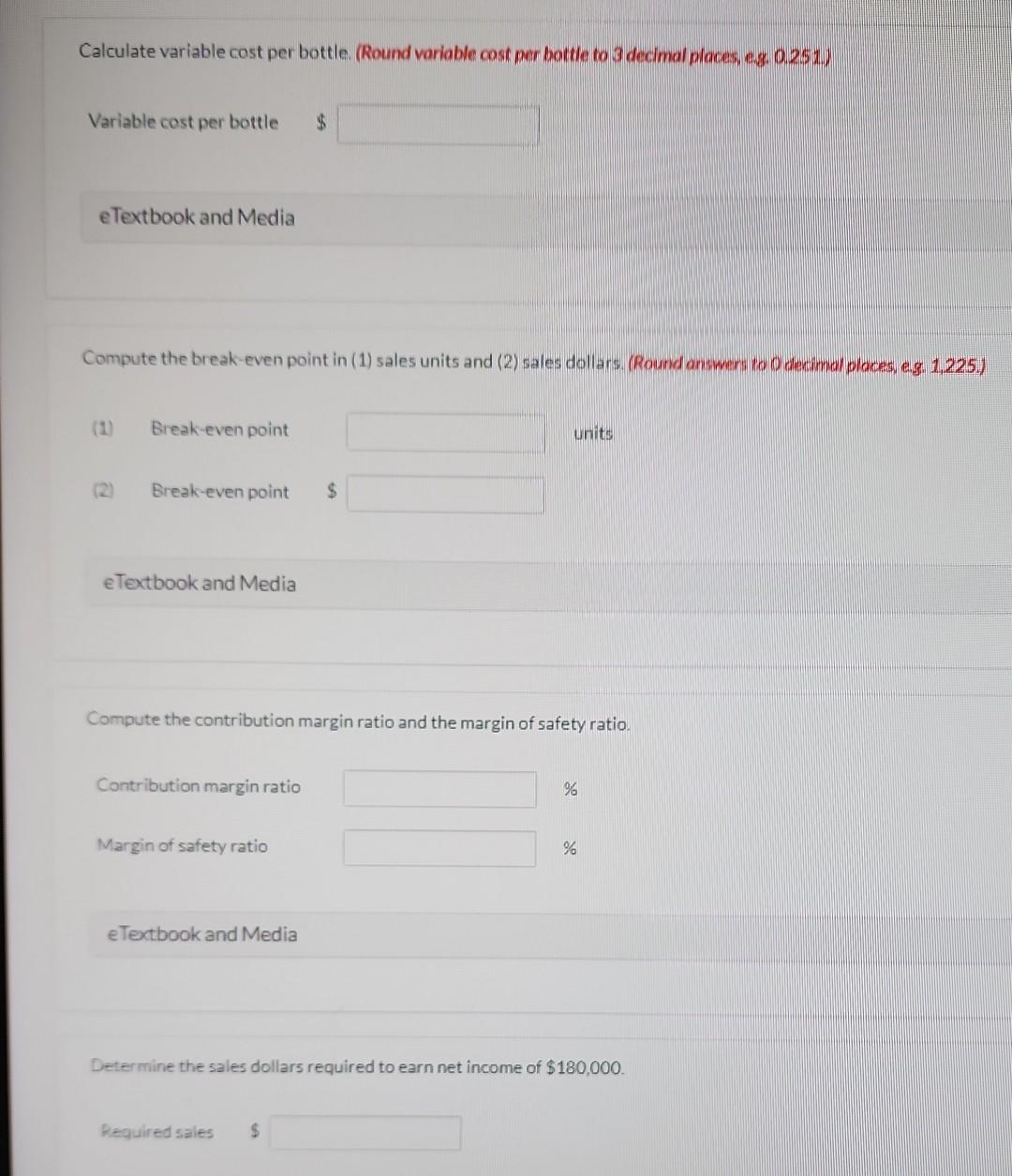

SalesDirectmaterialsDirectlaborManufacturingoverhead-variableManufacturingoverhead-fixed$1,550,000440,000340,000360,000100,000Sellingexpenses-variableSellingexpenses-fixedAdministrativeexpenses-variableAdministrativeexpenses-fixed$72,00053,00028,00048,500 Prepare a CVP income statement for 2022 based on management's estimates. (Round per unit answers to 3 decimal places, eg. 0.251.) Calculate variable cost per bottle. (Round variable cost per bottie to 3 decimal places es 0.25 12) Variable cost per bottle $ eTextbook and Media Compute the break-even point in (1) sales units and (2) sales dollars. (Round onswers to 0 decimol places, eg. 1,225.) (1) Break-even point units (2) Break-even point $ eTextbook and Media Compute the contribution margin ratio and the margin of safety ratio. Contribution margin ratio % Margin of safety ratio % eTextbook and Media Determine the sales dollars required to earn net income of $180,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started