Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally and Timothy are going to take a vacation to Israel. The tour company they are going with has a special promotion that allows travellers

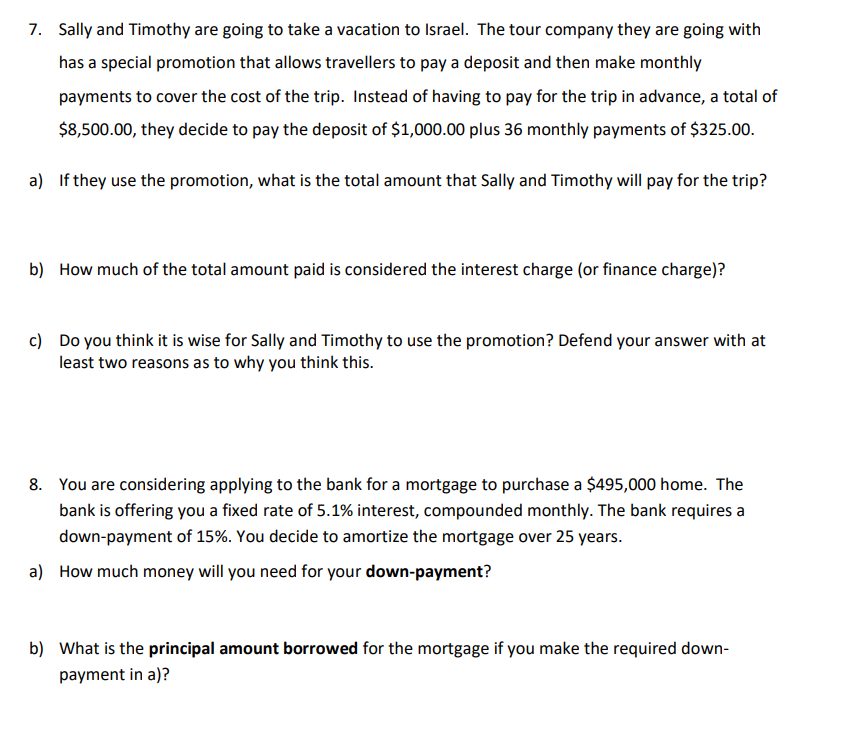

Sally and Timothy are going to take a vacation to Israel. The tour company they are going with

has a special promotion that allows travellers to pay a deposit and then make monthly

payments to cover the cost of the trip. Instead of having to pay for the trip in advance, a total of

$ they decide to pay the deposit of $ plus monthly payments of $

a If they use the promotion, what is the total amount that Sally and Timothy will pay for the trip?

b How much of the total amount paid is considered the interest charge or finance charge

c Do you think it is wise for Sally and Timothy to use the promotion? Defend your answer with at

least two reasons as to why you think this.

You are considering applying to the bank for a mortgage to purchase a $ home. The

bank is offering you a fixed rate of interest, compounded monthly. The bank requires a

downpayment of You decide to amortize the mortgage over years.

a How much money will you need for your downpayment?

b What is the principal amount borrowed for the mortgage if you make the required down

payment in a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started