Question

Sally Beauchamp, the Director of Finance of your Northern Expeditions company, has advised that the company will be opening an office in Nunavut this year.

Sally Beauchamp, the Director of Finance of your Northern Expeditions company, has advised that the company will be opening an office in Nunavut this year. The office will offer guided northern trips to hunters and adventurers. It expects to mainly employ local guides (40 days over the summer period) but the company will also be periodically bringing in guides from its offices in Alberta, Saskatchewan and Qubec. Some of the guides from outside Nunavut may work 10 days, others could work 15 days over the summer depending on the number of bookings; they normally work in their home province for 60 days every year. The average daily rate paid to these guides is $400. Sally is asking for information on the Nunavut Payroll Tax. Who pays the tax and how is it calculated? Are there any special considerations or challenges for the calculation of the payroll tax for the guides brought in from Alberta, Saskatchewan and Qubec? What are the reporting and remitting requirements during the year? What are the reporting requirements at year-end? Provide examples based on the information provided in the assignment to clarify.

Prepare your response (350 - 500 words) using your name, correct spelling, grammar and punctuation. You will be penalized if you are excessively over or under the suggested word count. Your response to this question must be stated in your own words and should be based on the course material, your experiences, knowledge gained through the course and at least one external government resource.

course material:

Alberta, Saskatchewan and Qubec? please find online

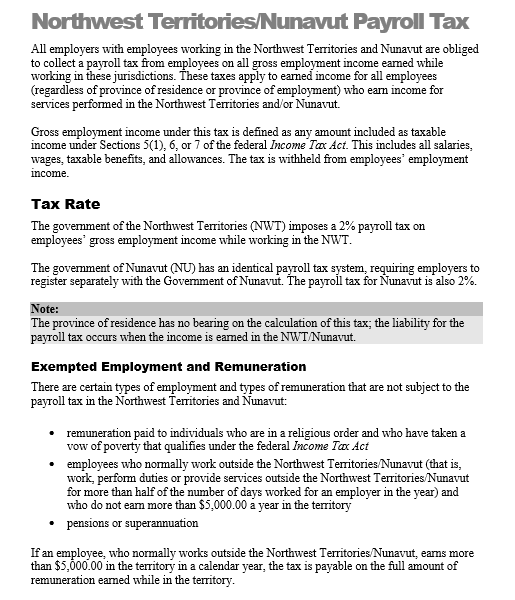

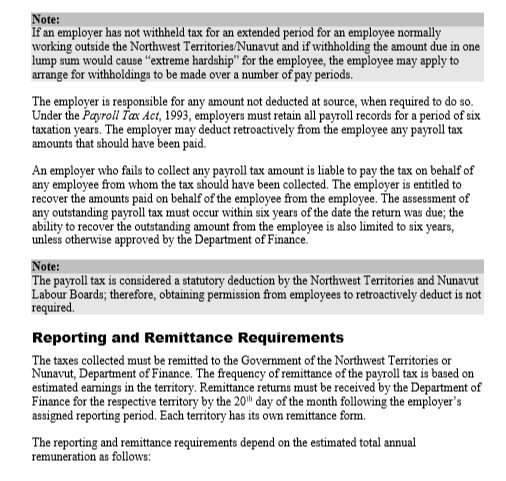

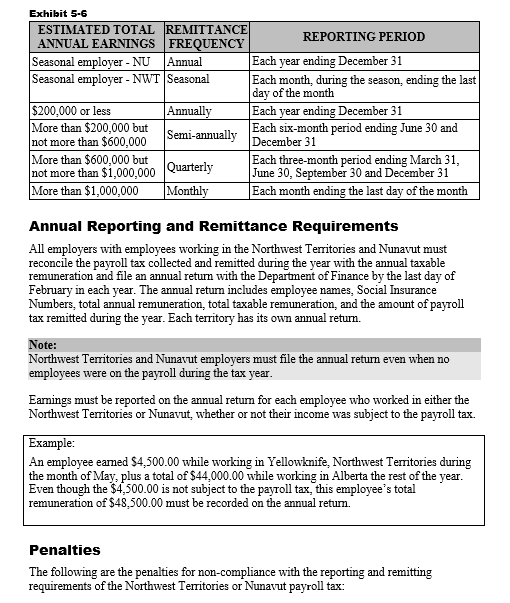

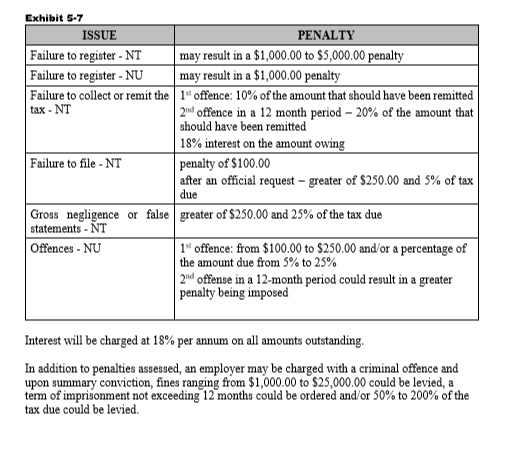

Northwest Territories/Nunavut Payroll Tax All employers with employees working in the Northwest Territories and Nunavut are obligecd to collect a payroll tax from employees on all gross empl working in these jurisdictions. These taxes apply to earned income for all employees (regardless of province of residence or province of employment) who earn income for oyment income eamed while services performed in the Northwest Territories and/or Nunavut. Gross employment income under this tax is defined as any amount included as taxable income under Sections 5(1), 6, or 7 of the federal Income Tax Act. This includes all salaries, wages, taxable benefits, and allowances. The tax is withheld from employees' employment ncome Tax Rate The government of the Northwest Territories (NWT) imposes a 2% payroll tax on employees' gross employment income while working in the NWT The govemment ofNunavut (NU) has an identical payroll tax s register separately with the Government of Nunavut. The payroll tax for Nunavut is also 2%. requiring employers to ote: The province of residence has no bearing on the calculation of this tax; the liability for the payroll tax occurs when the income is earned in the NWT Nunavut. Exempted Employment and Remuneration There are certain types of employment and types of remuneration that are not subject to the payroll tax in the Northwest Territories and Nunavut: * remuneration paid to individuals who are in a religious order and who have taken a * employees who normally work outside the Northwest Territories/Nunavut (that is, for more than half of the number of days worked for an employer in the year) and vow of poverty that qualifies under the federal Income Iax Act work, perform duties or provide services outside the Northwest Territories Nunavut who do not earn more than S5,000.00 a year in the territory * pensions or superannuation If an employee, who normally works outside the Northwest Territories Nunavut, earns more remuneration earmed while in the territory than $5,000.00 in the territory in a calendar year, the tax is payable on the full amount ofStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started