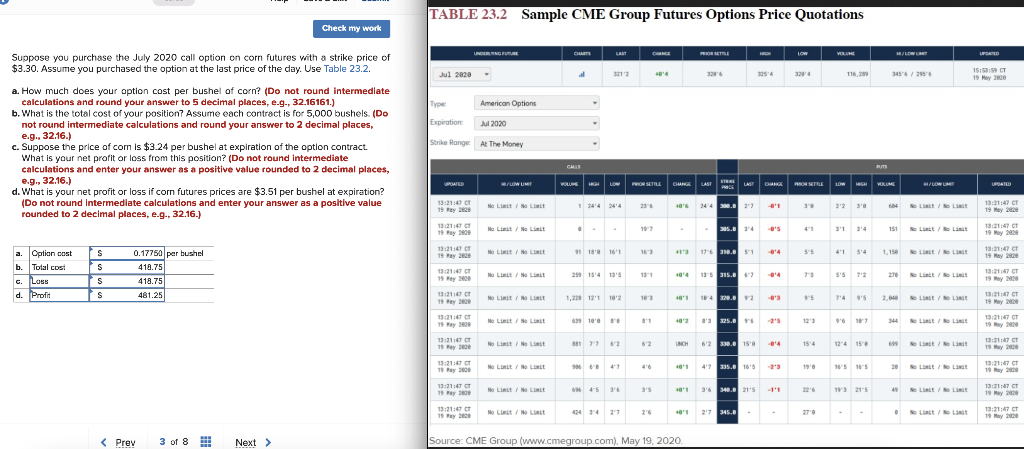

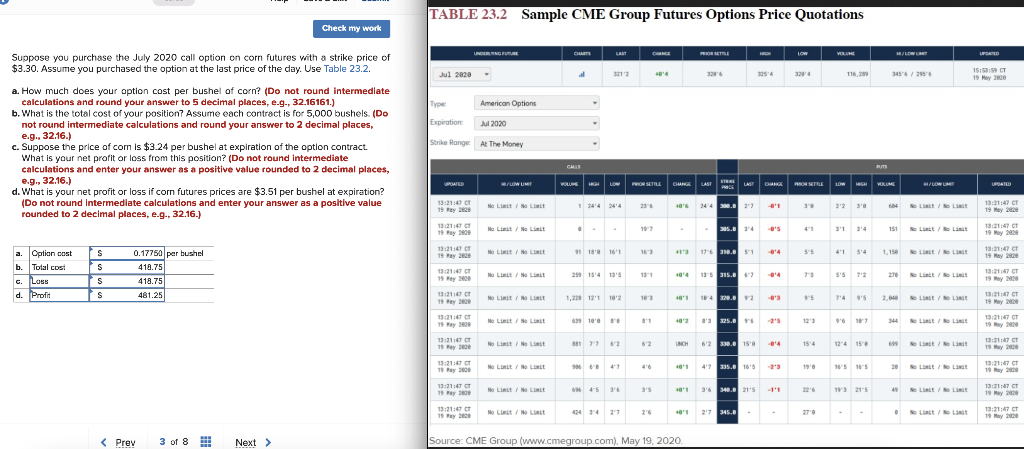

Suppose you purchase the July 2020 call option on corn futures with a strike price of $3.30. Assume you purchased the option at the last price of the day. Use Table 23.2. a. How much does your option cost per bushel of corn? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., 32.16161.) b. What is the total cost of your position? Assume each contract is for 5,000 bushels. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Suppose the price of com is $3.24 per bushel at expiration of the option contract. What is your net profit or loss from this position? (Do not round intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) d. What is your net profit or loss if corn futures prices are $3.51 per bushel at expiration? (Do not round Intermediate calculations and enter your answer as a positive value rounded to 2 decimal places, e.g., 32.16.) a. Option cost b. Total cost C. Loss d. Profit S S S s 0.17750 per bushel 418.75 418.75 481.25 Check my work TABLE 23.2 Sample CME Group Futures Options Price Quotations Jul 2020 Type: Expiration: Strike Range: 13:21:47 C 19 May 2629 13:21:47 C 19 May 2009 13:21:47 Cr 19 May 2629 13:21:47 T 19 May 2009 13:21:47 CT 19 May 2628 13:21:47 CT 19 May 2009 13:21:47 T 19 May 2008 13:21:47 T 19 May 2008 13:21:47 CT 19 May 2009 13:21:47 T 19 May 2009 UNDERLYING FUTURE American Options Jul 2020 At The Money M/LOW LIMIT No Limit / No Limit No Limit / No Limit No Limit / No Limit No Limit / No Limit No Limit No Limit No Limit No Limit No Limit / No Limit No Limit / No Limit No Limit / No Limit No Limit / No Limit CHARTS al CALLS VOLUME HIGH .. LAST 3212 LD 91 18' 16'1 259 15'413'5 1,228 12'1 102 69645 639 100 86 881 77 62 424 324 27 PRIOR SETTLE 197 16'3 131 103 8'1 6:2 404 3'5 CHANGE LAST 40'6 244 300.0 27 40'1 PRIOR SETTLE +1'3 17 6 310.051 UNCH STRME PRACE 40'413'5 315.0 47 40'1 +0'1 305.0 34 +0'2 8'3 325.0 16 Source: CME Group (www.cmegroup.com), May 19, 2020 LAST CHANGE PROR SETTLE 164 320.0 12 HIGH 325 4 36 340.0 21'5 217 345.0 401 47 335.0 16'5 -23 -8'4 --04 6'2 330.0 15'004 -0'3 LOW -1'1 320/4 30 4'1 5'5 73 12'3 15:4 19'0 27'0 VOLUME 116,299 2'23'0 PUTS LOW HIGH VOLUME 31 34 5'4 5'5 72 96 187 124 15 M/LOW LIMIT 165 165 3456/295/6 193 215 684 151 1,156 M/LOW LI 7'49'5 2,040 No List/No Lin No Limit / No Limit 49 No Limit / No Li No List/No Limit No Limit/No Limit No List/No L 699 No List/No Limit No List/No L No Limit / No Limit No List/No Li UPDATED 15:53:59 CT 19 May 200 13:21:47 T 19 May 200 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2829 13:21:47 CT 19 May 2929 13:21:47 CT 19 May 2929 13:21:47 CT 19 May 2929 13:21:47 T 19 May 200 13:21:47 T 19 May 200 13:21:47 CT 19 May 2020 13:21:47 CT 19 May 2020