Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally became an employee of DotGismo, Inc., a privately held firm. On December 15, 20X3, Sally was allowed to buy 20,000 shares of DotGismo

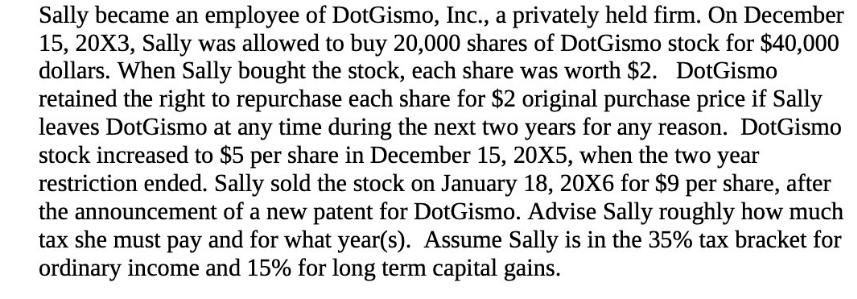

Sally became an employee of DotGismo, Inc., a privately held firm. On December 15, 20X3, Sally was allowed to buy 20,000 shares of DotGismo stock for $40,000 dollars. When Sally bought the stock, each share was worth $2. DotGismo retained the right to repurchase each share for $2 original purchase price if Sally leaves DotGismo at any time during the next two years for any reason. DotGismo stock increased to $5 per share in December 15, 20X5, when the two year restriction ended. Sally sold the stock on January 18, 20X6 for $9 per share, after the announcement of a new patent for DotGismo. Advise Sally roughly how much tax she must pay and for what year(s). Assume Sally is in the 35% tax bracket for ordinary income and 15% for long term capital gains.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sally will have to pay taxes on the gains from selling her DotGismo stock Lets brea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started