Answered step by step

Verified Expert Solution

Question

1 Approved Answer

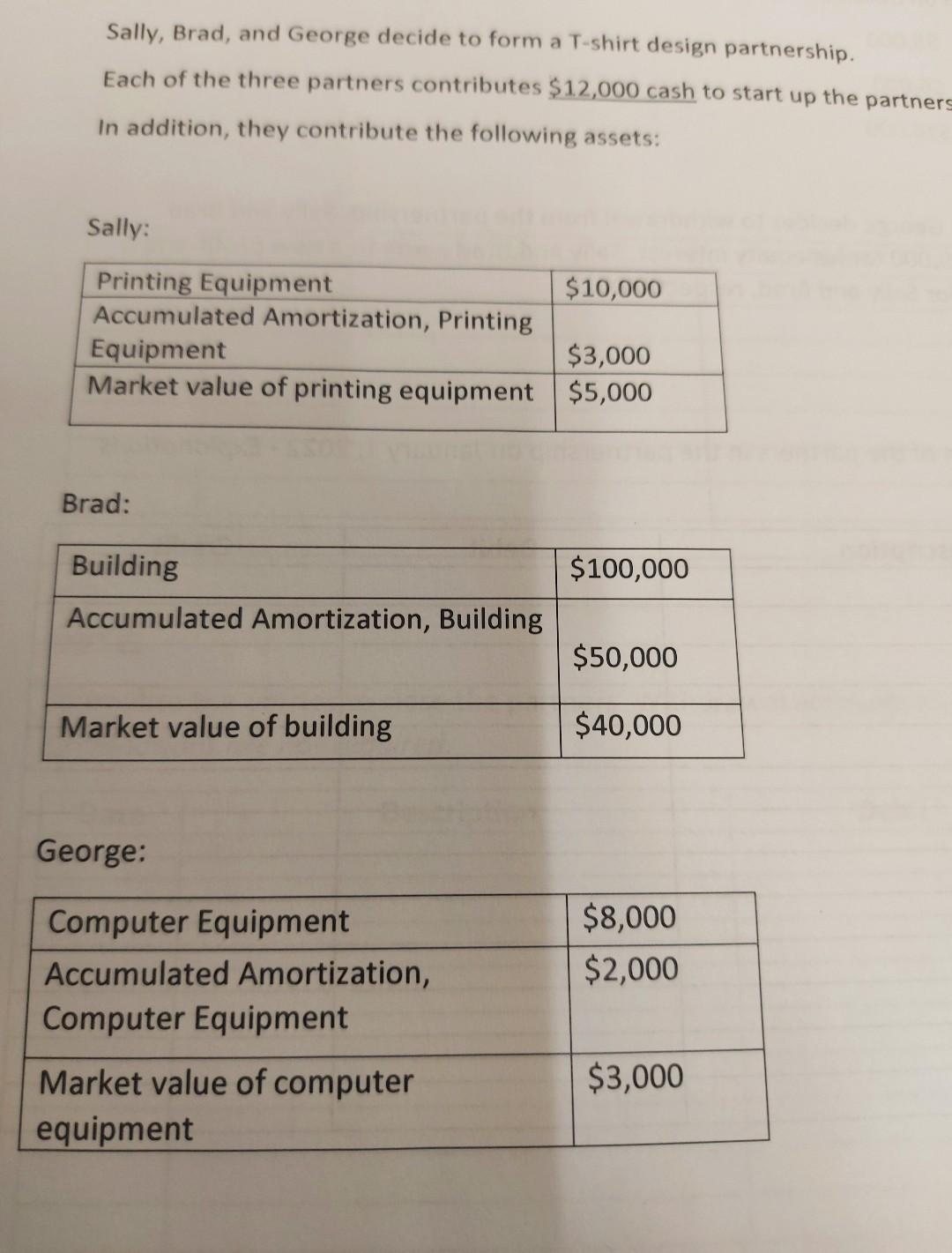

Sally, Brad, and George decide to form a T-shirt design partnership. Each of the three partners contributes $12,000 cash to start up the partners In

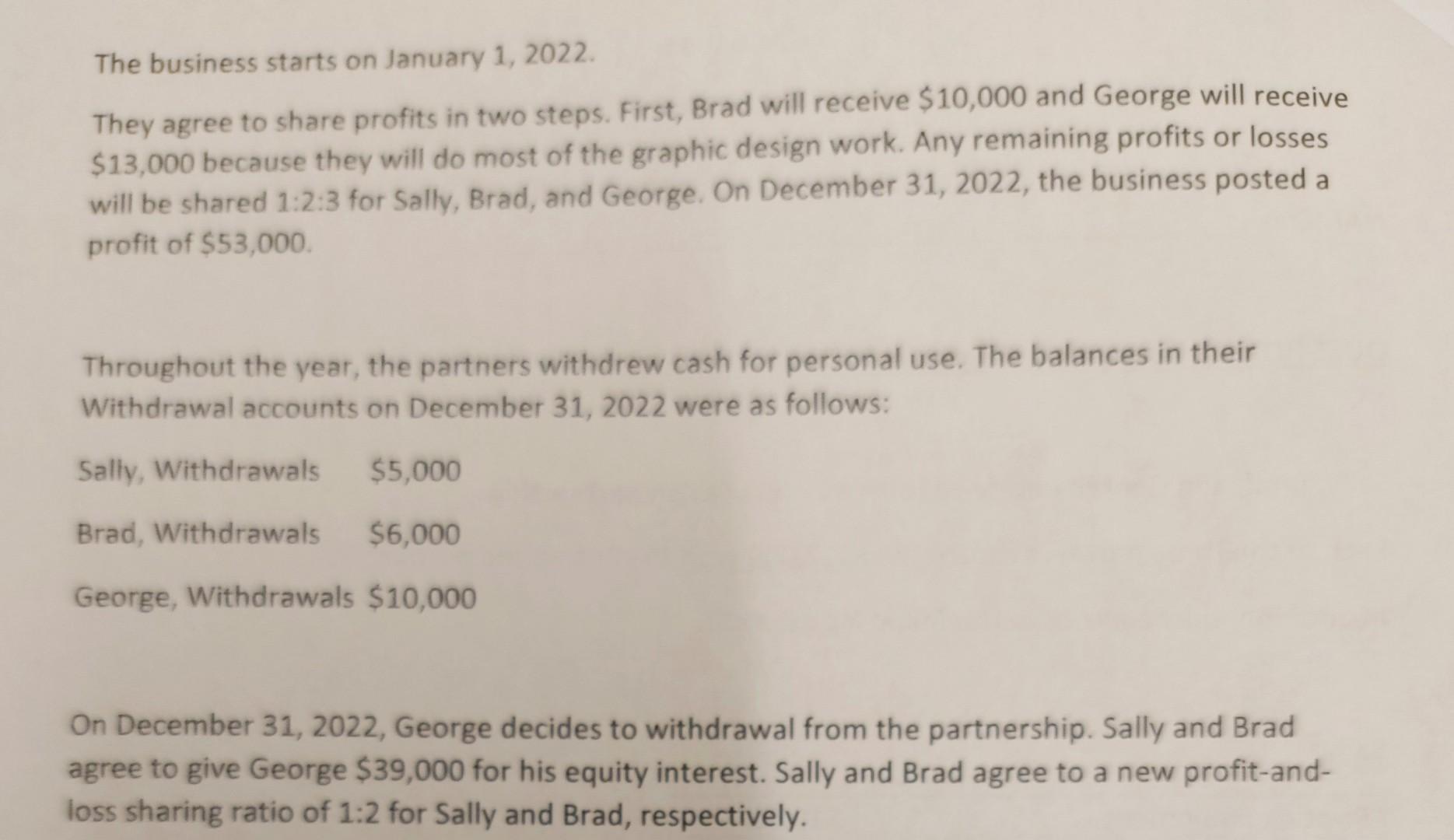

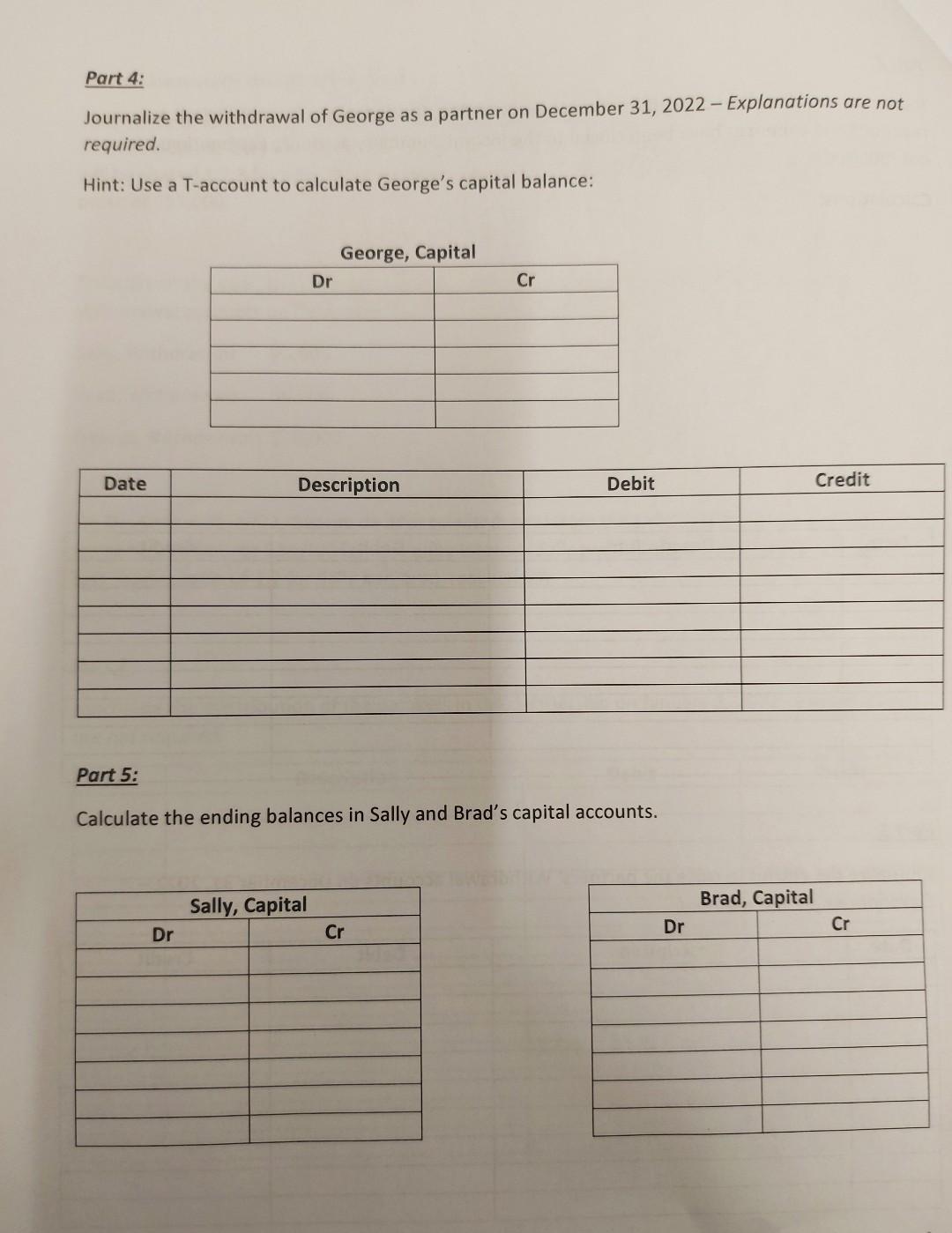

Sally, Brad, and George decide to form a T-shirt design partnership. Each of the three partners contributes $12,000 cash to start up the partners In addition, they contribute the following assets: Sally: Printing Equipment $10,000 Accumulated Amortization, Printing Equipment $3,000 Market value of printing equipment $5,000 Brad: $100,000 Building Accumulated Amortization, Building $50,000 Market value of building $40,000 George: $8,000 Computer Equipment Accumulated Amortization, Computer Equipment $2,000 $3,000 Market value of computer equipment The business starts on January 1, 2022 They agree to share profits in two steps. First, Brad will receive $10,000 and George will receive $13,000 because they will do most of the graphic design work. Any remaining profits or losses will be shared 1:2:3 for Sally, Brad, and George On December 31, 2022, the business posted a profit of $53,000 Throughout the year, the partners withdrew cash for personal use. The balances in their Withdrawal accounts on December 31, 2022 were as follows: Sally, Withdrawals $5,000 Brad, Withdrawals $6,000 George, Withdrawals $10,000 On December 31, 2022, George decides to withdrawal from the partnership. Sally and Brad agree to give George $39,000 for his equity interest. Sally and Brad agree to a new profit-and- loss sharing ratio of 1:2 for Sally and Brad, respectively. Part 4: Journalize the withdrawal of George as a partner on December 31, 2022 Explanations are not required. Hint: Use a T-account to calculate George's capital balance: George, Capital Dr Cr Date Description Debit Credit Part 5: Calculate the ending balances in Sally and Brad's capital accounts. Sally, Capital Brad, Capital Dr Cr Dr Cr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started