Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally sells authentic Amish quilts on her website. Suppose Sally expects to sell 2,000 quilts during the coming year. Her average sales price per quilt

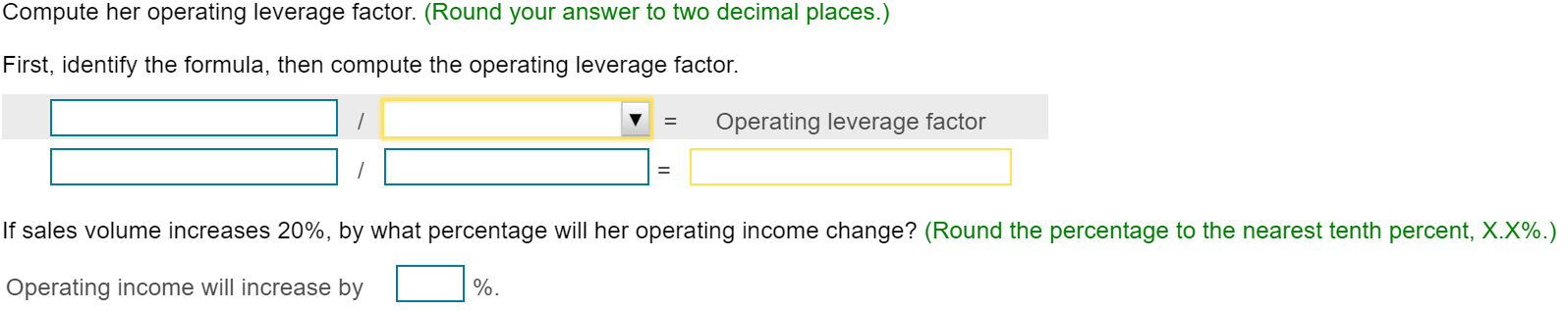

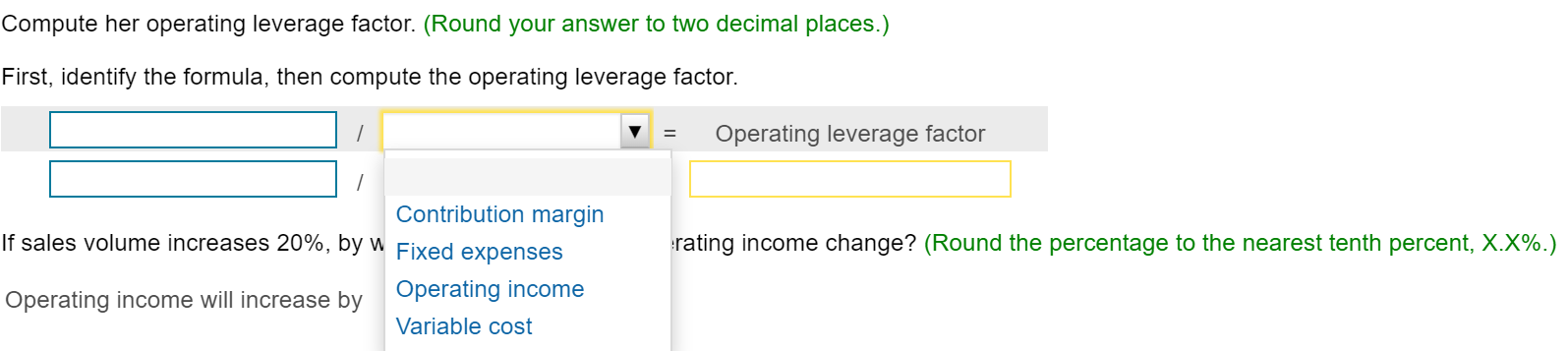

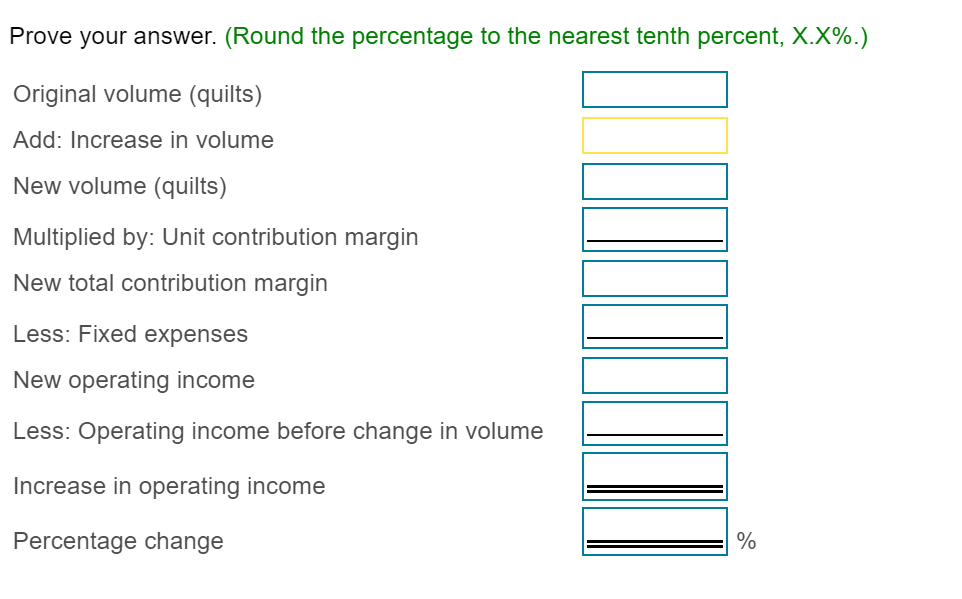

Sally sells authentic Amish quilts on her website. Suppose Sally expects to sell 2,000 quilts during the coming year. Her average sales price per quilt is $ 375, and her average cost per quilt is $ 175. Her fixed expenses total $ 200,000. Compute Sally's operating leverage factor at an expected sales level of 2,000 quilts. If sales volume increases 20%, by what percentage will her operating income change? Prove your answer by calculating operating income at a sales volume of 2,000 and at a sales volume of 2,400.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started