Question

Sam agency bought machine costing $150000 on 1st April 2016.He writes off depreciation @10% p.a on written down value method every year. his books

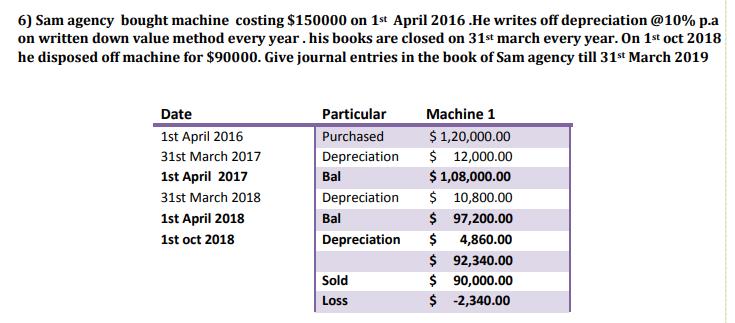

Sam agency bought machine costing $150000 on 1st April 2016.He writes off depreciation @10% p.a on written down value method every year. his books are closed on 31st march every year. On 1st oct 2018 he disposed off machine for $90000. Give journal entries in the book of Sam agency till 31st March 2019 Date 1st April 2016 31st March 2017 1st April 2017 31st March 2018 1st April 2018 1st oct 2018 Particular Purchased Depreciation Bal Depreciation Bal Depreciation Sold Loss Machine 1 $ 1,20,000.00 $ 12,000.00 $ 1,08,000.00 $ 10,800.00 $ 97,200.00 $ 4,860.00 $ 92,340.00 $ 90,000.00 $ -2,340.00

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2020 Comprehensive

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

43rd Edition

357109147, 978-0357109144

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App