Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam deposits 1600 every year on his birthday into a retirement fund earning an annual effective rate of 10%. The first deposit is made on

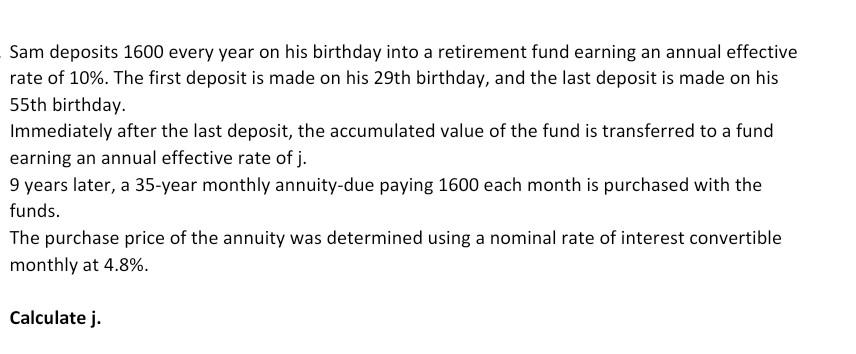

Sam deposits 1600 every year on his birthday into a retirement fund earning an annual effective rate of 10%. The first deposit is made on his 29th birthday, and the last deposit is made on his 55th birthday. Immediately after the last deposit, the accumulated value of the fund is transferred to a fund earning an annual effective rate of j. 9 years later, a 35-year monthly annuity-due paying 1600 each month is purchased with the funds. The purchase price of the annuity was determined using a nominal rate of interest convertible monthly at 4.8%. Calculate j

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started