Answered step by step

Verified Expert Solution

Question

1 Approved Answer

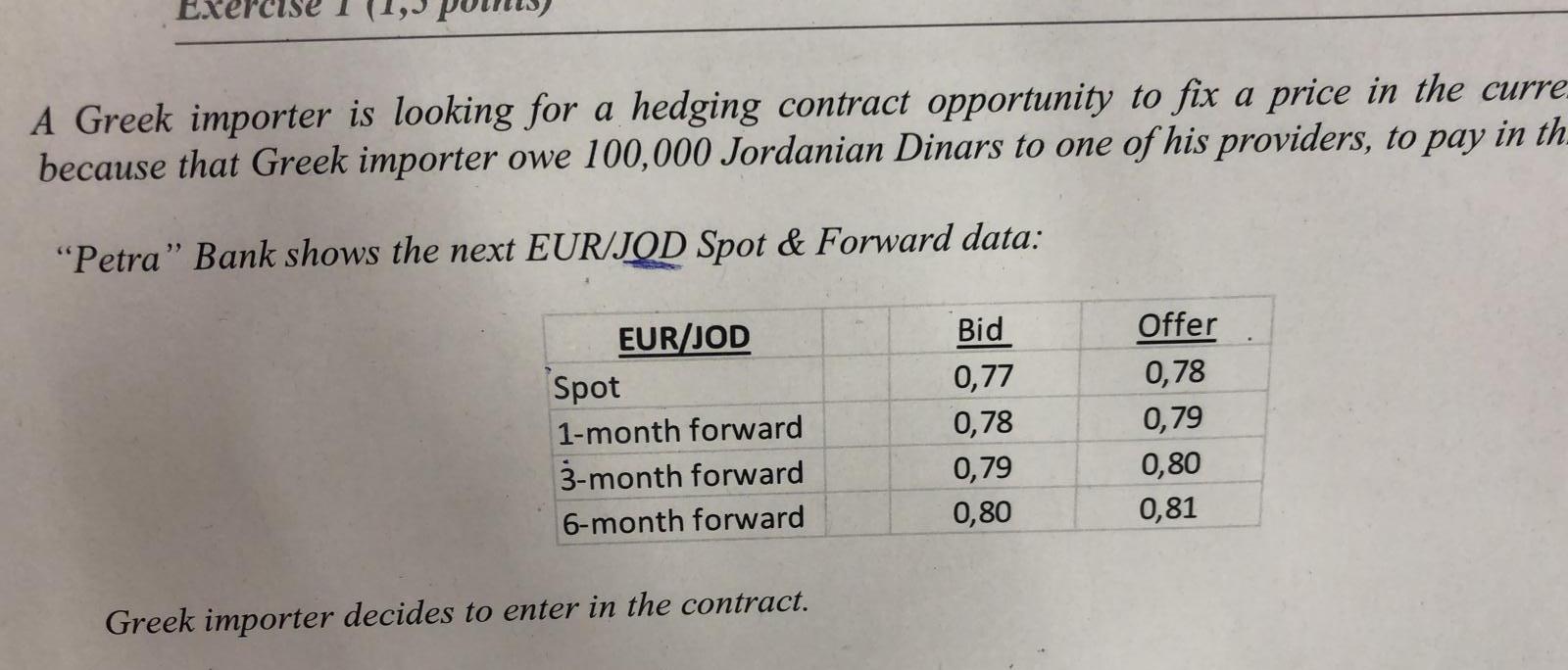

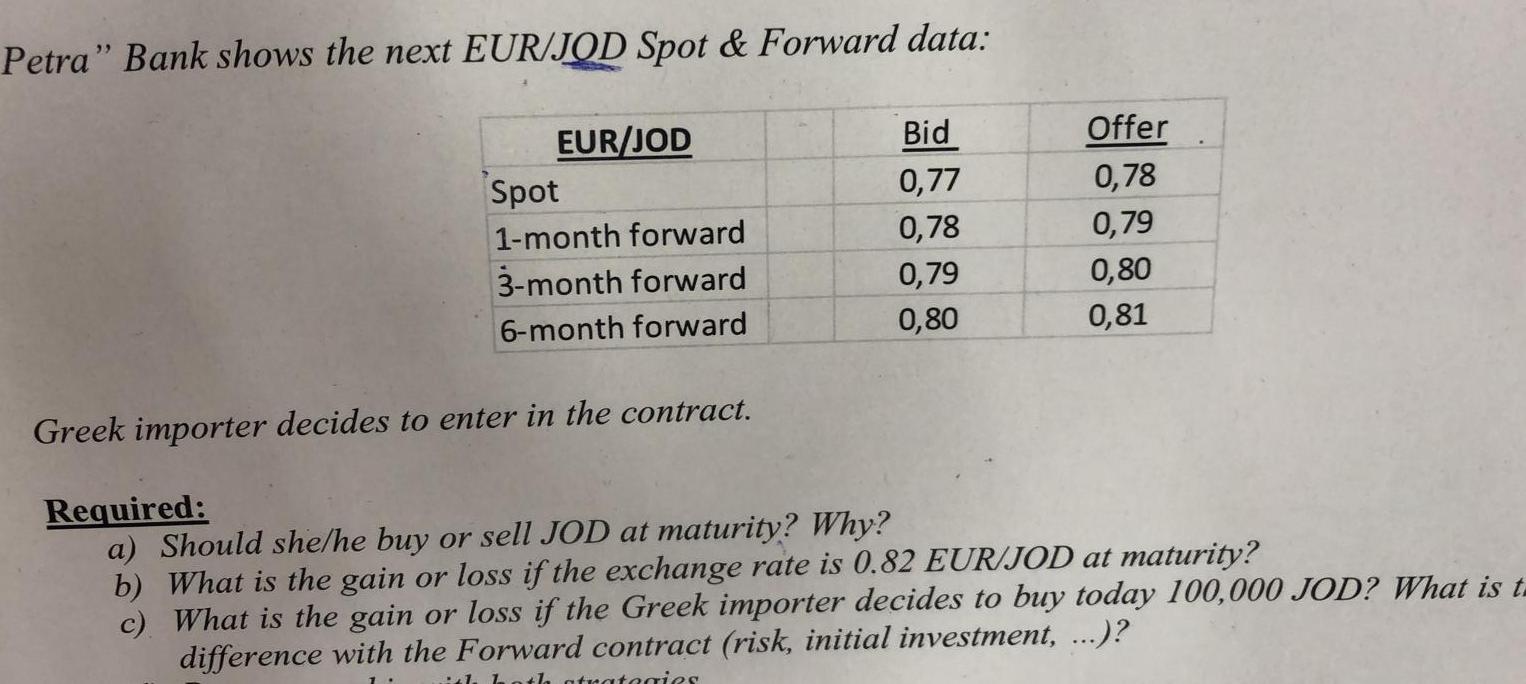

A Greek importer is looking for a hedging contract opportunity to fix a price in the curre because that Greek importer owe 100,000 Jordanian Dinars

A Greek importer is looking for a hedging contract opportunity to fix a price in the curre because that Greek importer owe 100,000 Jordanian Dinars to one of his providers, to pay in th "Petra" Bank shows the next EUR/JOD Spot & Forward data: EUR/JOD Spot 1-month forward 3-month forward 6-month forward Bid 0,77 0,78 0,79 0,80 Offer 0,78 0,79 0,80 0,81 Greek importer decides to enter in the contract. Petra" Bank shows the next EUR/JOD Spot & Forward data: EUR/JOD Spot 1-month forward 3-month forward 6-month forward Bid 0,77 0,78 0,79 0,80 Offer 0,78 0,79 0,80 0,81 Greek importer decides to enter in the contract. Required: a) Should she/he buy or sell JOD at maturity? Why? b) What the gain or loss if the exchange rate is 0.82 EUR/JOD at maturity? c) What is the gain or loss if the Greek importer decides to buy today 100,000 JOD? What is t- difference with the Forward contract (risk, initial investment, ...)? 1. Lotlotratories A Greek importer is looking for a hedging contract opportunity to fix a price in the curre because that Greek importer owe 100,000 Jordanian Dinars to one of his providers, to pay in th "Petra" Bank shows the next EUR/JOD Spot & Forward data: EUR/JOD Spot 1-month forward 3-month forward 6-month forward Bid 0,77 0,78 0,79 0,80 Offer 0,78 0,79 0,80 0,81 Greek importer decides to enter in the contract. Petra" Bank shows the next EUR/JOD Spot & Forward data: EUR/JOD Spot 1-month forward 3-month forward 6-month forward Bid 0,77 0,78 0,79 0,80 Offer 0,78 0,79 0,80 0,81 Greek importer decides to enter in the contract. Required: a) Should she/he buy or sell JOD at maturity? Why? b) What the gain or loss if the exchange rate is 0.82 EUR/JOD at maturity? c) What is the gain or loss if the Greek importer decides to buy today 100,000 JOD? What is t- difference with the Forward contract (risk, initial investment, ...)? 1. Lotlotratories

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started