Answered step by step

Verified Expert Solution

Question

1 Approved Answer

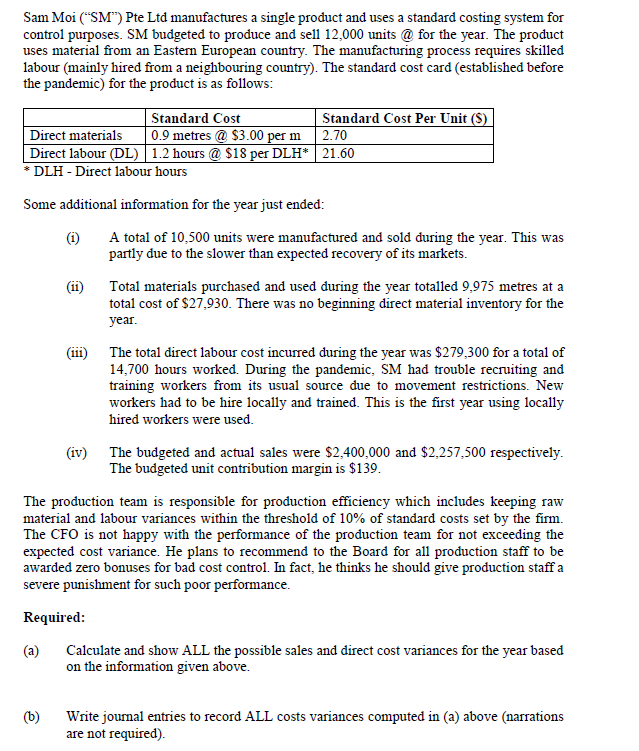

Sam Moi (SM) Pte Ltd manufactures a single product and uses a standard costing system for control purposes. SM budgeted to produce and sell12,000 units

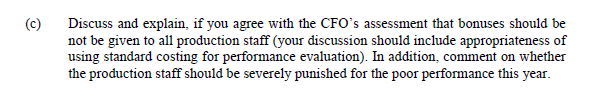

Sam Moi ("SM") Pte Ltd manufactures a single product and uses a standard costing system for control purposes. SM budgeted to produce and sell12,000 units @ for the year. The product uses material from an Eastern European country. The manufacturing process requires skilled labour (mainly hired from a neighbouring country). The standard cost card (established before the pandemic) for the product is as follows: - VLH - Direct labour nours Some additional information for the year just ended: (i) A total of 10,500 units were manufactured and sold during the year. This was partly due to the slower than expected recovery of its markets. (ii) Total materials purchased and used during the year totalled 9,975 metres at a total cost of $27,930. There was no beginning direct material inventory for the year. (iii) The total direct labour cost incurred during the year was $279,300 for a total of 14,700 hours worked. During the pandemic, SM had trouble recruiting and training workers from its usual source due to movement restrictions. New workers had to be hire locally and trained. This is the first year using locally hired workers were used. (iv) The budgeted and actual sales were $2,400,000 and $2,257,500 respectively. The budgeted unit contribution margin is $139. The production team is responsible for production efficiency which includes keeping raw material and labour variances within the threshold of 10% of standard costs set by the firm. The CFO is not happy with the performance of the production team for not exceeding the expected cost variance. He plans to recommend to the Board for all production staff to be awarded zero bonuses for bad cost control. In fact, he thinks he should give production staff a severe punishment for such poor performance. Required: (a) Calculate and show ALL the possible sales and direct cost variances for the year based on the information given above. (b) Write journal entries to record ALL costs variances computed in (a) above (narrations are not required). Discuss and explain, if you agree with the CFO's assessment that bonuses should be not be given to all production staff (your discussion should include appropriateness of using standard costing for performance evaluation). In addition, comment on whether the production staff should be severely punished for the poor performance this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started