Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sameera, a woman aged over 50 years old, died on 23 February 2020, leaving an estate estimated to be about 1million. She had been

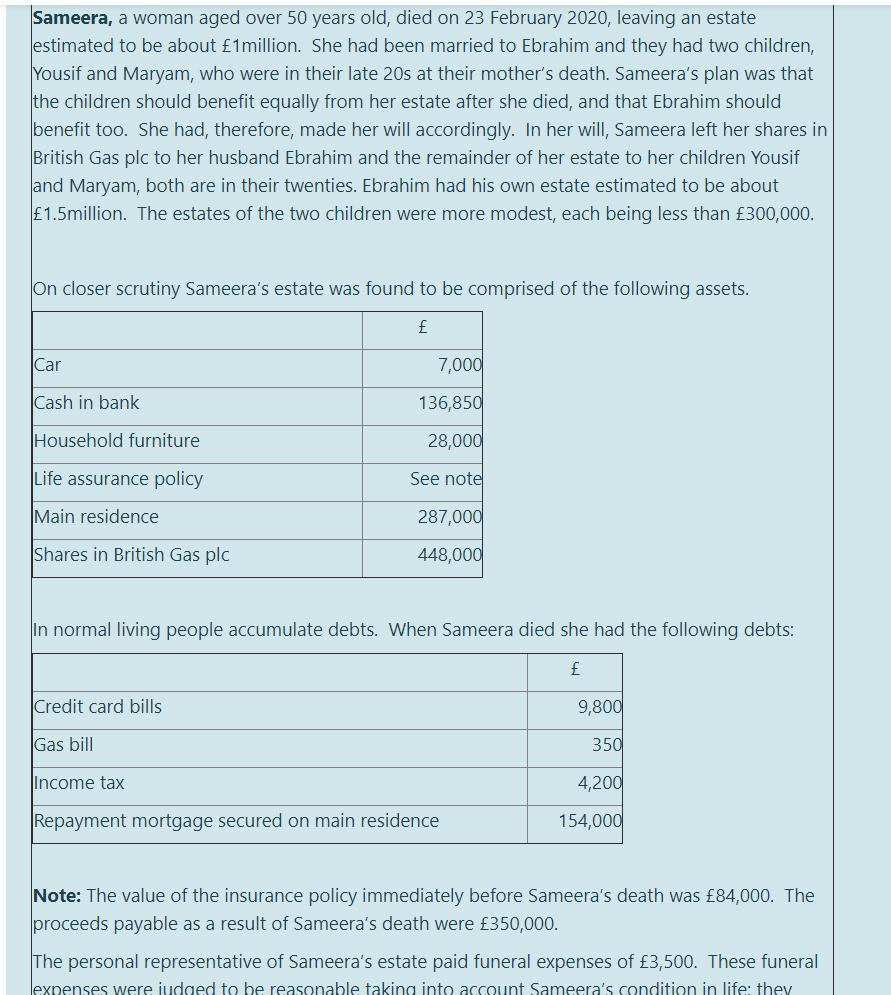

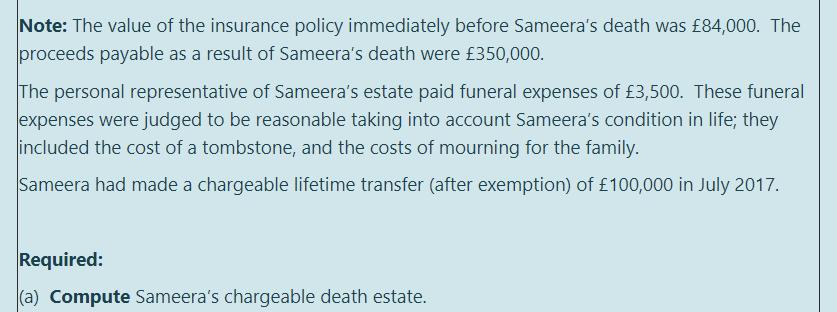

Sameera, a woman aged over 50 years old, died on 23 February 2020, leaving an estate estimated to be about 1million. She had been married to Ebrahim and they had two children, Yousif and Maryam, who were in their late 20s at their mother's death. Sameera's plan was that the children should benefit equally from her estate after she died, and that Ebrahim should benefit too. She had, therefore, made her will accordingly. In her will, Sameera left her shares in British Gas plc to her husband Ebrahim and the remainder of her estate to her children Yousif and Maryam, both are in their twenties. Ebrahim had his own estate estimated to be about 1.5million. The estates of the two children were more modest, each being less than 300,000. On closer scrutiny Sameera's estate was found to be comprised of the following assets. Car 7,000 Cash in bank 136,850 Household furniture 28,000 Life assurance policy See note Main residence 287,000 Shares in British Gas plc 448,000 In normal living people accumulate debts. When Sameera died she had the following debts: Credit card bills 9,800 Gas bill 350 Income tax 4,200 Repayment mortgage secured on main residence 154,000 Note: The value of the insurance policy immediately before Sameera's death was 84,000. The proceeds payable as a result of Sameera's death were 350,000. The personal representative of Sameera's estate paid funeral expenses of 3,500. These funeral lexpenses were judged to be reasonable taking into account Sameera's condition in life: they Note: The value of the insurance policy immediately before Sameera's death was 84,000. The proceeds payable as a result of Sameera's death were 350,000. The personal representative of Sameera's estate paid funeral expenses of 3,500. These funeral expenses were judged to be reasonable taking into account Sameera's condition in life; they included the cost of a tombstone, and the costs of mourning for the family. Sameera had made a chargeable lifetime transfer (after exemption) of 100,000 in July 2017. Required: (a) Compute Sameera's chargeable death estate.

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63628789ac180_236481.pdf

180 KBs PDF File

63628789ac180_236481.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started