Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sami Terry is working as an Electrician for Siemens International in Toronto, Ontario. He earns $1500.00 on a bi-weekly basis. Sami's Federal and provincial

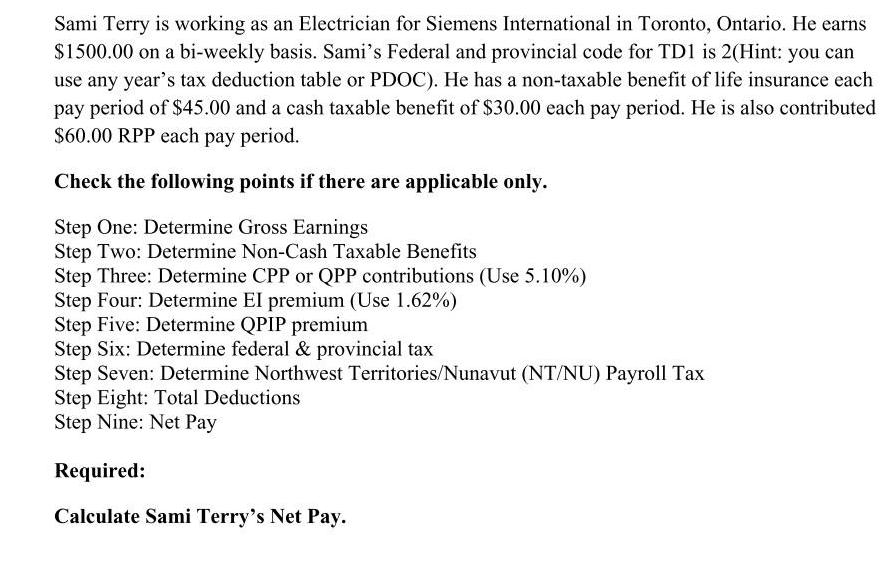

Sami Terry is working as an Electrician for Siemens International in Toronto, Ontario. He earns $1500.00 on a bi-weekly basis. Sami's Federal and provincial code for TD1 is 2(Hint: you can use any year's tax deduction table or PDOC). He has a non-taxable benefit of life insurance each pay period of $45.00 and a cash taxable benefit of $30.00 each pay period. He is also contributed $60.00 RPP each pay period. Check the following points if there are applicable only. Step One: Determine Gross Earnings Step Two: Determine Non-Cash Taxable Benefits Step Three: Determine CPP or QPP contributions (Use 5.10%) Step Four: Determine El premium (Use 1.62%) Step Five: Determine QPIP premium Step Six: Determine federal & provincial tax Step Seven: Determine Northwest Territories/Nunavut (NT/NU) Payroll Tax Step Eight: Total Deductions Step Nine: Net Pay Required: Calculate Sami Terry's Net Pay.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

His Biannual income is 1500 Nontaxable in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started