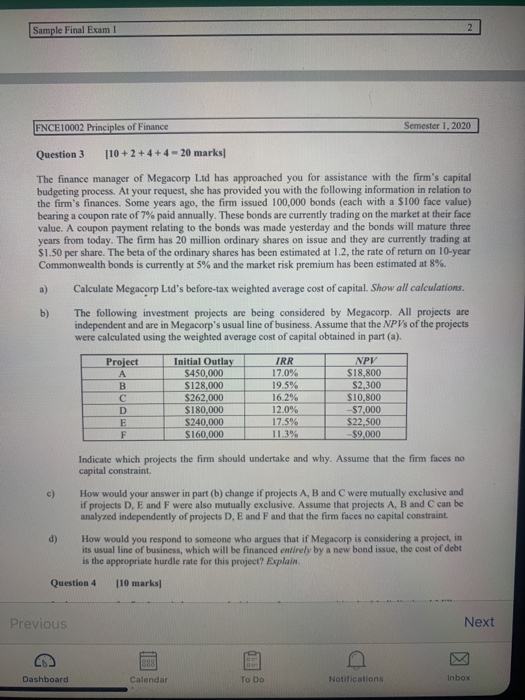

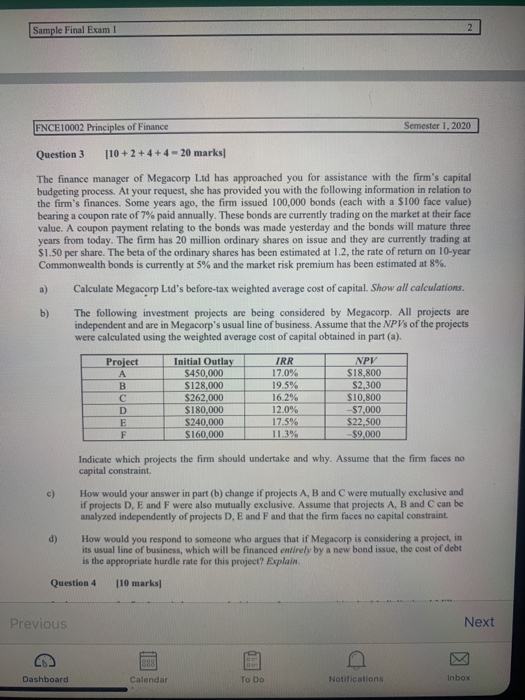

Sample Final Exam I 2 FNCE 10002 Principles of Finance Semester 1, 2020 Question 3 110 +2 +4 + 4-20 marks) The finance manager of Megacorp Ltd has approached you for assistance with the firm's capital budgeting process. At your request, she has provided you with the following information in relation to the firm's finances. Some years ago, the firm issued 100,000 bonds (each with a $100 face value) bearing a coupon rate of 7% paid annually. These bonds are currently trading on the market at their face value. A coupon payment relating to the bonds was made yesterday and the bonds will mature three years from today. The firm has 20 million ordinary shares on issue and they are currently trading at $1.50 per share. The beta of the ordinary shares has been estimated at 1.2, the rate of return on 10-year Commonwealth bonds is currently at 5% and the market risk premium has been estimated at 8%. Calculate Megacorp Ltd's before-tax weighted average cost of capital. Show all calculations b) The following investment projects are being considered by Megacorp. All projects are independent and are in Megacorp's usual line of business. Assume that the NPVs of the projects were calculated using the weighted average cost of capital obtained in part (a). Project A B D E F Initial Outlay $450,000 $128.000 $262,000 $180,000 $240,000 S160,000 IRR 17.0% 19.5% 16.2% 12.0% 17.5% 11.3% NPV $18,800 $2,300 $10.800 -$7,000 $22,500 $9,000 Indicate which projects the firm should undertake and why. Assume that the firm faces no capital constraint. c) How would your answer in part (b) change if projects A, B and C were mutually exclusive and if projects D, E and F were also mutually exclusive. Assume that projects A, B and C can be analyzed independently of projects D, E and F and that the firm faces no capital constraint. d) How would you respond to someone who argues that if Megacorp is considering a project, in its usual line of business, which will be financed entirely by a new bond issue, the cost of debt is the appropriate hurdle rate for this project? Explain Question 4 110 marks Previous Next D Dashboard Calendar To Do Notifications Inbox Sample Final Exam I 2 FNCE 10002 Principles of Finance Semester 1, 2020 Question 3 110 +2 +4 + 4-20 marks) The finance manager of Megacorp Ltd has approached you for assistance with the firm's capital budgeting process. At your request, she has provided you with the following information in relation to the firm's finances. Some years ago, the firm issued 100,000 bonds (each with a $100 face value) bearing a coupon rate of 7% paid annually. These bonds are currently trading on the market at their face value. A coupon payment relating to the bonds was made yesterday and the bonds will mature three years from today. The firm has 20 million ordinary shares on issue and they are currently trading at $1.50 per share. The beta of the ordinary shares has been estimated at 1.2, the rate of return on 10-year Commonwealth bonds is currently at 5% and the market risk premium has been estimated at 8%. Calculate Megacorp Ltd's before-tax weighted average cost of capital. Show all calculations b) The following investment projects are being considered by Megacorp. All projects are independent and are in Megacorp's usual line of business. Assume that the NPVs of the projects were calculated using the weighted average cost of capital obtained in part (a). Project A B D E F Initial Outlay $450,000 $128.000 $262,000 $180,000 $240,000 S160,000 IRR 17.0% 19.5% 16.2% 12.0% 17.5% 11.3% NPV $18,800 $2,300 $10.800 -$7,000 $22,500 $9,000 Indicate which projects the firm should undertake and why. Assume that the firm faces no capital constraint. c) How would your answer in part (b) change if projects A, B and C were mutually exclusive and if projects D, E and F were also mutually exclusive. Assume that projects A, B and C can be analyzed independently of projects D, E and F and that the firm faces no capital constraint. d) How would you respond to someone who argues that if Megacorp is considering a project, in its usual line of business, which will be financed entirely by a new bond issue, the cost of debt is the appropriate hurdle rate for this project? Explain Question 4 110 marks Previous Next D Dashboard Calendar To Do Notifications Inbox