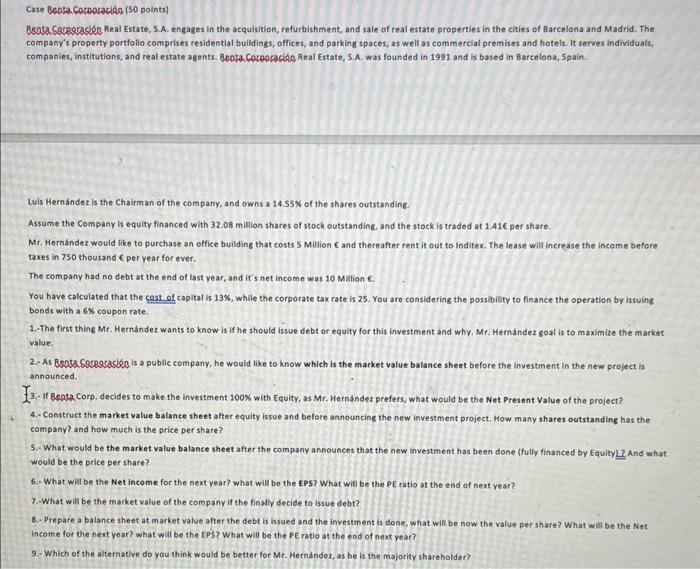

Case Beata Copooraciong ( 50 points) Beata Soyporackg. Real Estate, S.A. engages in the acquisition, refurbishment, and sale of real estate properties in the cities of Barcelona and Madrid. The company's property portfolio comprises residential buildings, offices, and parking spaces, as well as commercial premises and hotels. It serves individuals, companies, institutions, and real estate agents. Beota. Cocpopecioo Real Estate, \$. A. was founded in 1991 and is based in Barcelona, Spain. Luis Hernndez is the Chairman of the company, and owns a 14.55% of the shares outstanding. Assume the Company is equity financed with 32.08 million shares of stock outstanding, and the stock is traded at 1.416 per share. Mr. Herndindez would like to purchase an office building that costs 5 Million C and thereafter rent it out to inditex. The lease will increase the income before taxes in 750 thousand C per year for ever. The company had no debt at the end of last year, and it's net income was 10 Million f.. You have calculated that the cost of capital is 13%, while the corporate tax rate is 25 . You are considering the possibility to finance the operation by issuing bonds with a 6 coupon rate. 1.-The first thing Mr. Hernndez wants to know is if he should issue debt or equity for this investment and why. Mr. Hernaindez goal is to maximize the market value. 2,- As Resata Gopegcasibng is a public company, he would like to know which is the market value balance sheet before the investment in the new project is announced. E3,- If Beata Corp. decides to make the investment 100% with Equity, as Mr. Hernandez prefers, what would be the Net Present Value of the project? 4.- Construct the market value balance sheet after equity issue and belore announcing the new investment project. How many shares outstanding has the company? and how much is the price per share? 5.- What would be the market value balance sheet after the company announces that the new investment has been done (fully financed by Equity ? And what would be the price per share? 6. What wial be the Net income for the next year? what will be the EP5? What will be the PE ratio at the end of next year? 7.-What will be the market value of the company if the finally decide to issue debt? 8.- Prepare a balance sheet at market value after the debt is issued and the investment is done, what will be now the value per share? What wit be the Net income for the next year? what will be the EPS? What will be the PE ratio at the end of next year? 9. Which of the alternative do you think would be better for Mr. Hernandex, as he it the majority shareholder