Question

Sample format of another question answer for reference: A positive figure in cash flow, given a significant outflow caused by receivable 2017 In both years,

Sample format of another question answer for reference:

A positive figure in cash flow, given a significant outflow caused by receivable 2017

In both years, the net cash from operating activities was positive. This implies that cash from operations was sufficient to cover payments for interest, dividends and tax, and to contribute to the non-current assets acquisition.

In 2017, the net cash inflow from operation (10.8M) did not cover the full amount of non-current asset investment. But it was not a problem in cash, due to the large amount of investment in non-current asset.

However, a significant decrease in cash may be a problem; for normally more cash would be required to support the increased activities.

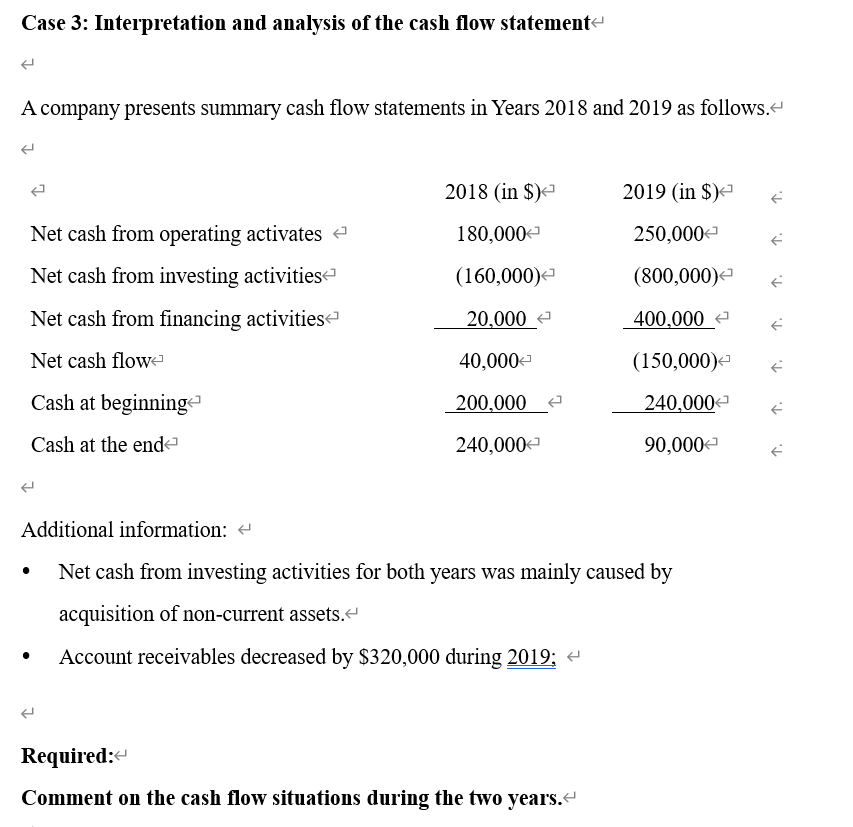

Case 3: Interpretation and analysis of the cash flow statement- A company presents summary cash flow statements in Years 2018 and 2019 as follows. 2018 (in $ 2019 (in $ 1. Net cash from operating activates 180,000 250,000 1. Net cash from investing activities (160,000 (800,000) . Net cash from financing activities 20,000 400,000 1. 40,000 (150,000 1. Net cash flowe Cash at beginning 200.000 e 240,000 1. Cash at the end 240,000 90,000 1. Additional information: Net cash from investing activities for both years was mainly caused by acquisition of non-current assets. Account receivables decreased by $320,000 during 2019; Required: Comment on the cash flow situations during the two years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started