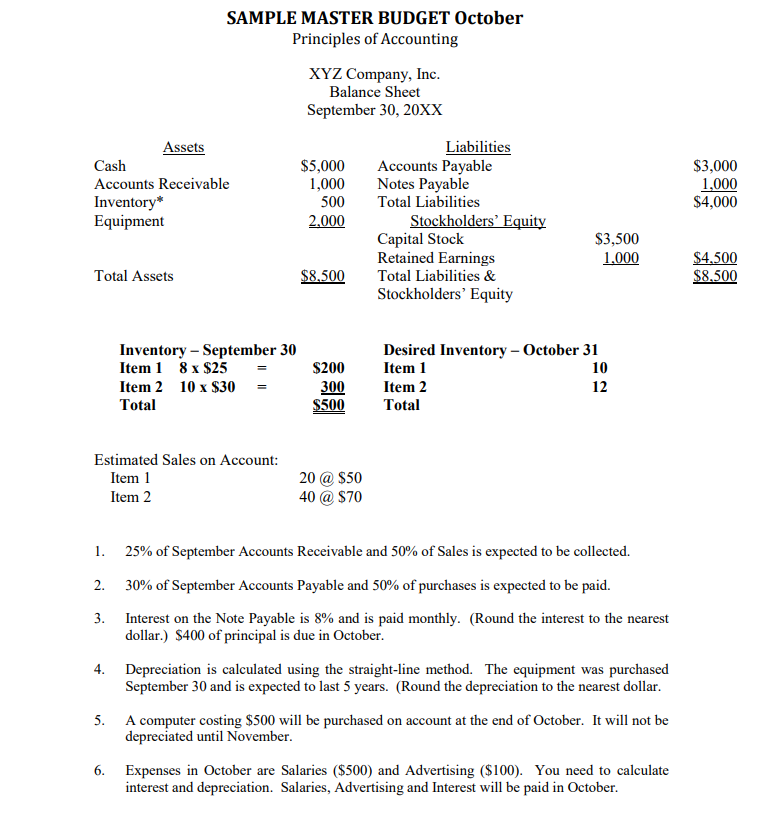

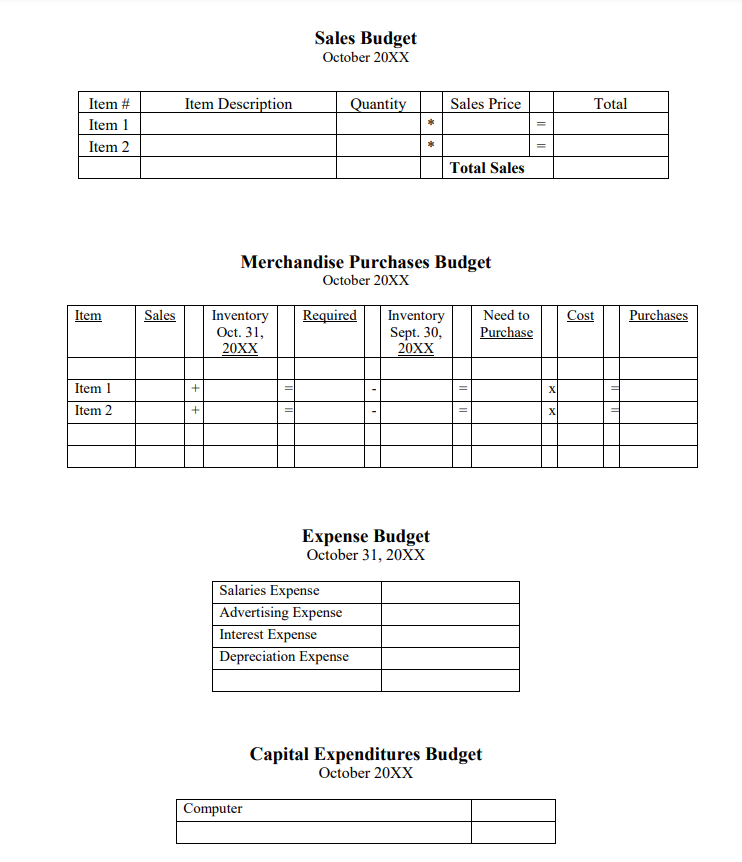

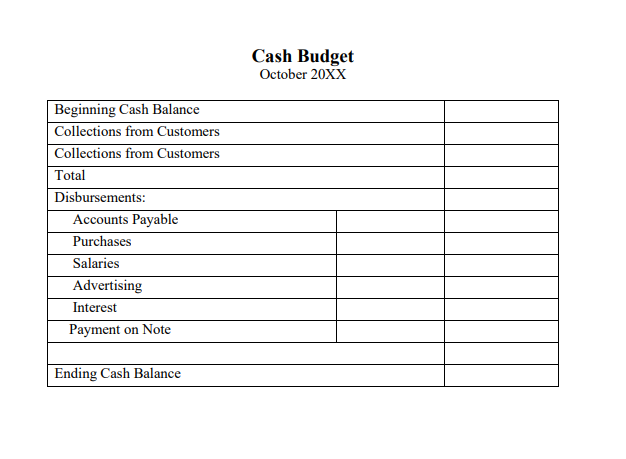

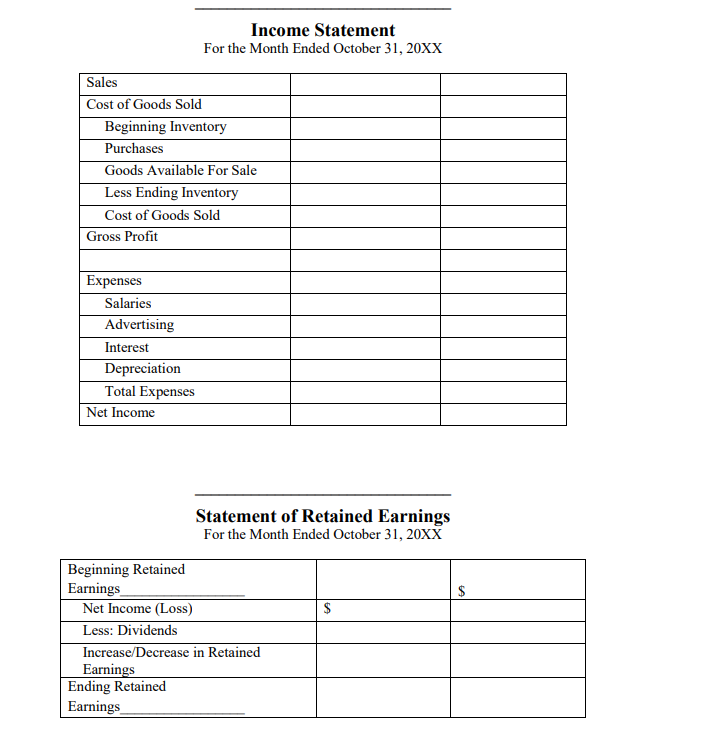

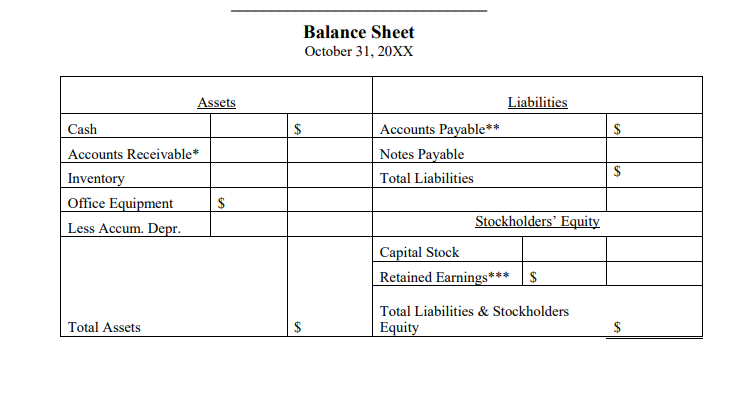

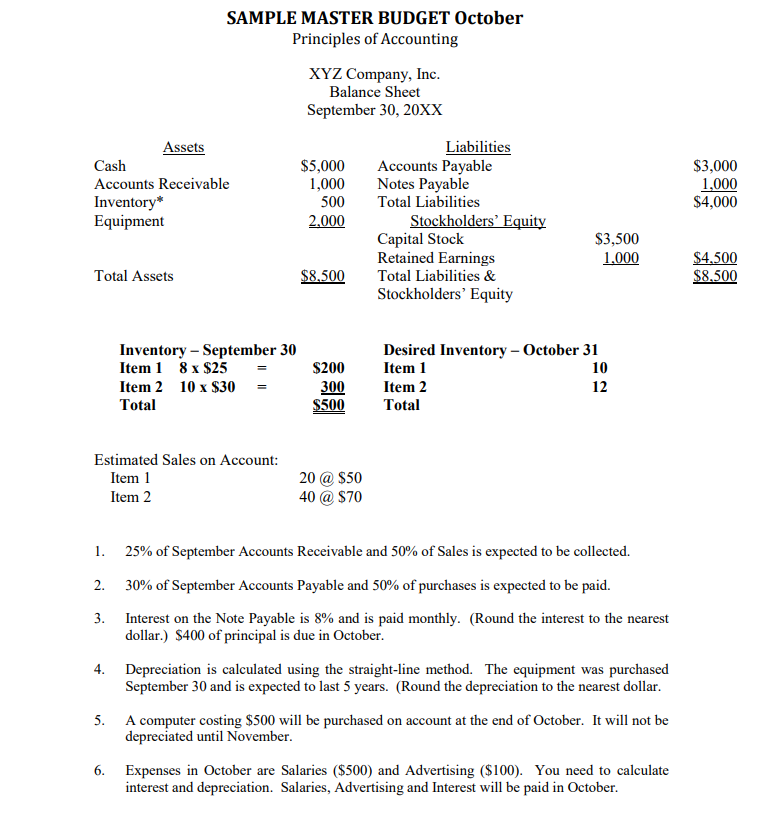

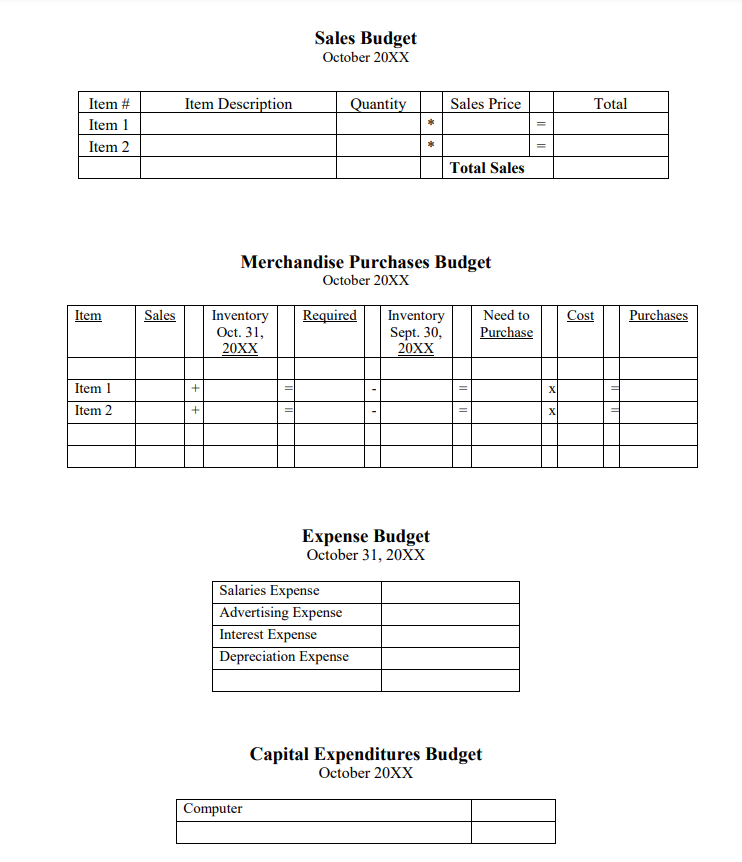

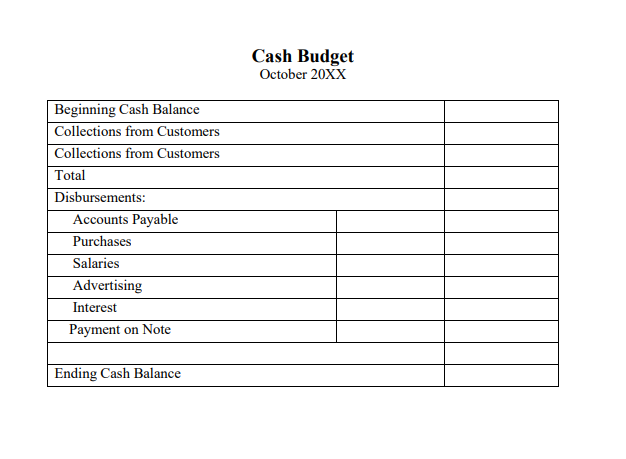

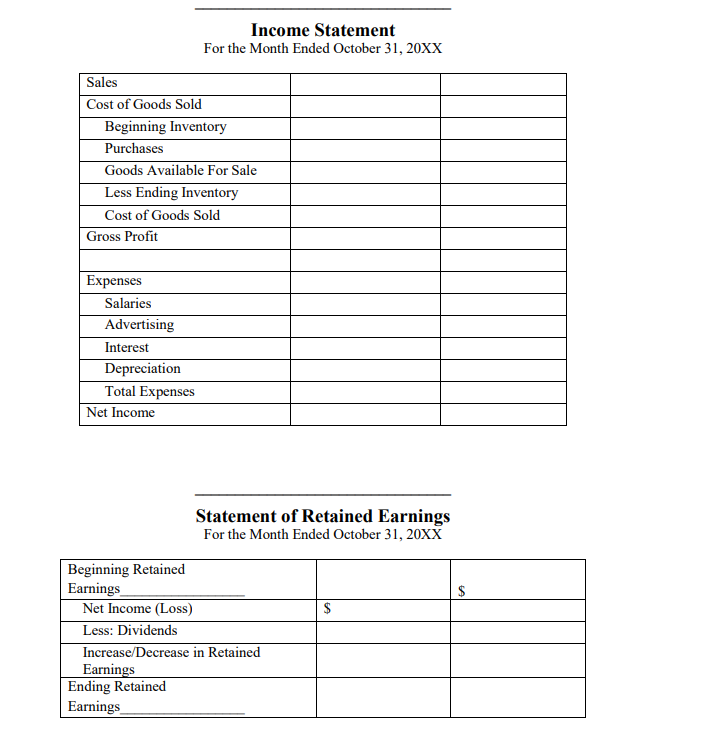

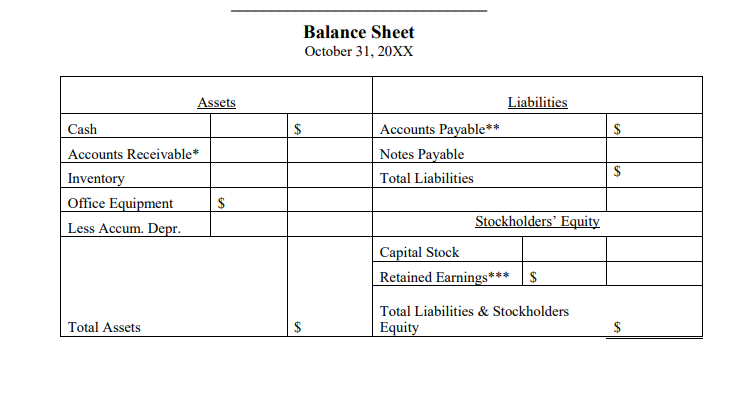

SAMPLE MASTER BUDGET October Principles of Accounting XYZ Company, Inc. Balance Sheet September 30, 20XX Assets Cash Accounts Receivable Inventory* Equipment $5,000 1,000 500 2.000 $3,000 1,000 $4,000 Liabilities Accounts Payable Notes Payable Total Liabilities Stockholders' Equity Capital Stock Retained Earnings Total Liabilities & Stockholders' Equity $3,500 1,000 $4,500 $8.500 Total Assets $8,500 Inventory - September 30 Item 1 8 x $25 Item 210 x $30 Total $200 300 $500 Desired Inventory - October 31 Item 1 10 Item 2 12 Total Estimated Sales on Account: Item 1 Item 2 20 @ $50 40 @ $70 1. 25% of September Accounts Receivable and 50% of Sales is expected to be collected. 2. 30% of September Accounts Payable and 50% of purchases is expected to be paid. 3. Interest on the Note Payable is 8% and is paid monthly. (Round the interest to the nearest dollar.) $400 of principal is due in October. 4. Depreciation is calculated using the straight-line method. The equipment was purchased September 30 and is expected to last 5 years. (Round the depreciation to the nearest dollar. 5. A computer costing $500 will be purchased on account at the end of October. It will not be depreciated until November. 6. Expenses in October are Salaries ($500) and Advertising ($100). You need to calculate interest and depreciation. Salaries, Advertising and Interest will be paid in October. Sales Budget October 20XX Item Description Quantity Sales Price Total Item # Item 1 Item 2 Total Sales Merchandise Purchases Budget October 20XX Item Sales Required Cost Inventory Oct. 31, 20XX Purchases Inventory Sept. 30, 20XX Need to Purchase + X Item 1 Item 2 + Expense Budget October 31, 20XX Salaries Expense Advertising Expense Interest Expense Depreciation Expense Capital Expenditures Budget October 20XX Computer Cash Budget October 20XX Beginning Cash Balance Collections from Customers Collections from Customers Total Disbursements: Accounts Payable Purchases Salaries Advertising Interest Payment on Note Ending Cash Balance Income Statement For the Month Ended October 31, 20XX Sales Cost of Goods Sold Beginning Inventory Purchases Goods Available For Sale Less Ending Inventory Cost of Goods Sold Gross Profit Expenses Salaries Advertising Interest Depreciation Total Expenses Net Income Statement of Retained Earnings For the Month Ended October 31, 20XX $ $ Beginning Retained Earnings Net Income (Loss) Less: Dividends Increase/Decrease in Retained Earnings Ending Retained Earnings Balance Sheet October 31, 20XX Assets Liabilities $ $ Cash Accounts Receivable* Inventory Office Equipment Less Accum. Depr. Accounts Payable** Notes Payable Total Liabilities $ $ Stockholders' Equity Capital Stock Retained Earnings* $ Total Liabilities & Stockholders Equity *** Total Assets $