Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sample Q 3 A trader anticipates a change in the U . S . short - term yield curve. He expects all rates to change;

Sample Q

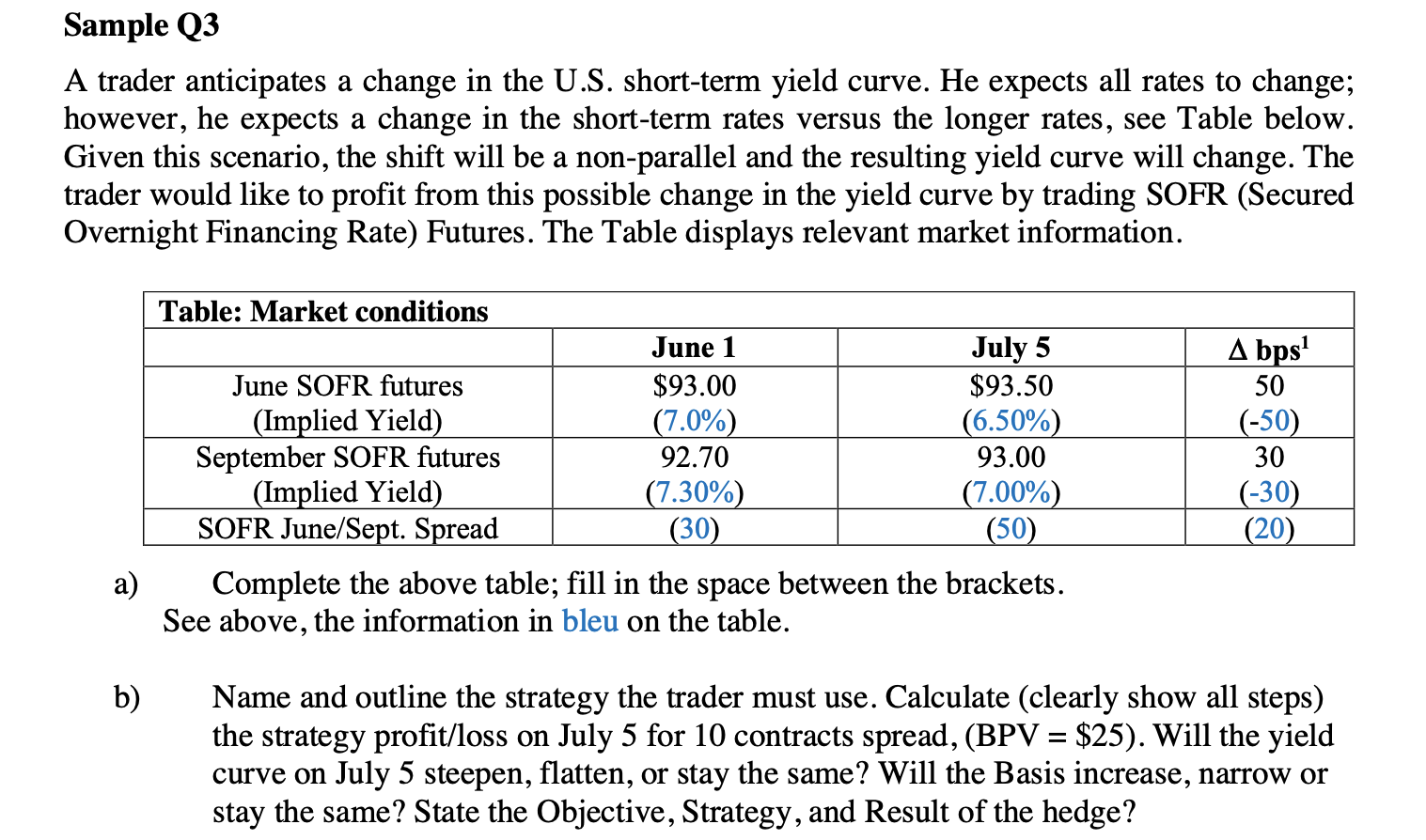

A trader anticipates a change in the US shortterm yield curve. He expects all rates to change;

however, he expects a change in the shortterm rates versus the longer rates, see Table below.

Given this scenario, the shift will be a nonparallel and the resulting yield curve will change. The

trader would like to profit from this possible change in the yield curve by trading SOFR Secured

Overnight Financing Rate Futures. The Table displays relevant market information.

a Complete the above table; fill in the space between the brackets.

See above, the information in bleu on the table.

b Name and outline the strategy the trader must use. Calculate clearly show all steps

the strategy profitloss on July for contracts spread, $ Will the yield

curve on July steepen, flatten, or stay the same? Will the Basis increase, narrow or

stay the same? State the Objective, Strategy, and Result of the hedge?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started