Answered step by step

Verified Expert Solution

Question

1 Approved Answer

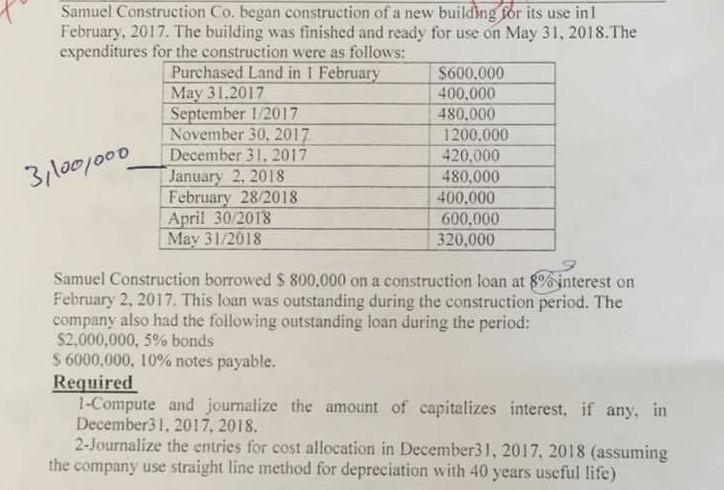

Samuel Construction Co. began construction of a new building for its use in 1 February, 2017. The building was finished and ready for use on

Samuel Construction Co. began construction of a new building for its use in 1 February, 2017. The building was finished and ready for use on May 31, 2018. The expenditures for the construction were as follows: Purchased Land in 1 February $600.000 May 31.2017 400.000 September 1/2017 480.000 November 30, 2017 1200.000 December 31. 2017 420,000 January 2, 2018 480,000 February 28/2018 400.000 April 30/2018 600,000 May 31/2018 320,000 3,100,000 Samuel Construction borrowed $ 800.000 on a construction loan at 8% interest on February 2, 2017. This loan was outstanding during the construction period. The company also had the following outstanding loan during the period: $2,000,000.5% bonds S 6000.000, 10% notes payable. Required 1-Compute and journalize the amount of capitalizes interest, if any, in December31, 2017, 2018. 2-Journalize the entries for cost allocation in December31, 2017, 2018 (assuming the company use straight line method for depreciation with 40 years useful life)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started