Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part a Teach Ltd ('Teach) was incorporated in June 2008 and commenced with trading as from 1 July 2008. The financial year-end is 30 June.

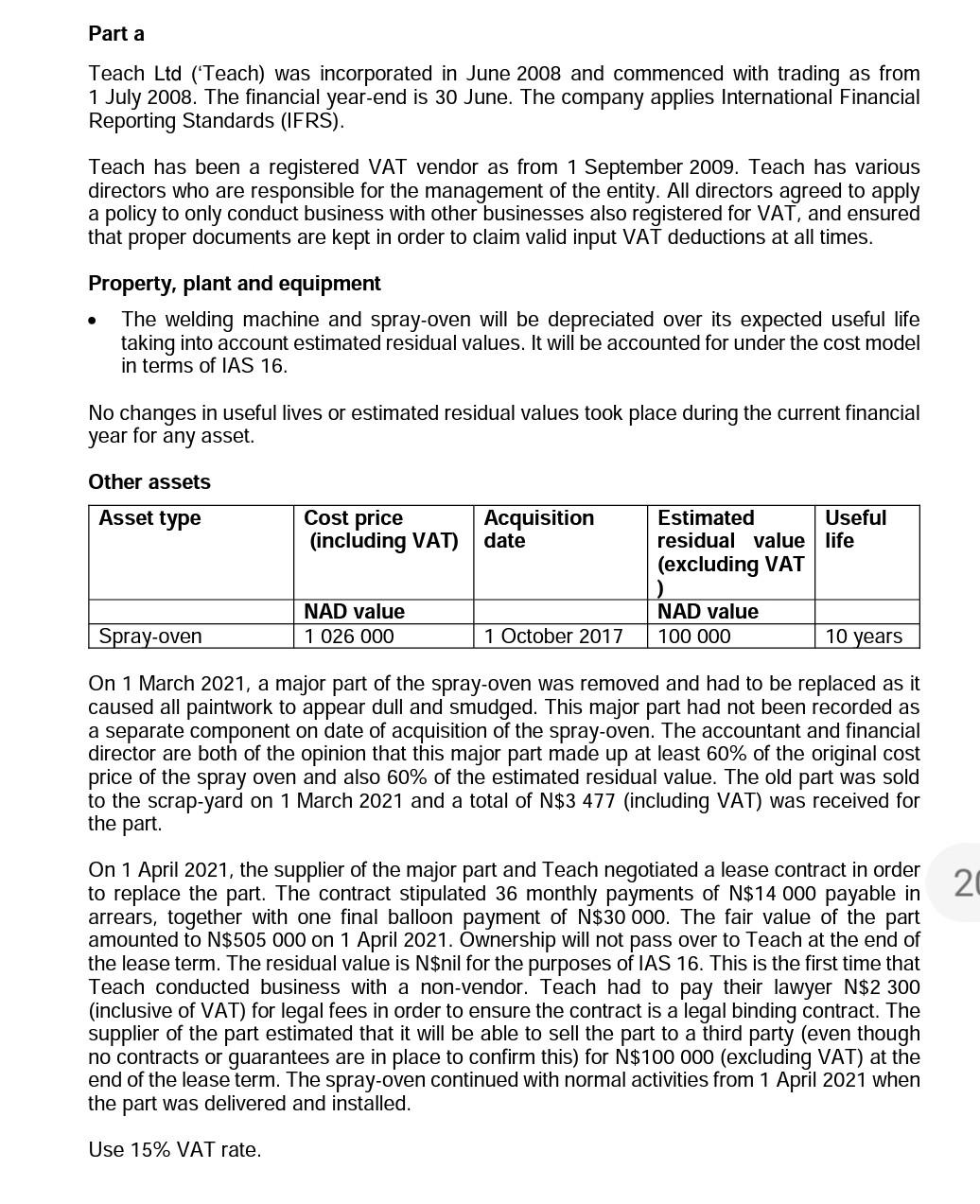

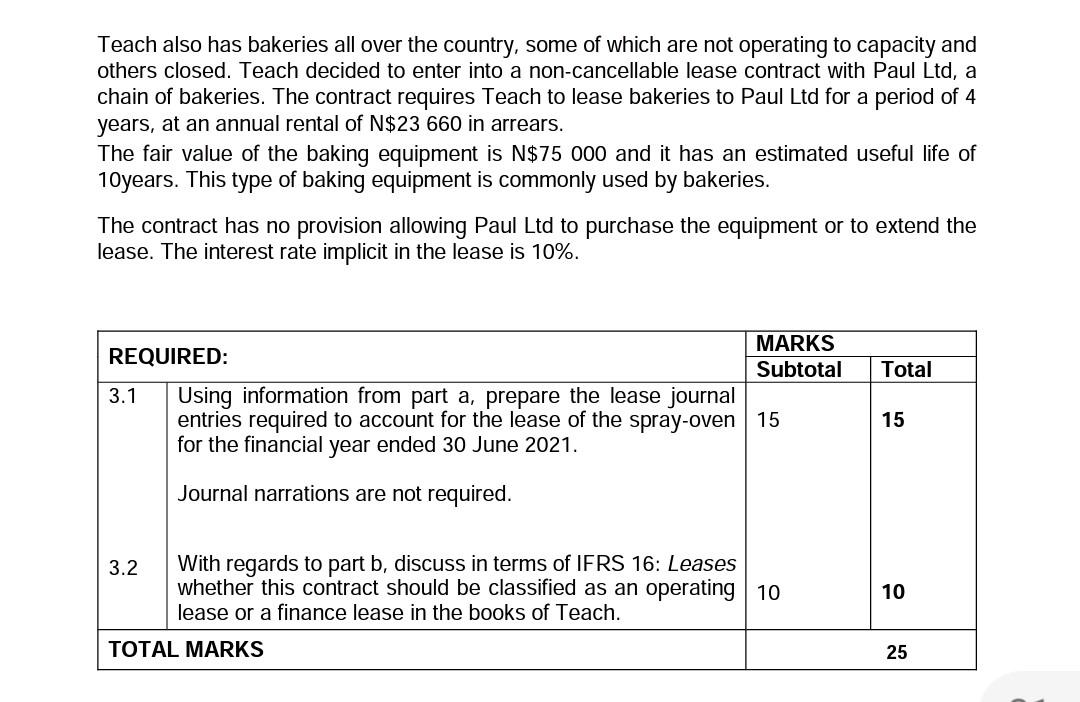

Part a Teach Ltd ('Teach) was incorporated in June 2008 and commenced with trading as from 1 July 2008. The financial year-end is 30 June. The company applies International Financial Reporting Standards (IFRS). Teach has been a registered VAT vendor as from 1 September 2009. Teach has various directors who are responsible for the management of the entity. All directors agreed to apply a policy to only conduct business with other businesses also registered for VAT, and ensured that proper documents are kept in order to claim valid input VAT deductions at all times. Property, plant and equipment - The welding machine and spray-oven will be depreciated over its expected useful life taking into account estimated residual values. It will be accounted for under the cost model in terms of IAS 16. No changes in useful lives or estimated residual values took place during the current financial year for any asset. Other assets On 1 March 2021, a major part of the spray-oven was removed and had to be replaced as it caused all paintwork to appear dull and smudged. This major part had not been recorded as a separate component on date of acquisition of the spray-oven. The accountant and financial director are both of the opinion that this major part made up at least 60% of the original cost price of the spray oven and also 60% of the estimated residual value. The old part was sold to the scrap-yard on 1 March 2021 and a total of N$3477 (including VAT) was received for the part. On 1 April 2021, the supplier of the major part and Teach negotiated a lease contract in order to replace the part. The contract stipulated 36 monthly payments of N$14000 payable in arrears, together with one final balloon payment of N$30000. The fair value of the part amounted to N$505000 on 1 April 2021. Ownership will not pass over to Teach at the end of the lease term. The residual value is N \$nil for the purposes of IAS 16. This is the first time that Teach conducted business with a non-vendor. Teach had to pay their lawyer N$2300 (inclusive of VAT) for legal fees in order to ensure the contract is a legal binding contract. The supplier of the part estimated that it will be able to sell the part to a third party (even though no contracts or guarantees are in place to confirm this) for N$100000 (excluding VAT) at the end of the lease term. The spray-oven continued with normal activities from 1 April 2021 when the part was delivered and installed. Teach also has bakeries all over the country, some of which are not operating to capacity and others closed. Teach decided to enter into a non-cancellable lease contract with Paul Ltd, a chain of bakeries. The contract requires Teach to lease bakeries to Paul Ltd for a period of 4 years, at an annual rental of N$23660 in arrears. The fair value of the baking equipment is N$75000 and it has an estimated useful life of 10years. This type of baking equipment is commonly used by bakeries. The contract has no provision allowing Paul Ltd to purchase the equipment or to extend the lease. The interest rate implicit in the lease is 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started