Question

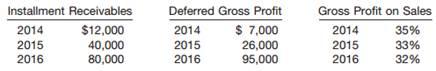

Samuels Co. appropriately uses the installment-sales method of accounting. On December 31, 2016, the books show balances as follows. (a) Prepare the adjusting entry or

Samuels Co. appropriately uses the installment-sales method of accounting. On December 31, 2016, the books show balances as follows.

(a) Prepare the adjusting entry or entries required on December 31, 2016 to recognize 2016 realized gross profit.

(b) Compute the amount of cash collected in 2016 on accounts receivable from each year.

Installment Receivables Deferred Gross Profit Gross Profit on Sales $ 7,000 26,000 2014 $12,000 40,000 2014 2014 35% 2015 2016 2015 2015 33% 2016 80,000 95,000 2016 32%

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution Adjustment for deferred gross profit2014 Balance in deferred gross profit acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones

10th Edition

324300980, 978-0324300987

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App