Question

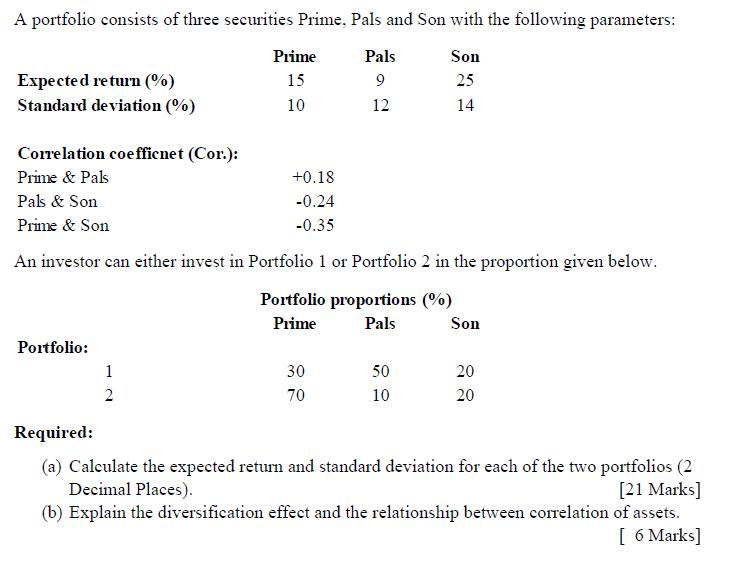

A portfolio consists of three securities Prime. Pals and Son with the following parameters: Son 25 14 Expected return (%) Standard deviation (%) Correlation

A portfolio consists of three securities Prime. Pals and Son with the following parameters: Son 25 14 Expected return (%) Standard deviation (%) Correlation coefficnet (Cor.): Prime & Pals Pals & Son Prime & Son Portfolio: Prime 15 10 1 2 +0.18 -0.24 -0.35 An investor can either invest in Portfolio 1 or Portfolio 2 in the proportion given below. Portfolio proportions (%) Prime Pals Pals 9 12 30 70 50 10 Son 20 20 Required: (a) Calculate the expected return and standard deviation for each of the two portfolios (2 Decimal Places). [21 Marks] (b) Explain the diversification effect and the relationship between correlation of assets. [ 6 Marks]

Step by Step Solution

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Portfolio 1 Expected return 030 x 15 050 x 10 020 x 25 145 Standard deviation sqrt0302 x 122 0502 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: James D. Stice, Earl K. Stice, Fred Skousen

17th Edition

032459237X, 978-0324592375

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App