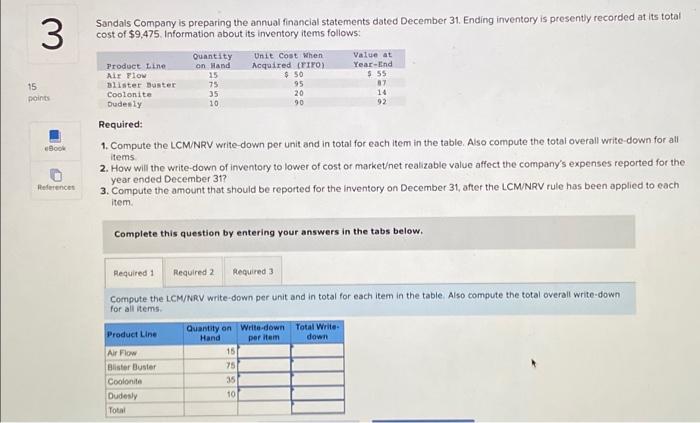

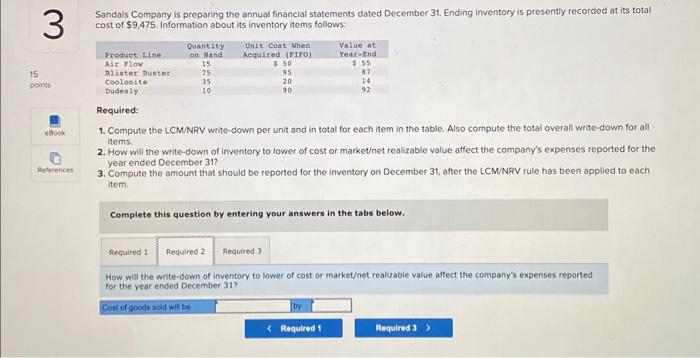

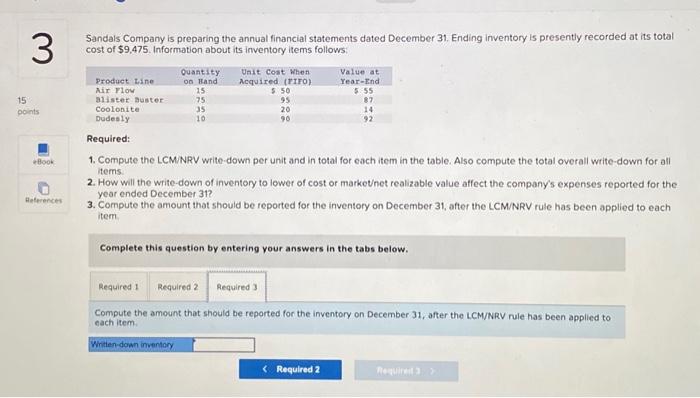

Sandals Company is preparing the annual financial statements dated December 3t. Ending inventory is presently recorded at its total cost of $9,475, Information about its inventory items follows: Required: 1. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all itoms. 2. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 31 ? 3. Compute the amount that should be reported for the inventory on December 3t, after the LCMNRV rule has been applied to each item. Complete this question by entering your answers in the tabs below. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the vear ended December 31? Sandais Company is preparing the annual financial statements dated December 31. Ending inventory is presently recorded at its total cost of $9,475. Information about its inventory items follows: Required: 1. Compute the LCMNRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items 2. How will the write-down of inventory to lower of cost or marketet realizable value affect the company's expenses reported for the year ended December 31 ? 3. Compute the amount that should be reported for the inventory on December 31 , after the LCMNRV rule has been applied to each item. Complete this question by entering your answers in the tabs below. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items. Sandals Company is preparing the annual financial statements dated December 31. Ending inventory is presently recorded at its total cost of \$9,475. Information about its inventory items follows: Required: 1. Compute the LCMNNV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items. 2. How will the write-down of inventory to lower of cost or marketnet realizable value affect the company's expenses reported for the year ended December 31 ? 3. Compute the amount that should be reported for the inventory on December 31 , after the LCM/NRV rule has been applied to each item Complete this question by entering your answers in the tabs below. Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item