Answered step by step

Verified Expert Solution

Question

1 Approved Answer

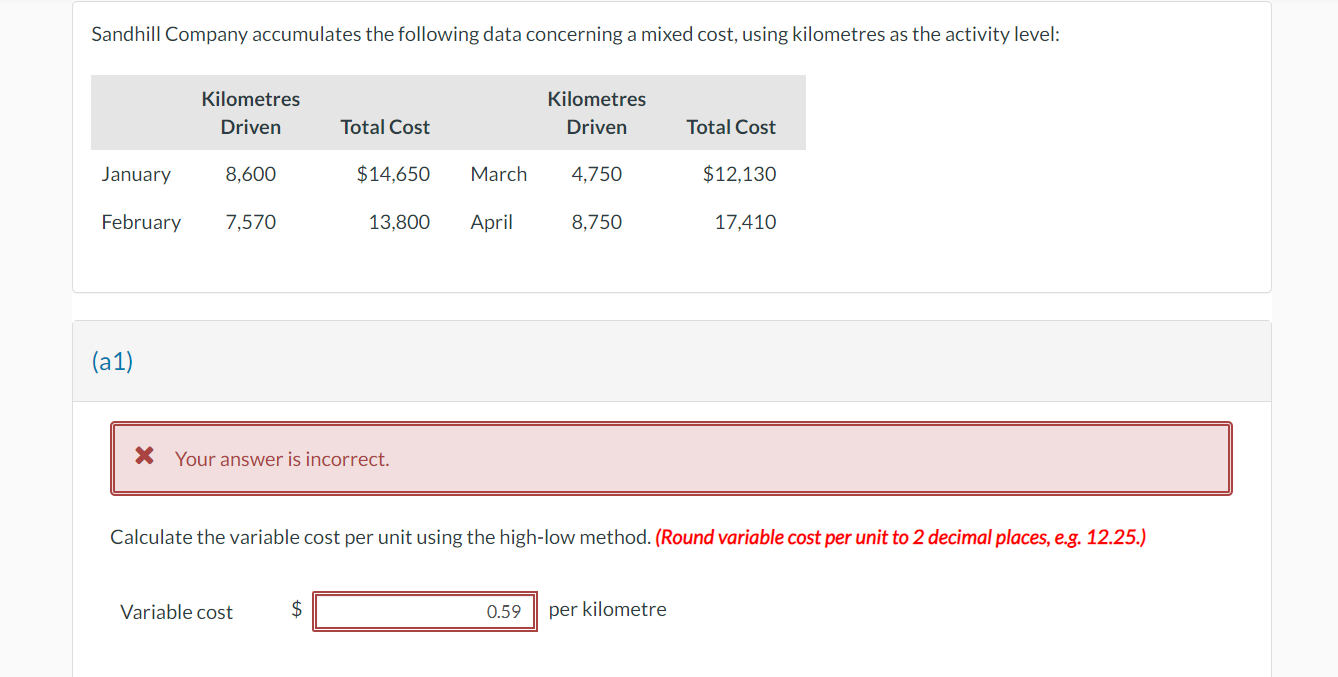

Sandhill Company accumulates the following data concerning a mixed cost, using kilometres as the activity level: Kilometres Driven Total Cost Kilometres Driven Total Cost

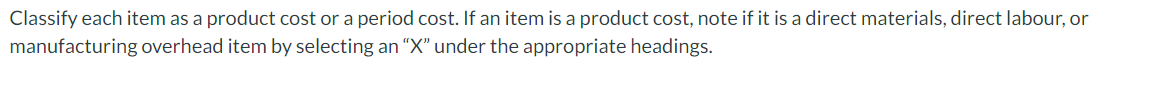

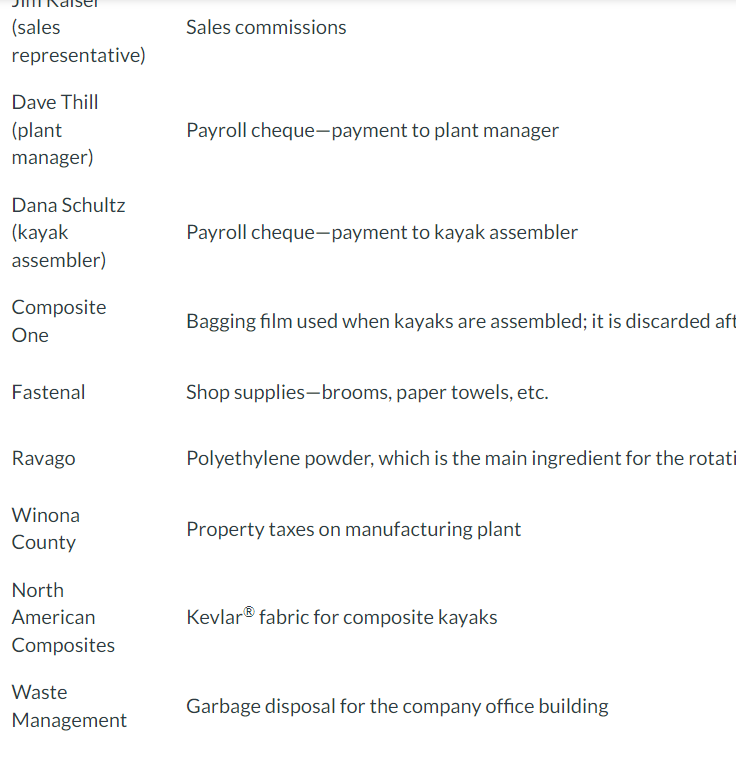

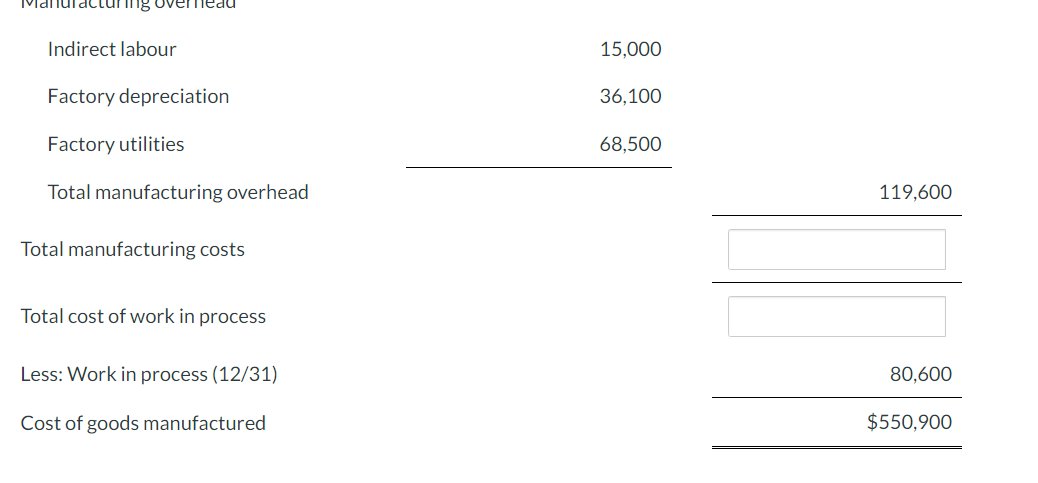

Sandhill Company accumulates the following data concerning a mixed cost, using kilometres as the activity level: Kilometres Driven Total Cost Kilometres Driven Total Cost January 8.600 $14,650 March 4,750 $12.130 February 7,570 13,800 April 8.750 17,410 (a1) Your answer is incorrect. Calculate the variable cost per unit using the high-low method. (Round variable cost per unit to 2 decimal places, e.g. 12.25.) Variable cost $ 0.59 per kilometre Classify each item as a product cost or a period cost. If an item is a product cost, note if it is a direct materials, direct labour, or manufacturing overhead item by selecting an "X" under the appropriate headings. (sales representative) Dave Thill Sales commissions (plant manager) Dana Schultz (kayak assembler) Payroll cheque-payment to plant manager Payroll cheque-payment to kayak assembler Composite One Bagging film used when kayaks are assembled; it is discarded aft Fastenal Shop supplies-brooms, paper towels, etc. Ravago Polyethylene powder, which is the main ingredient for the rotati Winona Property taxes on manufacturing plant County North American Kevlar fabric for composite kayaks Composites Waste Garbage disposal for the company office building Management An incomplete cost of goods manufactured schedule is presented below for Carla Vista Manufacturing Company for th December 2022: Complete the cost of goods manufactured schedule for Carla Vista Manufacturing Company. CARLA VISTAMANUFACTURING COMPANY Cost of Goods Manufactured Schedule For the Year Ended December 31, 2022 Work in process (1/1) $210,000 Direct materials Raw materials inventory, (1/1) $ Raw materials purchases 165,000 Total raw materials available for use Less: Raw materials inventory (12/31) 17,900 Direct materials used $188,000 Direct labour Manufacturing overhead turing over Indirect labour Factory depreciation 15,000 36,100 Factory utilities 68,500 Total manufacturing overhead 119,600 Total manufacturing costs Total cost of work in process Less: Work in process (12/31) Cost of goods manufactured 80,600 $550,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started