Answered step by step

Verified Expert Solution

Question

1 Approved Answer

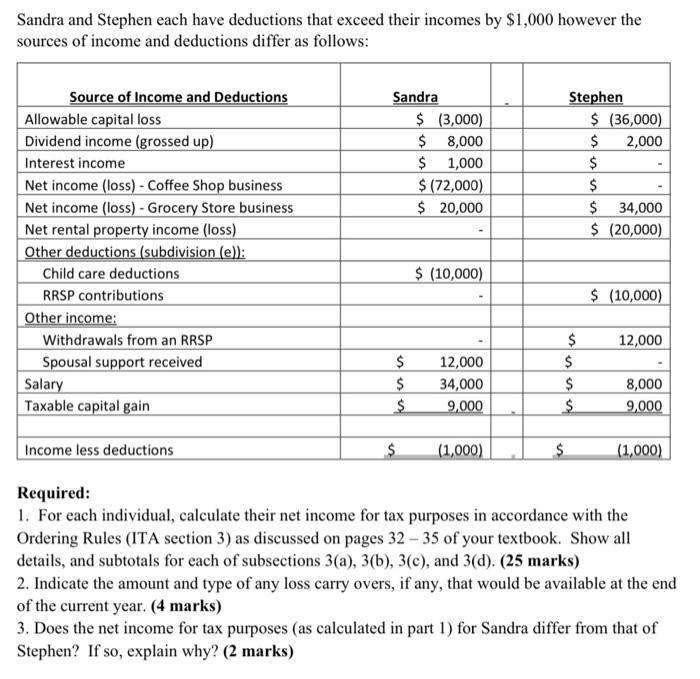

Sandra and Stephen each have deductions that exceed their incomes by $1,000 however the sources of income and deductions differ as follows: Source of

Sandra and Stephen each have deductions that exceed their incomes by $1,000 however the sources of income and deductions differ as follows: Source of Income and Deductions Allowable capital loss Dividend income (grossed up) Interest income Net income (loss) - Coffee Shop business Net income (loss) - Grocery Store business Net rental property income (loss) Other deductions (subdivision (e)): Child care deductions RRSP contributions Other income: Withdrawals from an RRSP Spousal support received Salary Taxable capital gain Income less deductions Sandra $ (3,000) $ 8,000 $ 1,000 $ (72,000) $ 20,000 $ $ (10,000) $ 12,000 $ 34,000 $ 9,000 (1,000) Stephen $ $ $ $ $ (36,000) $ 2,000 $ $ $ 34,000 $ (20,000) $ (10,000) 12,000 8,000 9,000 (1,000) Required: 1. For each individual, calculate their net income for tax purposes in accordance with the Ordering Rules (ITA section 3) as discussed on pages 32-35 of your textbook. Show all details, and subtotals for each of subsections 3(a), 3(b), 3(c), and 3(d). (25 marks) 2. Indicate the amount and type of any loss carry overs, if any, that would be available at the end of the current year. (4 marks) 3. Does the net income for tax purposes (as calculated in part 1) for Sandra differ from that of Stephen? If so, explain why? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Sandra Net Income for Tax Purposes Gross Income Deductions Loss Carryovers Sandras net income for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started