Question

Sandra Kapple presents Maria VanHusen with a description, given in the following exhibit, of the bond portfolio held by the Star Hospital Pension Plan. All

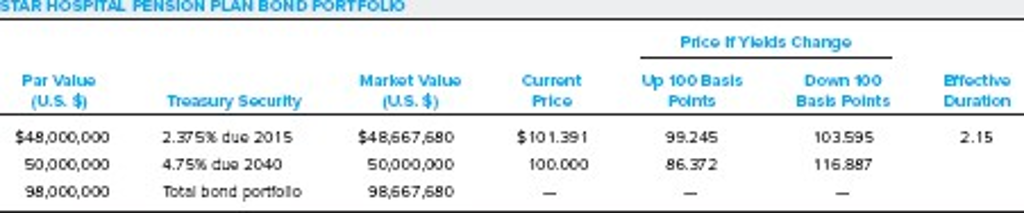

Sandra Kapple presents Maria VanHusen with a description, given in the following exhibit, of the bond portfolio held by the Star Hospital Pension Plan. All securities in the bond portfolio are noncallable U.S. Treasury securities.

a) Calculate the effective duration of each of the following:

1) The 4.75% Treasury security due 2040. 2) The total bond portfolio

b) VanHusen remarks to Kapple, If you changed the maturity structure of the bond portfolio to result in a portfolio duration of 5.25, the price sensitivity of that portfolio would be identical to the price sensitivity of a single, noncallable Treasury security that has a duration of 5.25. In what circumstance would VanHusen's remark be correct?

SHOW ALL WORK!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started