Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sanka Blanc wants to receive $8000 each year for 20 years how much must sanka invest today at 4% interest compounded annually How much should

Sanka Blanc wants to receive $8000 each year for 20 years how much must sanka invest today at 4% interest compounded annually How much should sanka invest

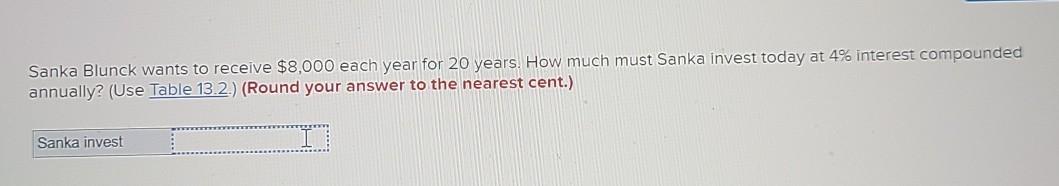

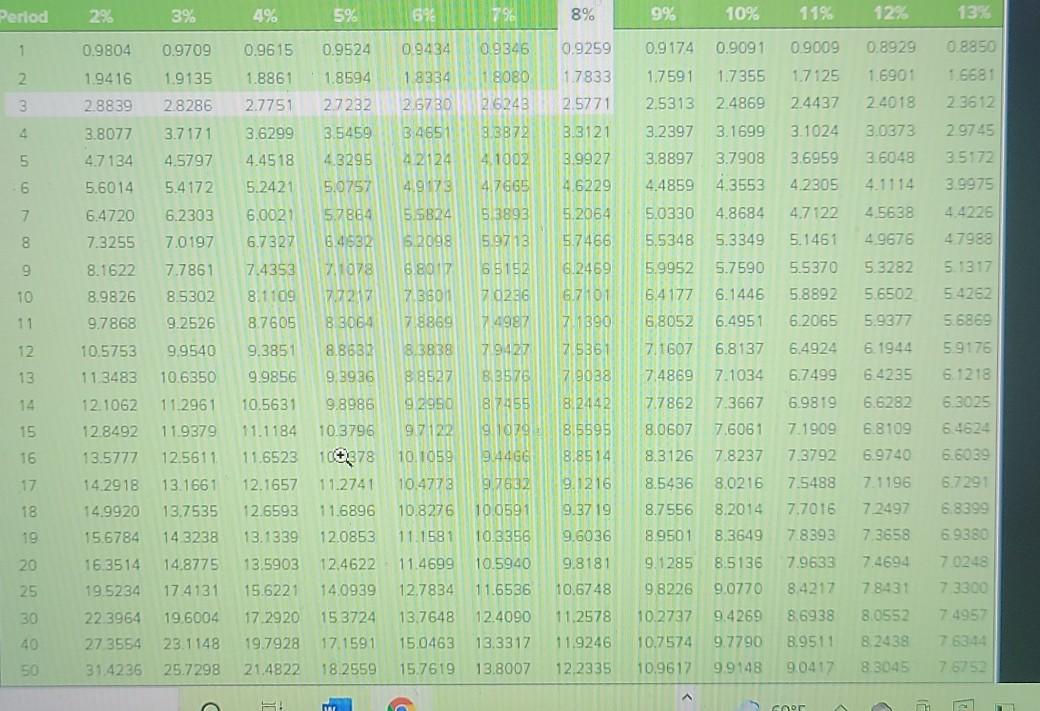

Sanka Blunck wants to receive $8,000 each year for 20 years. How much must Sanka invest today at 4% interest compounded annually? (Use Table 13.2.) (Round your answer to the nearest cent.) Sanka invest Period 2% 3% 4% 5% 6% 79 8% 9% 10% 11% 12% 13% 1 0.9804 0.9709 0.9615 0.9524 0.9346 0.9174 0.9091 0.9009 0.8929 0.8850 2. 0.9259 1.7833 2.5771 1.7591 1.8861 27751 1.7355 1.7125 2.4437 1.6901 2.4018 1.6681 23612 3 2.5313 2.4869 1.9416 2.8839 3.8077 4.7134 1.9135 28286 3.7171 4.5797 0.9434 1.8334 2.6730 3.4651 42124 4.9173 1.8594 2.7232 3.5459 4.3295 5.0757 3.3121 3.2397 3.1699 3.1024 3.0373 3.6299 4.4518 5.2421 5 3.8897 3.9927 46229 3.7908 4.3553 3.6959 4.2305 3.6048 4.1114 2.9745 3.5172 3.9975 6 5.6014 4.4859 7 6.4720 5.4172 6.2303 7.0197 6.0021 5.2064 18080 26243 8.6872 4.1002 4.7665 5.3893 5.97 13 6.5152 7 0286 74987 7.9427 5.0330 4.7122 5.7 864 6.4532 4 4226 5.5824 5.2098 4.8684 5.3349 4.5638 4.9676 8 7.3255 6.7327 47988 9 8.1622 71078 8.8017 5.1317 7.4353 8.1109 8.9826 10 11 7.7861 8.5302 9.2526 9.9540 10.6350 5.1461 5.5370 5.8892 6.2065 57466 612469 6.7101 71390 7 5361 710038 7/3501 7.8869 5.5348 5.9952 6.4177 6,8052 7.1 607 7.4869 7.7217 8.3064 8.8633 5.7590 6.1446 6.4951 5.3282 5.6502 5.9377 9.7868 54262 5.6869 8.7605 12 10.5753 8.3838 6.8137 6.4924 6.1944 9.3851 9.9856 5.9176 6.1218 13 11.3483 8.8527 6.7499 64235 8.3576 8.7455 14 12.1062 10.5631 8.2442 6.6282 11.2961 11.9379 12.5611 9.2950 9.7 1202 15 9.3936 9.8986 10.3796 100878 11.2741 11.1184 6.3025 6.4624 9 1079 7.7862 8.0607 8.3126 6.9819 7.1909 7.3792 6.8109 7.1034 7.3667 7.6061 7.8237 8.0216 8.2014 8.5595 8.8514 9.1216 16 6.9740 6.6039 9.4466 9.7832 10.1059 10.4778 10.8276 17 13.1661 8.5436 7 1196 18 13.7535 11.6896 9.3719 8.7556 7.5488 7.7016 78393 10.0591 10.3356 7 2497 6.7291 6.8399 6.9380 19 14 3238 11.1581 9.6036 8.9501 8.3649 7.3658 12.8492 13.5777 14.2918 14.9920 15.6784 16.3514 19.5234 22.3964 27 3554 314236 20 11.6523 12.1657 12.6593 13.1339 13.5903 15.6221 17.2920 19.7928 21.4822 14.8775 17.4131 12.0853 12.4622 14.0939 10.5940 9.8181 10.6748 7.9633 8.4217 70248 73300 25 11.6536 30 8.5136 9.0770 9.4269 9.7790 15 3724 11.4699 12.7834 13.7648 15.0463 15.7619 19.6004 23.1148 25.7298 9.1285 9.8226 10.2737 10.7574 10.9617 12.4090 13.3317 7495 40 7.4694 7.8431 8.0552 8.2438 8.3045 11.2578 11.9246 12.2335 8.6938 8.9511 9.0417 17.1591 18.2559 76314 50 13.8007 99148 7.675 A R! coor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started