Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Santana Rey created Business Solutions on Oct 1, 2021. the company has been successful and its list od customers has grown. to accommodate the growth

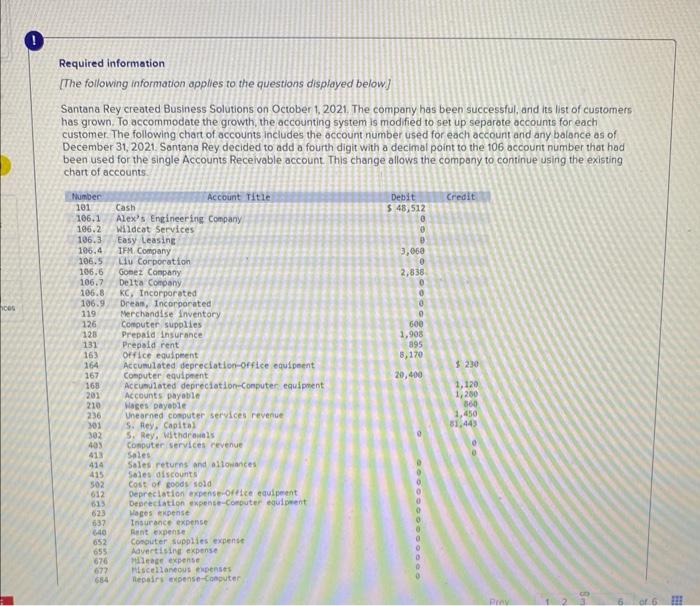

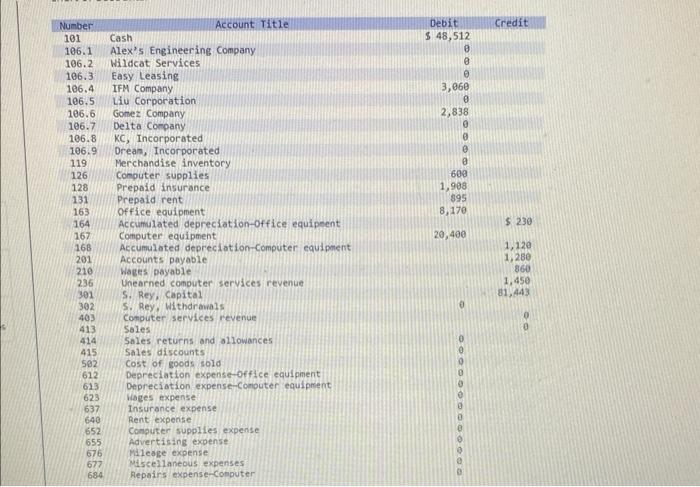

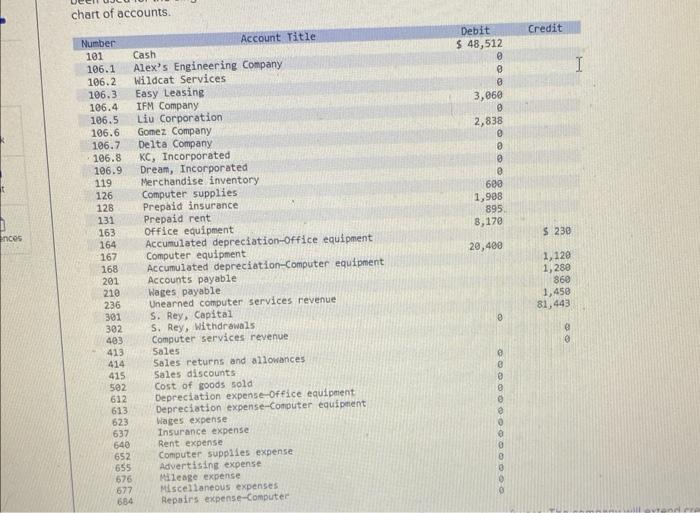

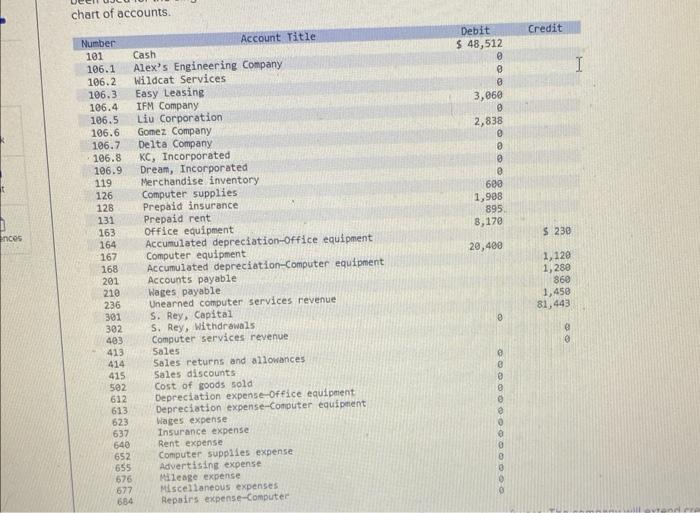

Santana Rey created Business Solutions on Oct 1, 2021. the company has been successful and its list od customers has grown. to accommodate the growth the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balances as of December 31, 2021. Santana Rey decided to add a forth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. That change allows the company to continue using the exsisting chart of accounts.

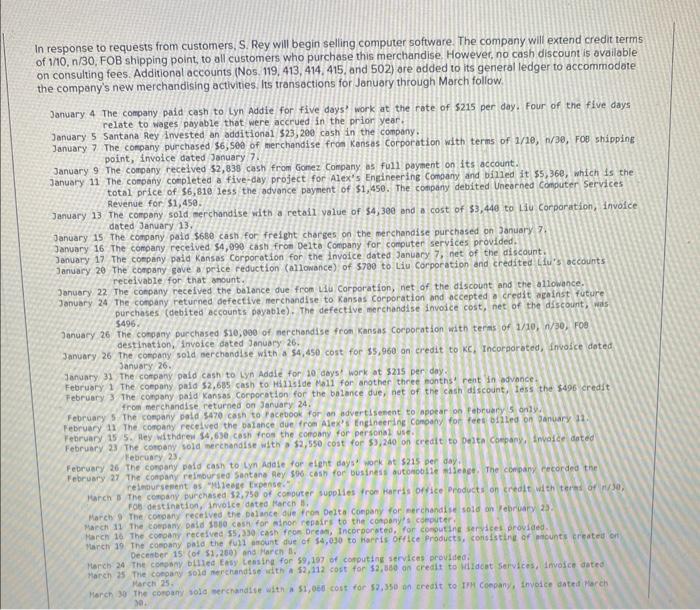

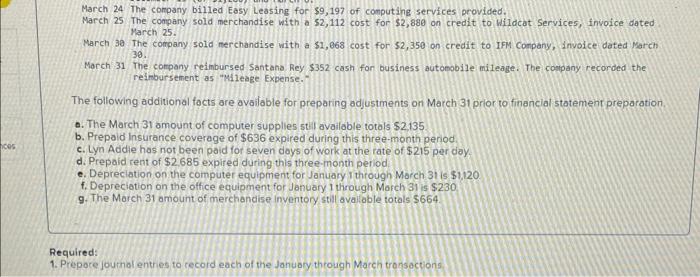

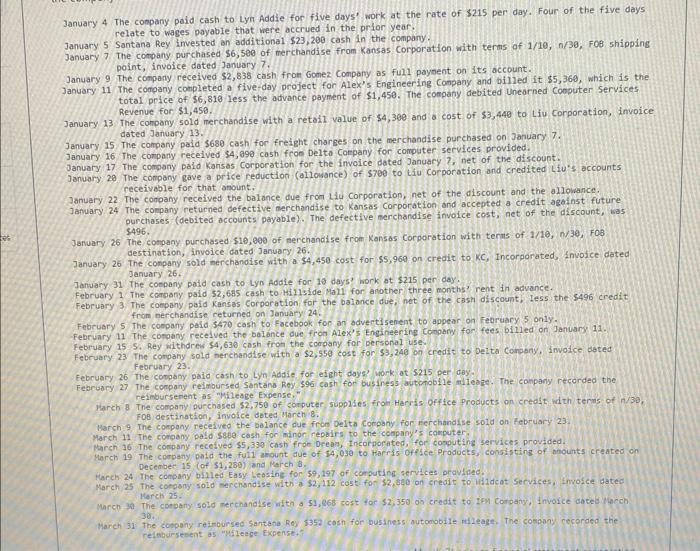

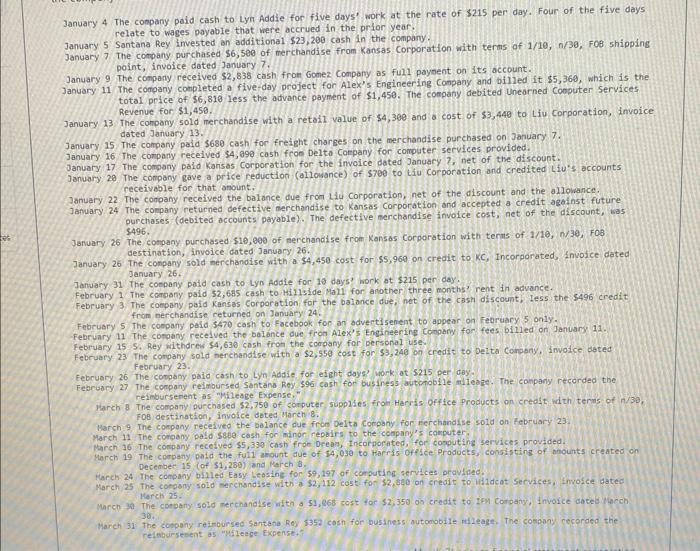

Required information [The following information applies to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30,FOB shipping point, to all customers who purchase this merchandise, However, no cash discount is ovailable on consulting fees. Additional accounts (Nos. 119,413. 414.415. and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. Janwary 4 The company paid cash to Lyn Addie for five days' work at the rote of $215 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional 523,200 cash in the compony, January 7 The conpany purchased $6,500 of merchandise from Kansas corporation with terms of 1/10,n/30,F08 shippine point, invoice dated January 7. January 9. The corpany received 52,838 cash from Gonez Company as full payment on its account. January 11 The company completed a five-day project for Alex's Engineering comaany and billed it $5,36e, which is the total price of $6,810 less the advance payment of $1,450. The conpany debited Unearned conghter Services Revenue for $1,450. January 13 The company sold merchandise with a retail value of $4,300 and a cost of $3,440 to Liu Corporation, involce dated January 13 . January 15 The compary paid $680 cash for freight charges on the merchanaise purchased on January 7. January 16 The company recelved $4,090 casti from Delta Company for computer services provided. January 17 The company paid Kansas Corporation for the invoice dated. 2anuary 7 , net of the discount. January 20 The corpany gave a peice reduction (allowance) of 5700 to liu corporation and credited Liu's accounts recelvable for that anount. january 22. The company recelved the balance due from uia Corporation, net af the discount and the a1lowance. January 24 The conolany returned defective nerchandise to kansas corporation and accepted a credit against future purchases (debited accounts bayable). The defective merchandise invoice cost, net of the discount, wis \$496. January 26. The congany purchased $10,000 of nerehandise fcom Kansas corporation with terms of 1/10, n/30,F09 destination, Invoice dated January 26. 3anuary 26 The company sold serchondise with a $4,350 cost for 35,960 an eredit to kC. Incoraorated, invoice doted January 26. January 31 the compary pald cash to Lyn Addie for 10 deyst work at $215 per day. February 1 The coepany pald $2,685 cash to Millslde Na11 for another three nonths' rent in advonce. February 3. The conpany paid Kansas corpocation for the balance due, net of the cash alscount, less the $496 credit Februany 5 thom merchandse returned on 3anuary 24 . Peonuary 5 the company pald 3470 cash ta facevook for an advertisenent to appear on fabruac 5 anly. February 11 The conoany recelved the oalance due trom Alex's Engineering company for fees bliled on aanuary al. Fearuary 15. 5. Hey witharee $4,65, cost fros the conpany for persconal vise. February 23 The cotoen sold merchandise whth a $2,550 cost for 53,240 on credit to Delta chepany, invalce doted rebcuary 23 . February 26 the corpany paid cash to tyn addie for eleht days' work at $2215 per day. February 27 The conpany reimbursed Santana Rey sio cash for business autonobile misebce. The conpany recorded the reloaursenent as - Mideale trpense. foo dratination, involce dated Raren H. Harch 9" The comany recelved the Dalance die fron Delta coepany for merchandise sold an lebrivary 22. rasect i1 the coepany pald 1060 coss for ainon repairs to the conpeny's cseputer? parch 16 The conoany recelved 55,330 cash fcom Dreas, Incorporateo, for conouting serdices provided. Marct 19 the comony pald the full anount due of s4,030 to harris office froducts, consistire of micunts erieated on Decenber 15 (of $1,269 ) and Faren 1. Merch 24 The compny bllied Eaby tensing for 59,197 of corputing services prouldeos Karch 25. March 24 The company billed Easy Leasing for $9,197 of computing services pcovided. March 25 The company sold merchandise with a 52,112 cost for $2,880 on credit to Wildcat Services, invoice dated March 25. March 30 The company soid merchandise with a $1,868 cost for $2,350 on credit to IFM conpany, invoice dated March 30 . Morch 31 The conpany reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursenent as mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation. a. The March 31 a mount of computer supplies stil available totals $2,135 b. Prepaid Insurance coverage of $636 expired during this three-month penod. c. Lyn Addie has not been paid for seven days of work at the rate of $215 per day. d. Prepaid rent of $2.685 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,120. f. Depreciation on the otfice equipment for January 1 through March 31 is $230 9. The March 31 amount of merchandise inventory still available totals $664. Required: 1. Prepore joutnal enthes to record each of the January through March tronsactions chart of accounts. January 4 The company paid cash to Lyn Addie for five days' work at the rate of $215 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $23,200 cash in the company. January 7 The company purchased $6,500 of merchandise from Kansas Corporation with terms of 1/10, n/30, Fo8 shipping point, invoice dated January 7. January 9 The company received $2,838 cash fron Gomez company as full paysent on its account. January 11 The company completed a five-day project for Alex's Engincering Canpany and billed it $5,360, which is the total price of $6,810 less the advance payment of $1,450. The company debited uneorned Conputer Services Revenue for $1,450. January 13 The company 501d merchandise with a retail value of $4,300 and a cost of $3,440 to Liu Corporation, invoice dated January 13. January 15 The company paid $680cash for freight charges on the merchandise purchased on Januari. 7. January 16 . The compary received \$4,090 cash fron Delta corpany for computer services provided. January 17 The company paid Kansas corporation for the invoice dated January ?, net of the discount. January 20. The company gave a price reduction (allowance) of \$7e to tiu corporation and credited Liu's accounts receivable for that anount. January 22. The conoany received the balance due from Liu corporation, net of the discount and the allowance. January: 24 The company returned defective nerchandise to Kansas corporation and accepted a credit ageinst future purchases (debited accounts payable). The defective merchandise involce cost, net of the discount, was $496. January 26 The company purchased $10,600 of nerchandise from Kansas corporation with terms of 1/10, n/30, F08 destination, invoice dated January 26. January 26 The conpany sold merchandise with a $4,450 cost for $5,960 on credit to KC, incorporated, Involce dated January 26. January 31 The conpany paid cash to Lyn Addie for 19 days' work at $215 pen day. February 1 The conpany paid 52,6 s. cash to Millside Mall for another three months? rent in advance. February 3. The coepany paid Kansas corporation for the balance due, het of the cash discount, less the $496 credit: from nerchandise returned on January 24 . February 5 the corpany paid $470 cash to Facebook for an advertisenent to appear on fearuacy 5 only. February 11 the comany recelved the balance due fron Alex's Engineering canpony for fees billed on January 11. February 15. S. Rey iilthdres $4,636 cash fron the corpany for personal use. February 23 The company sold nerchandtse with a $2,550 cost for $3,240 on credit to belta carpany, involce dated Feoruary 23. February 26 The company paid cash to Lyn Adaie, for eight days? nork at $215 per dey, February 27 The compony reimbursed Santans Rey $96 cash for bustress autctobile mileage. The conpany recorded the reimbursenent as nifieage Expense." Harch 8 The company purchased 52,750 of conputer sipplies from Herris office products on creait idth tenms of i/39, FOB destination, invoice dated mareh 8 . Harch 9 The compony receiveo the belance due fron beita Company for Ferchandise sold on February 23. March 11 - The corpany pald ssee cash for minor repairs to the conpany's computer. Harchi 16 The conpany received $5,330 cash froe breas, Incorporated, for copeuting services prowided. March 19 The corpany paid the full anount due of 54,030 to Harris ofefce pradocts, consisting of anounts created on Deceaber 15)(of $1,280) and Merch a a. Harch 24 The company bjlled Easy. Leosing for 59,197 of conputing serdices pravided. March 25 The corosny sold nerchandise with a 32,112 cest fon 32,360 on credit to iddent Services, fhvolce dated Merch 25. March 31 The conpony reinbursed Santata Rey $352 cash for business qutarobile rilleage. The conpany cecoraed the relabursesent as "isteege Expense-7 Required information [The following information applies to the questions displayed below] Santana Rey created Business Solutions on October 1, 2021. The company has been successful, and its list of customers has grown. To accommodate the growth, the accounting system is modified to set up separate accounts for each customer. The following chart of accounts includes the account number used for each account and any balance as of December 31, 2021. Santana Rey decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This change allows the company to continue using the existing chart of accounts. response to requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10,n/30,FOB shipping point, to all customers who purchase this merchandise, However, no cash discount is ovailable on consulting fees. Additional accounts (Nos. 119,413. 414.415. and 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. Janwary 4 The company paid cash to Lyn Addie for five days' work at the rote of $215 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional 523,200 cash in the compony, January 7 The conpany purchased $6,500 of merchandise from Kansas corporation with terms of 1/10,n/30,F08 shippine point, invoice dated January 7. January 9. The corpany received 52,838 cash from Gonez Company as full payment on its account. January 11 The company completed a five-day project for Alex's Engineering comaany and billed it $5,36e, which is the total price of $6,810 less the advance payment of $1,450. The conpany debited Unearned conghter Services Revenue for $1,450. January 13 The company sold merchandise with a retail value of $4,300 and a cost of $3,440 to Liu Corporation, involce dated January 13 . January 15 The compary paid $680 cash for freight charges on the merchanaise purchased on January 7. January 16 The company recelved $4,090 casti from Delta Company for computer services provided. January 17 The company paid Kansas Corporation for the invoice dated. 2anuary 7 , net of the discount. January 20 The corpany gave a peice reduction (allowance) of 5700 to liu corporation and credited Liu's accounts recelvable for that anount. january 22. The company recelved the balance due from uia Corporation, net af the discount and the a1lowance. January 24 The conolany returned defective nerchandise to kansas corporation and accepted a credit against future purchases (debited accounts bayable). The defective merchandise invoice cost, net of the discount, wis \$496. January 26. The congany purchased $10,000 of nerehandise fcom Kansas corporation with terms of 1/10, n/30,F09 destination, Invoice dated January 26. 3anuary 26 The company sold serchondise with a $4,350 cost for 35,960 an eredit to kC. Incoraorated, invoice doted January 26. January 31 the compary pald cash to Lyn Addie for 10 deyst work at $215 per day. February 1 The coepany pald $2,685 cash to Millslde Na11 for another three nonths' rent in advonce. February 3. The conpany paid Kansas corpocation for the balance due, net of the cash alscount, less the $496 credit Februany 5 thom merchandse returned on 3anuary 24 . Peonuary 5 the company pald 3470 cash ta facevook for an advertisenent to appear on fabruac 5 anly. February 11 The conoany recelved the oalance due trom Alex's Engineering company for fees bliled on aanuary al. Fearuary 15. 5. Hey witharee $4,65, cost fros the conpany for persconal vise. February 23 The cotoen sold merchandise whth a $2,550 cost for 53,240 on credit to Delta chepany, invalce doted rebcuary 23 . February 26 the corpany paid cash to tyn addie for eleht days' work at $2215 per day. February 27 The conpany reimbursed Santana Rey sio cash for business autonobile misebce. The conpany recorded the reloaursenent as - Mideale trpense. foo dratination, involce dated Raren H. Harch 9" The comany recelved the Dalance die fron Delta coepany for merchandise sold an lebrivary 22. rasect i1 the coepany pald 1060 coss for ainon repairs to the conpeny's cseputer? parch 16 The conoany recelved 55,330 cash fcom Dreas, Incorporateo, for conouting serdices provided. Marct 19 the comony pald the full anount due of s4,030 to harris office froducts, consistire of micunts erieated on Decenber 15 (of $1,269 ) and Faren 1. Merch 24 The compny bllied Eaby tensing for 59,197 of corputing services prouldeos Karch 25. March 24 The company billed Easy Leasing for $9,197 of computing services pcovided. March 25 The company sold merchandise with a 52,112 cost for $2,880 on credit to Wildcat Services, invoice dated March 25. March 30 The company soid merchandise with a $1,868 cost for $2,350 on credit to IFM conpany, invoice dated March 30 . Morch 31 The conpany reimbursed Santana Rey $352 cash for business automobile mileage. The company recorded the reimbursenent as mileage Expense." The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation. a. The March 31 a mount of computer supplies stil available totals $2,135 b. Prepaid Insurance coverage of $636 expired during this three-month penod. c. Lyn Addie has not been paid for seven days of work at the rate of $215 per day. d. Prepaid rent of $2.685 expired during this three-month period. e. Depreciation on the computer equipment for January 1 through March 31 is $1,120. f. Depreciation on the otfice equipment for January 1 through March 31 is $230 9. The March 31 amount of merchandise inventory still available totals $664. Required: 1. Prepore joutnal enthes to record each of the January through March tronsactions chart of accounts. January 4 The company paid cash to Lyn Addie for five days' work at the rate of $215 per day. Four of the five days relate to wages payable that were accrued in the prior year. January 5 Santana Rey invested an additional $23,200 cash in the company. January 7 The company purchased $6,500 of merchandise from Kansas Corporation with terms of 1/10, n/30, Fo8 shipping point, invoice dated January 7. January 9 The company received $2,838 cash fron Gomez company as full paysent on its account. January 11 The company completed a five-day project for Alex's Engincering Canpany and billed it $5,360, which is the total price of $6,810 less the advance payment of $1,450. The company debited uneorned Conputer Services Revenue for $1,450. January 13 The company 501d merchandise with a retail value of $4,300 and a cost of $3,440 to Liu Corporation, invoice dated January 13. January 15 The company paid $680cash for freight charges on the merchandise purchased on Januari. 7. January 16 . The compary received \$4,090 cash fron Delta corpany for computer services provided. January 17 The company paid Kansas corporation for the invoice dated January ?, net of the discount. January 20. The company gave a price reduction (allowance) of \$7e to tiu corporation and credited Liu's accounts receivable for that anount. January 22. The conoany received the balance due from Liu corporation, net of the discount and the allowance. January: 24 The company returned defective nerchandise to Kansas corporation and accepted a credit ageinst future purchases (debited accounts payable). The defective merchandise involce cost, net of the discount, was $496. January 26 The company purchased $10,600 of nerchandise from Kansas corporation with terms of 1/10, n/30, F08 destination, invoice dated January 26. January 26 The conpany sold merchandise with a $4,450 cost for $5,960 on credit to KC, incorporated, Involce dated January 26. January 31 The conpany paid cash to Lyn Addie for 19 days' work at $215 pen day. February 1 The conpany paid 52,6 s. cash to Millside Mall for another three months? rent in advance. February 3. The coepany paid Kansas corporation for the balance due, het of the cash discount, less the $496 credit: from nerchandise returned on January 24 . February 5 the corpany paid $470 cash to Facebook for an advertisenent to appear on fearuacy 5 only. February 11 the comany recelved the balance due fron Alex's Engineering canpony for fees billed on January 11. February 15. S. Rey iilthdres $4,636 cash fron the corpany for personal use. February 23 The company sold nerchandtse with a $2,550 cost for $3,240 on credit to belta carpany, involce dated Feoruary 23. February 26 The company paid cash to Lyn Adaie, for eight days? nork at $215 per dey, February 27 The compony reimbursed Santans Rey $96 cash for bustress autctobile mileage. The conpany recorded the reimbursenent as nifieage Expense." Harch 8 The company purchased 52,750 of conputer sipplies from Herris office products on creait idth tenms of i/39, FOB destination, invoice dated mareh 8 . Harch 9 The compony receiveo the belance due fron beita Company for Ferchandise sold on February 23. March 11 - The corpany pald ssee cash for minor repairs to the conpany's computer. Harchi 16 The conpany received $5,330 cash froe breas, Incorporated, for copeuting services prowided. March 19 The corpany paid the full anount due of 54,030 to Harris ofefce pradocts, consisting of anounts created on Deceaber 15)(of $1,280) and Merch a a. Harch 24 The company bjlled Easy. Leosing for 59,197 of conputing serdices pravided. March 25 The corosny sold nerchandise with a 32,112 cest fon 32,360 on credit to iddent Services, fhvolce dated Merch 25. March 31 The conpony reinbursed Santata Rey $352 cash for business qutarobile rilleage. The conpany cecoraed the relabursesent as "isteege Expense-7 (chart in pictures)

In response to the requests from customers, S. Rey will begin selling computer software. The company will extend credit terms of 1/10, n/30, FOB shipping point, to all customers who purchase this merchandise. However, no cash discount is available on consulting fees. Additional accounts (Nos. 119, 413, 415, 502) are added to its general ledger to accommodate the company's new merchandising activities. Its transactions for January through March follow. (see picture)

The following additional facts are available for preparing adjustments on March 31 prior to financial statement preparation.

a. The March 31 amount of computer supplies still available totals $2135

b. Prepaid Insurance coverage of $636 expired during the three month period.

c. Lyn Addie has not been paid for seven days of work at the rate of $215 per day.

d. Prepaid rent of $2,685 expired during the three month period.

e. Depreciation on the computer equipment for January 1-March 31 is $1,120

f. Depreciation on the office equipment foe January 1-March 31 is $230

g. The March 31 amount of merchandise inventory still available totals $664.

1. Prepare journal entries to record each of tge January-March transactions.

2. Post the journal entries in part 1 to the accounts in the company's genera ledger. note: begin with the ledger's post-closing adjusted balances as of December 31, 2021.

3. prepare a 6 column work sheet that includes the unadjusted trial balance, the March 31 adjustments (a) through (g) and the adjusted trial balance. do not prepare closing entries and do not journalize thw adjustments or post them to the ledger.

4. prepare an income statement(from adjusted trial balance in #3) for the three months ending march 31 2022.

a. use single step format

b. use multi step format that begins with gross sales

5. preparw a statement of owner's equity from adjusted trial balance for the three months ended march 31 2022.

6. prepare a classified balance sheet from adjusted trial balance as of march 31 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started