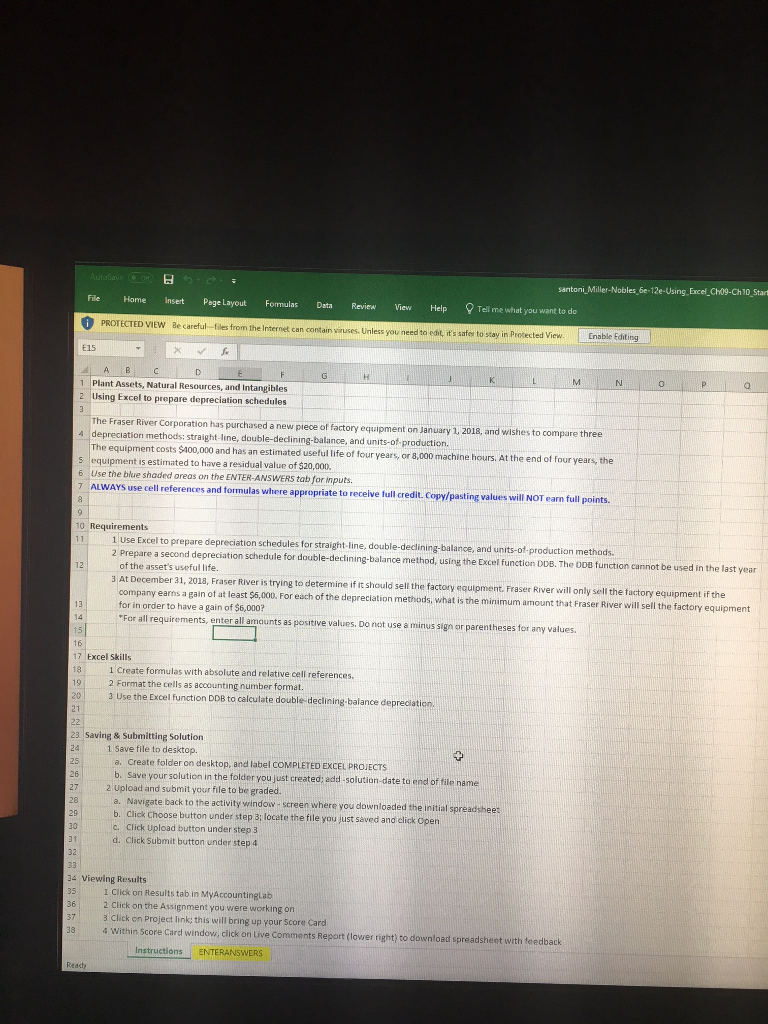

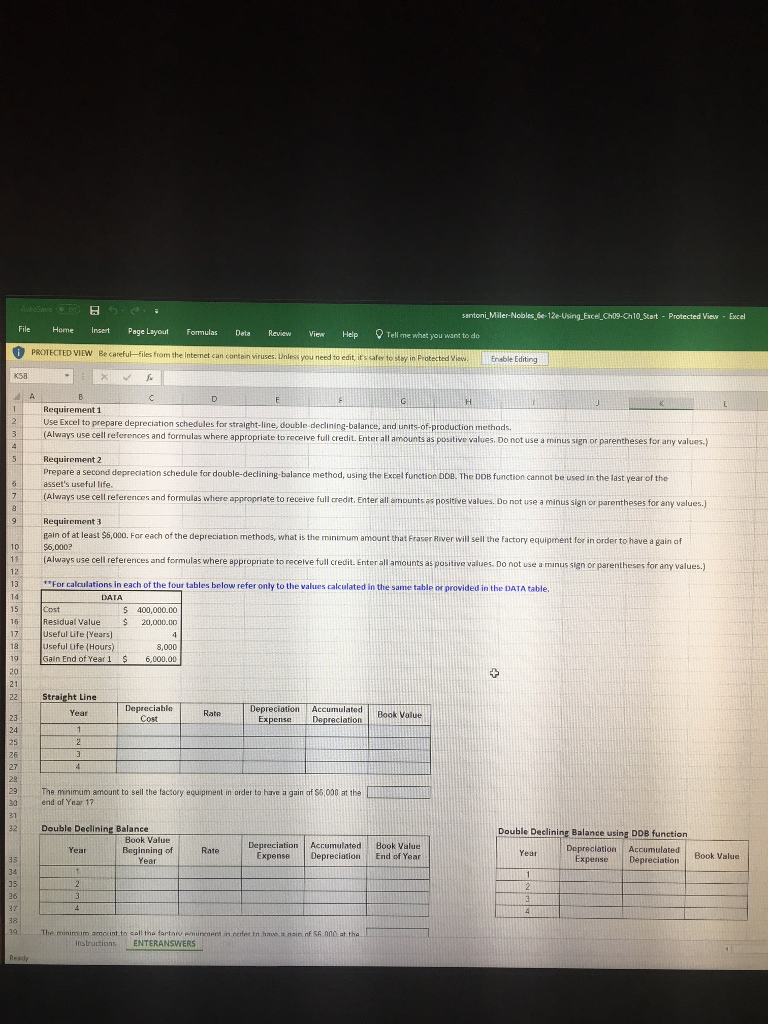

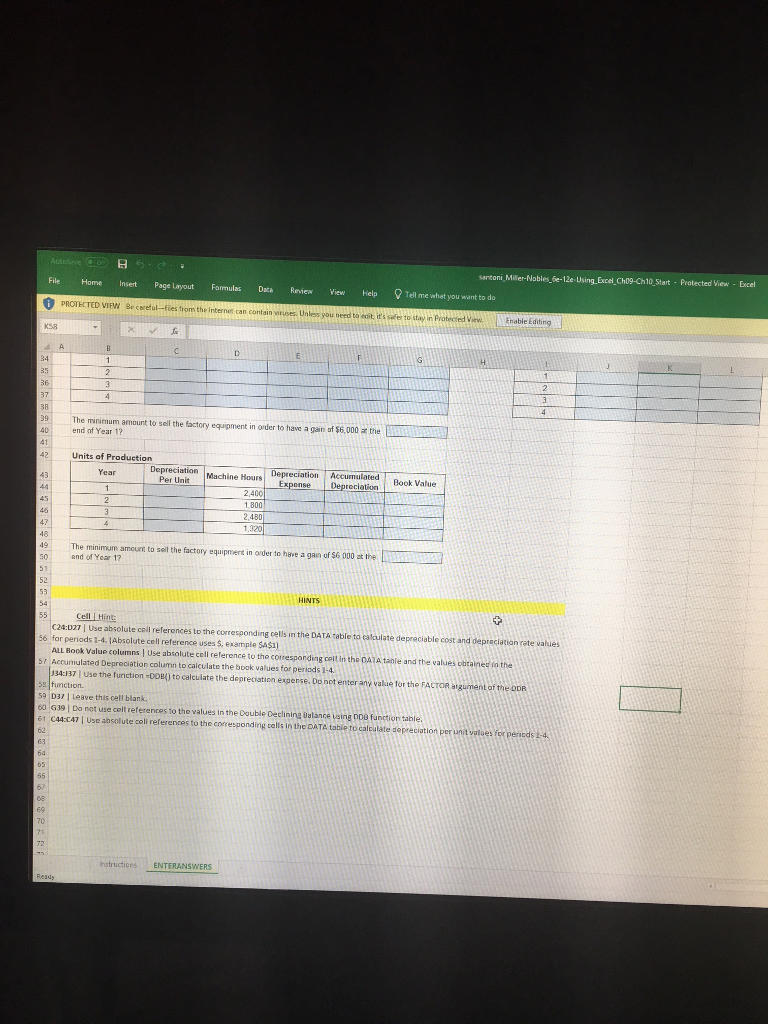

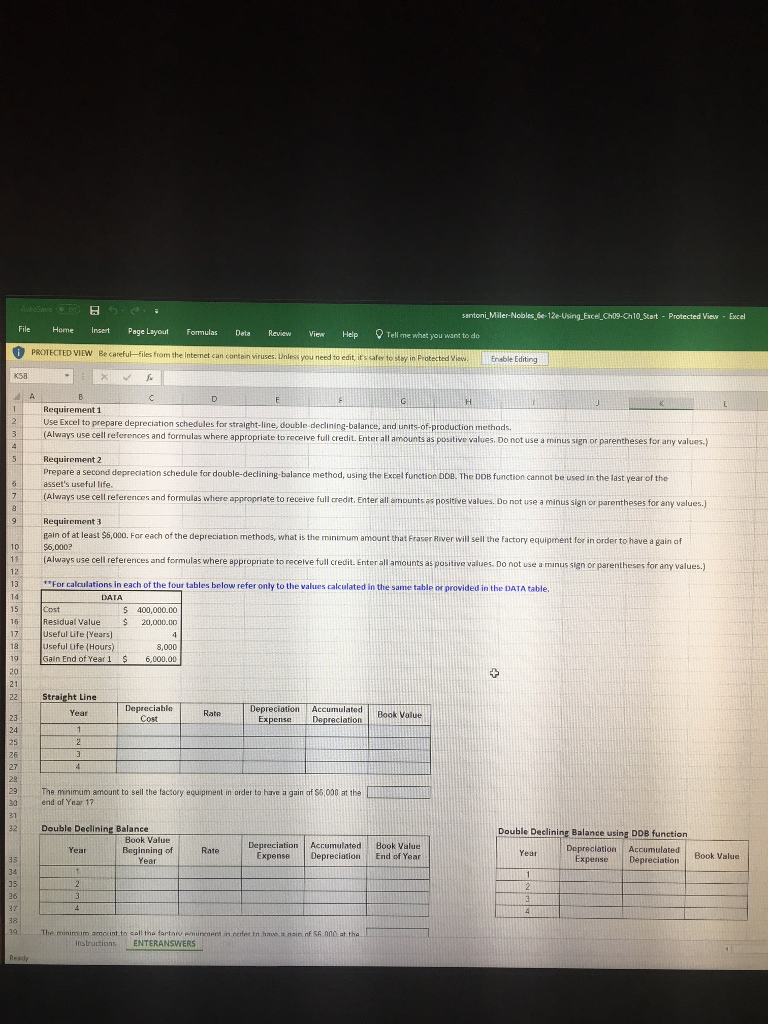

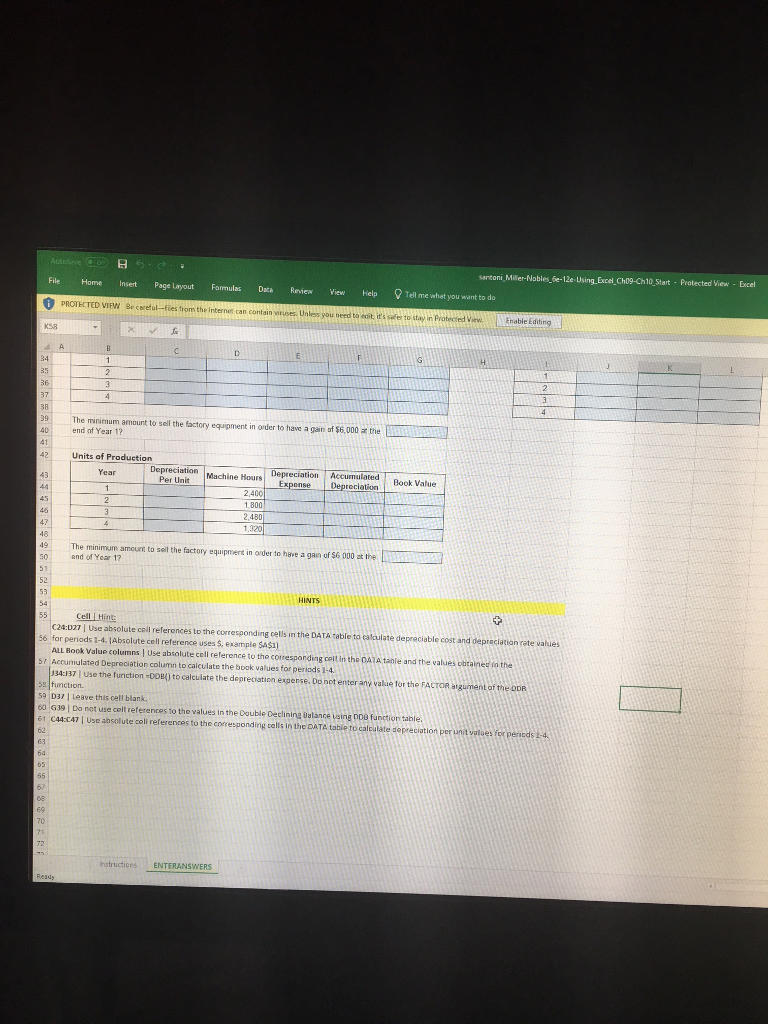

santoni Miller-Nobles 6e-12e-Using.Excel Cho9-Ch10 Star Page Layout Formulas Dsta Revien View Help Tell me what you want to do PROTECTED VIEW Be careful -files from the Internet can contain vinuses. Unless you need to edit, its safer to stay in Protect Enable Editing E15 0 Plant Assets, Natural Resources, and Intangibles lising Excel to prepare depreciation schedules 1 he Fraser River Corporation has purchased a new plece of factory equipment on January 1, 2018, and wishes to compare t depreciation methods: straight-line, double-declining-balance, and units-of production. costs $400,000and has an estimated useful life of four years, or 8.00 machine hours. At the end of four years, the 5 equipment is estimated to have a residual value of $20,000 7 ALWAYS use cell eferences and formulas where appropriate to recelve full credit. Copy/pasting values will NOT earn full points. Use the blue shaded areas on the ENTER-ANSWERS tab for inputs. 1 Use Excel to prepare depreciation schedules for straight-line, double-dedining-balance, and unitsofproduction methods. 2 Prepare a second depreciation schedule for double-decdining-balance method, usin g the Excel function DDB. The oDB function cannot be used in the last year of the asset's useful life. 3 At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum a for in order to have a gain of $6,000? For all req mount that Fraser River will sell the factory equipment quirements, enter all amounts as positive values. Do not use a minus signor parentheses for any values. 1 Excel Skills 1 Create formulas with absolute and relative cell references 2 Format the cells as accounting number format. Use the Excel function DDB to calculate double declining-balance depreciation. 21 23 Saving & Submitting Solution 1 Save file to desktop. a. Create folder on desktop, and label cOMPLETED EXCEL PROJECTS b. Save your solution in the folder youjust created: add solution-date to end of file name a. Navigate back to the activity window sereen where you downloaded the Initial spreadshee c. Click Upload button under step 3 d. Click Submit button under step 4 27 2 upload and submit your file to be graded. ose button under step 3; locate the file you just seved and click Open 4 Viewing Results 5 1 Click on Results tab in MyAccountinglab 36 2 Click on the Assignment you were working on 373 Click on Project link; this will bring up your Score Card a within Score Card windew, cick on live Comments Report(lower night) to download spreadsheet with teedback 38 Instructions ENTERANSWERS