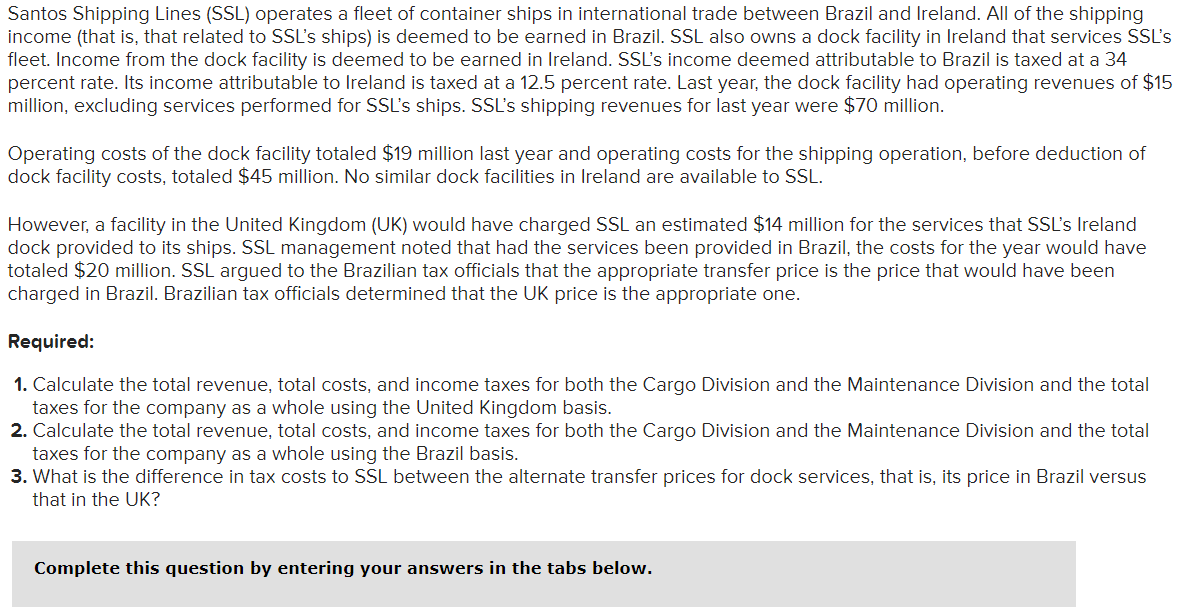

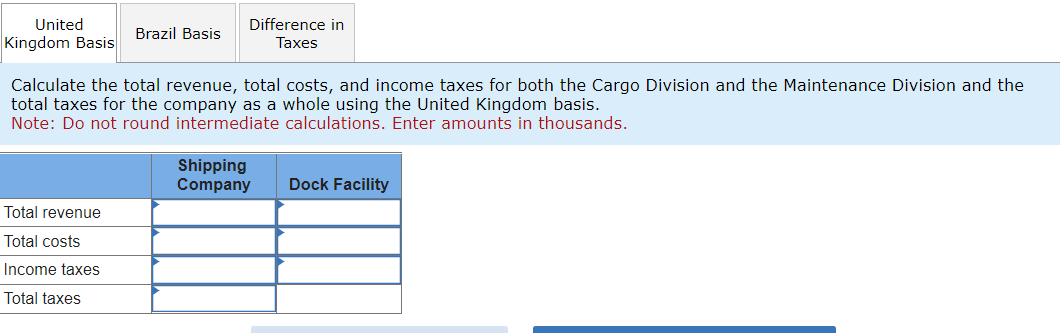

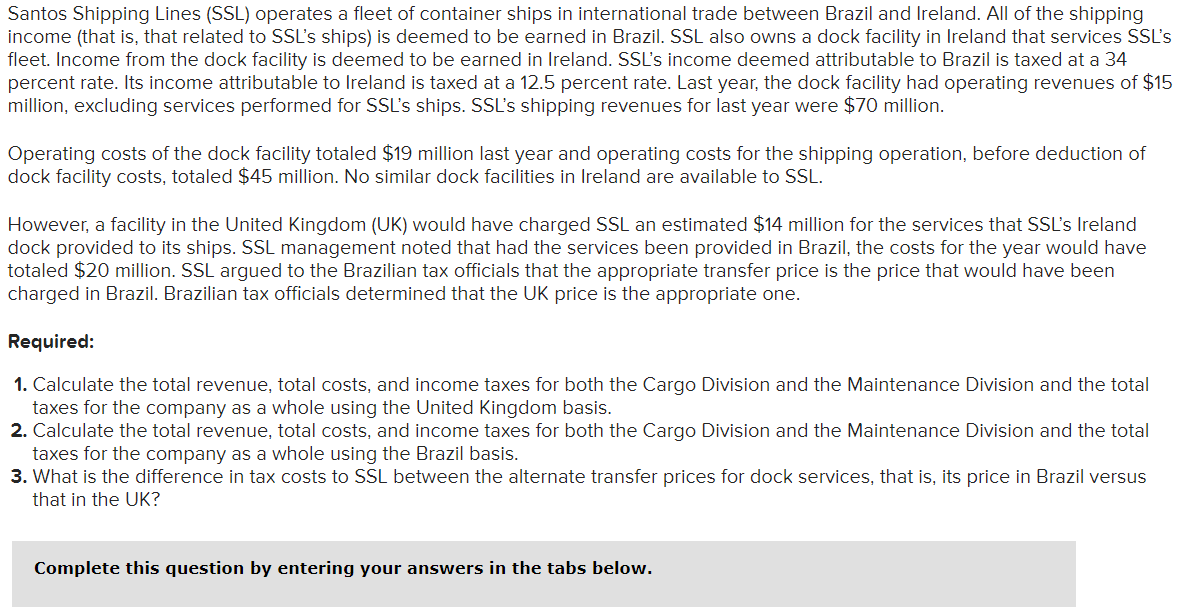

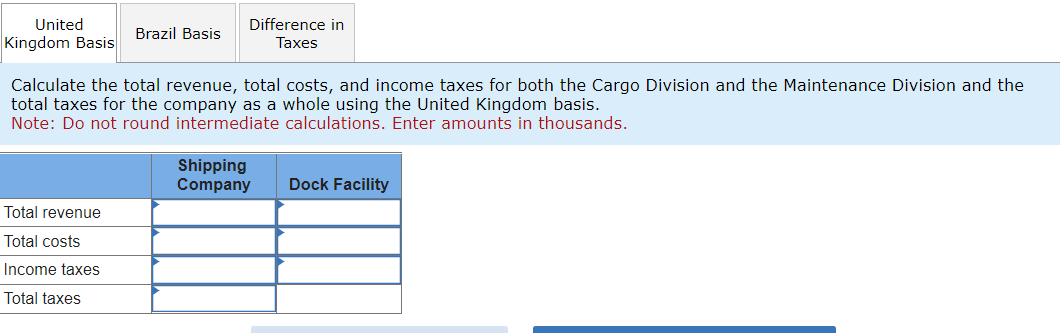

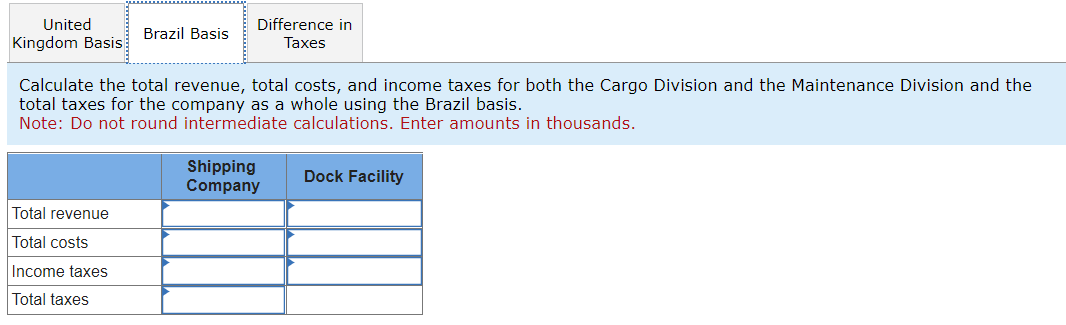

Santos Shipping Lines (SSL) operates a fleet of container ships in international trade between Brazil and Ireland. All of the shipping income (that is, that related to SSL's ships) is deemed to be earned in Brazil. SSL also owns a dock facility in Ireland that services SSL's fleet. Income from the dock facility is deemed to be earned in Ireland. SSL's income deemed attributable to Brazil is taxed at a 34 percent rate. Its income attributable to Ireland is taxed at a 12.5 percent rate. Last year, the dock facility had operating revenues of $15 million, excluding services performed for SSL's ships. SSL's shipping revenues for last year were $70 million. dock facility costs, totaled $45 million. No similar dock facilities in Ireland are available to SSL. However, a facility in the United Kingdom (UK) would have charged SSL an estimated \$14 million for the services that SSL's Ireland dock provided to its ships. SSL management noted that had the services been provided in Brazil, the costs for the year would have totaled $20 million. SSL argued to the Brazilian tax officials that the appropriate thansfer price is the price that charged in Brazil. Brazilian tax officials determined that the UK price is the appropriate one. Required: 1. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the United Kingdom basis. 2. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the Brazil basis. 3. What is the difference in tax costs to SSL between the alternate transfer prices for dock services, that is, its price in Brazil versus that in the UK? Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the United Kingdom basis. Note: Do not round intermediate calculations. Enter amounts in thousands. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the Brazil basis. Note: Do not round intermediate calculations. Enter amounts in thousands. What is the difference in tax costs to SSL between the alternate transfer prices for dock services, that is, its price in Brazil versus that in UK? Note: Do not round intermediate calculations. Enter amounts in thousands. Santos Shipping Lines (SSL) operates a fleet of container ships in international trade between Brazil and Ireland. All of the shipping income (that is, that related to SSL's ships) is deemed to be earned in Brazil. SSL also owns a dock facility in Ireland that services SSL's fleet. Income from the dock facility is deemed to be earned in Ireland. SSL's income deemed attributable to Brazil is taxed at a 34 percent rate. Its income attributable to Ireland is taxed at a 12.5 percent rate. Last year, the dock facility had operating revenues of $15 million, excluding services performed for SSL's ships. SSL's shipping revenues for last year were $70 million. dock facility costs, totaled $45 million. No similar dock facilities in Ireland are available to SSL. However, a facility in the United Kingdom (UK) would have charged SSL an estimated \$14 million for the services that SSL's Ireland dock provided to its ships. SSL management noted that had the services been provided in Brazil, the costs for the year would have totaled $20 million. SSL argued to the Brazilian tax officials that the appropriate thansfer price is the price that charged in Brazil. Brazilian tax officials determined that the UK price is the appropriate one. Required: 1. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the United Kingdom basis. 2. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the Brazil basis. 3. What is the difference in tax costs to SSL between the alternate transfer prices for dock services, that is, its price in Brazil versus that in the UK? Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the United Kingdom basis. Note: Do not round intermediate calculations. Enter amounts in thousands. Calculate the total revenue, total costs, and income taxes for both the Cargo Division and the Maintenance Division and the total taxes for the company as a whole using the Brazil basis. Note: Do not round intermediate calculations. Enter amounts in thousands. What is the difference in tax costs to SSL between the alternate transfer prices for dock services, that is, its price in Brazil versus that in UK? Note: Do not round intermediate calculations. Enter amounts in thousands