Sarasota Co. has the following defined benefit pension plan balances on January 1, 2020.

| Projected benefit obligation | | $4,576,000 |

| Fair value of plan assets | | 4,576,000 |

The interest (settlement) rate applicable to the plan is 10%. On January 1, 2021, the company amends its pension agreement so that prior service costs of $595,000 are created. Other data related to the pension plan are:

| | | 2020 | | 2021 |

| Service cost | | $151,000 | | | $170,000 | |

| Prior service cost amortization | | 0 | | | 89,000 | |

| Contributions (funding) to the plan | | 198,000 | | | 185,000 | |

| Benefits paid | | 222,000 | | | 280,000 | |

| Actual return on plan assets | | 254,000 | | | 349,000 | |

| Expected rate of return on assets | | 6 | % | | 8 | % |

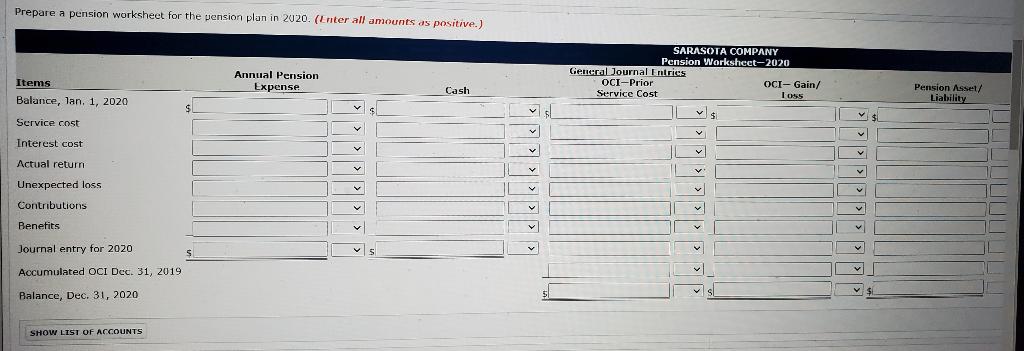

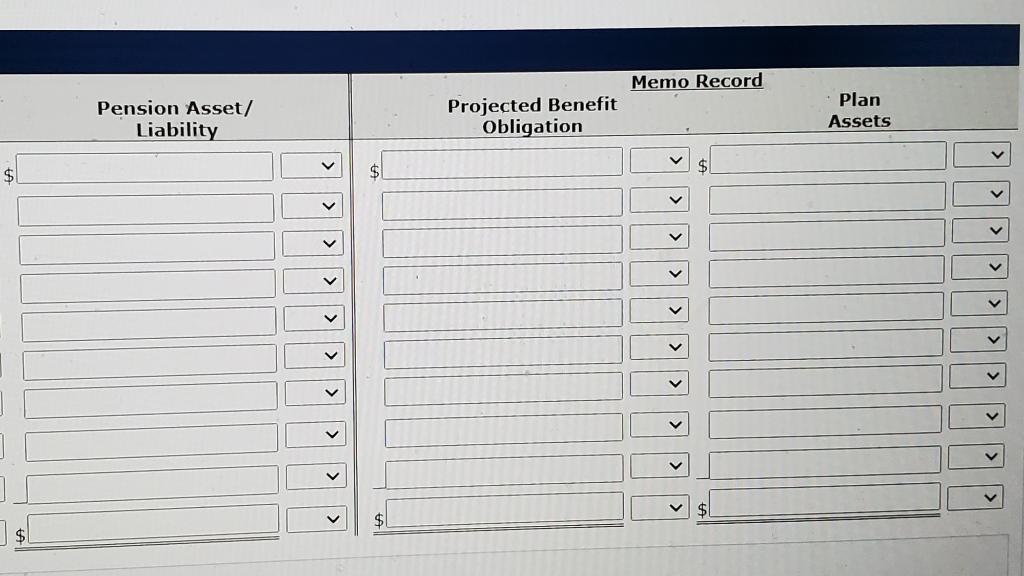

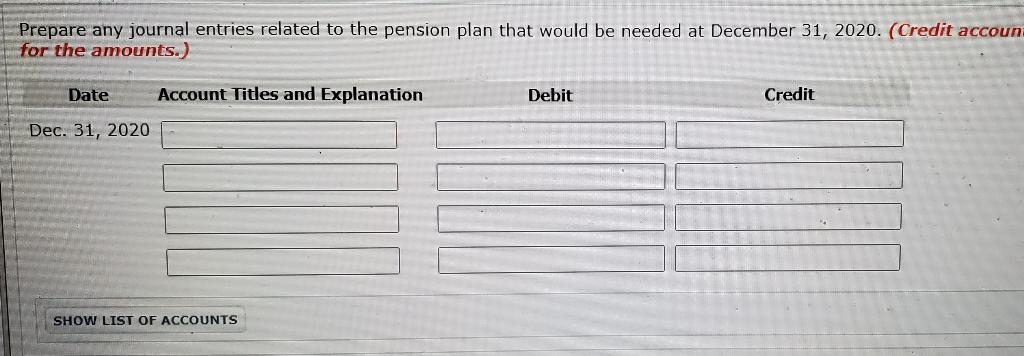

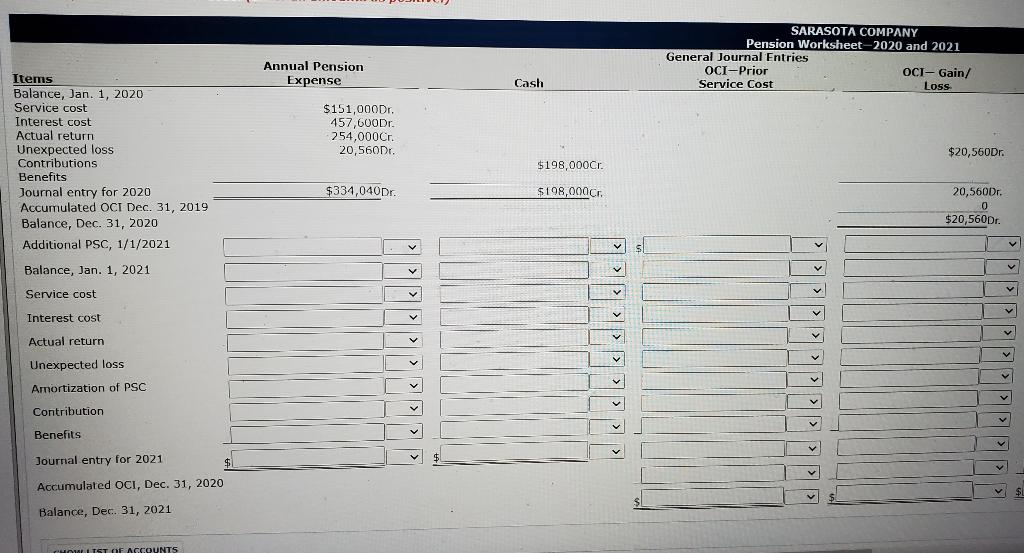

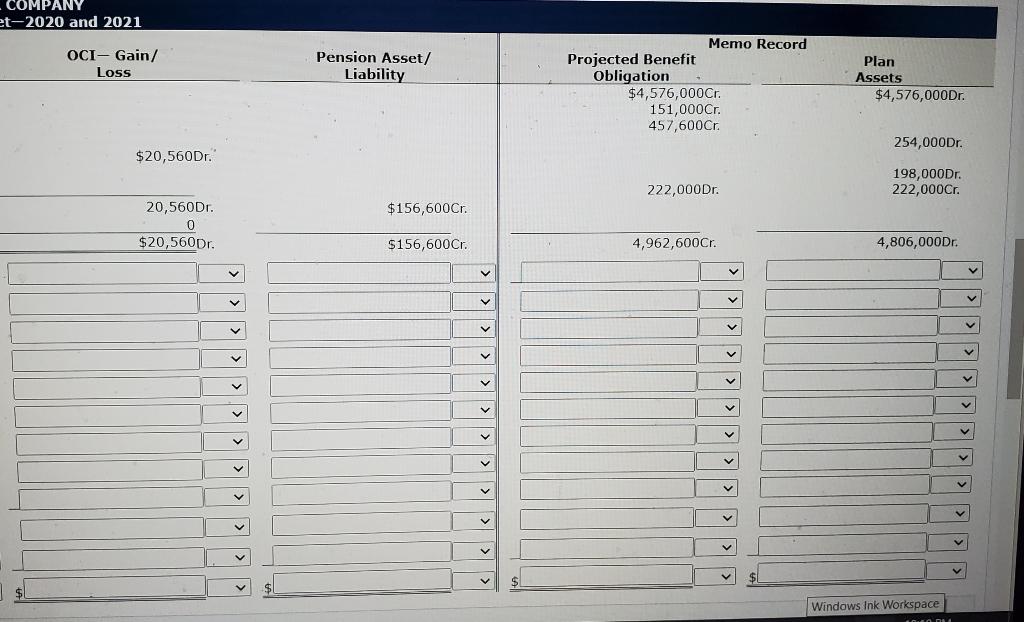

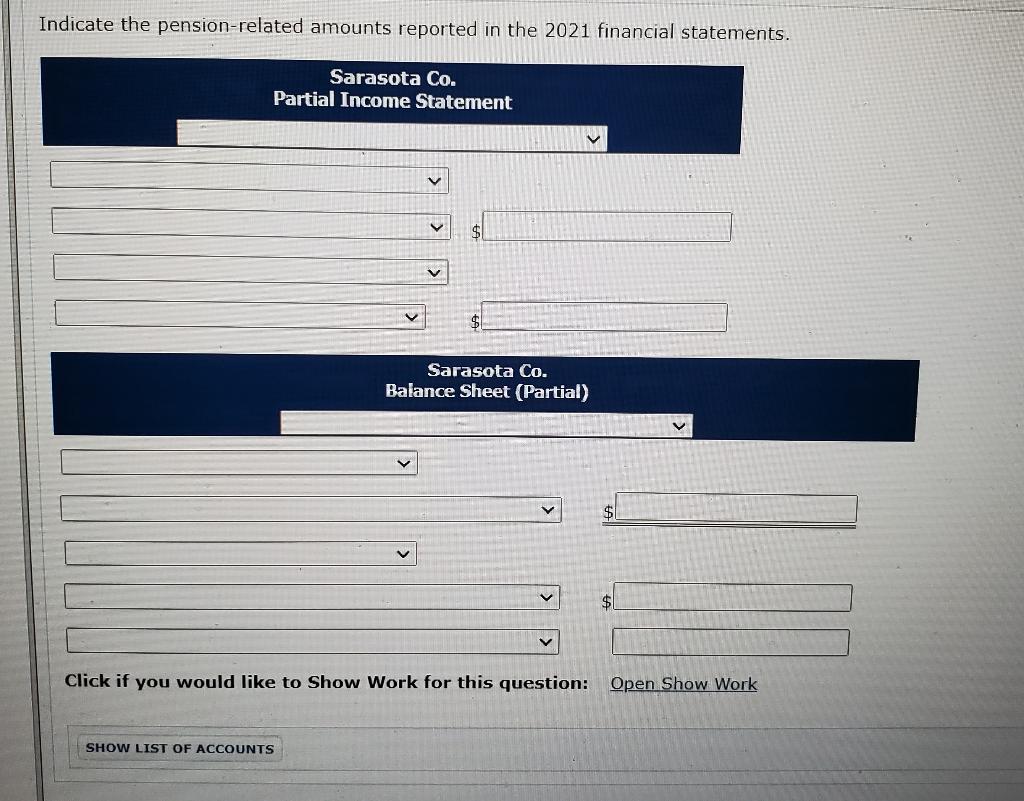

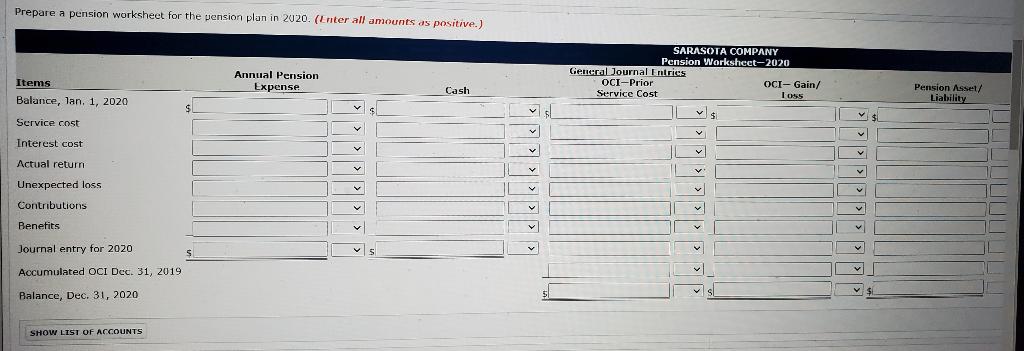

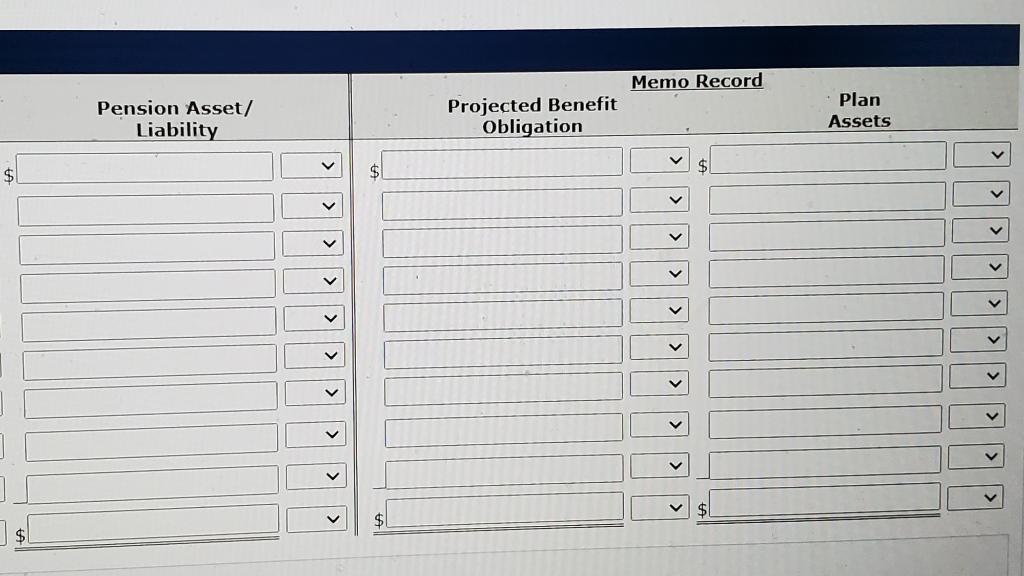

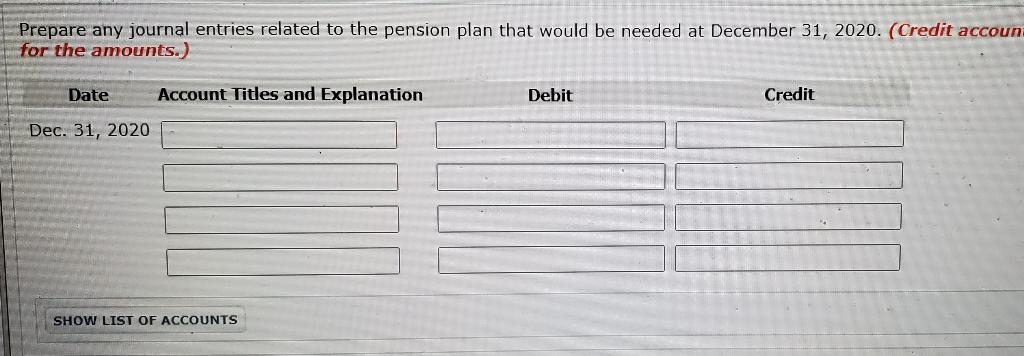

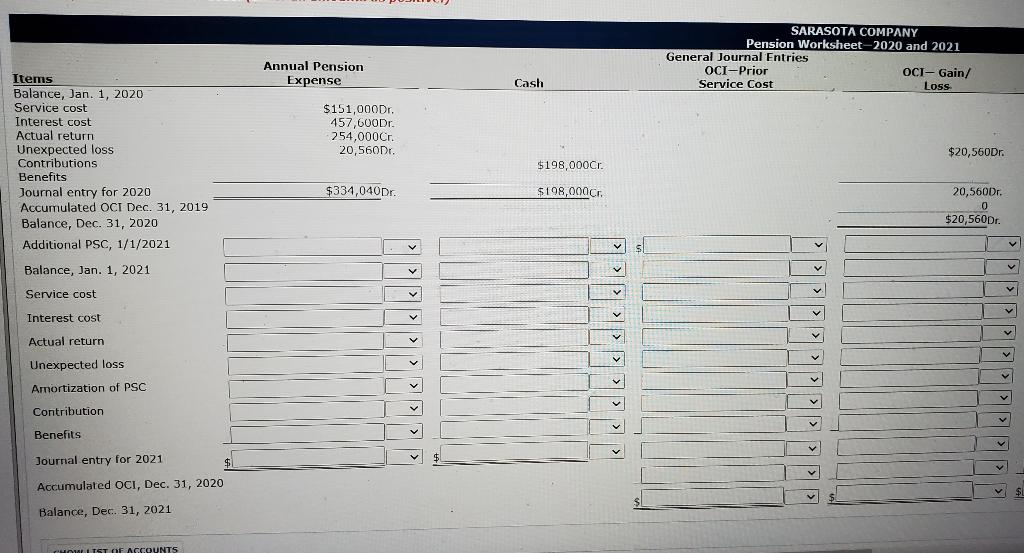

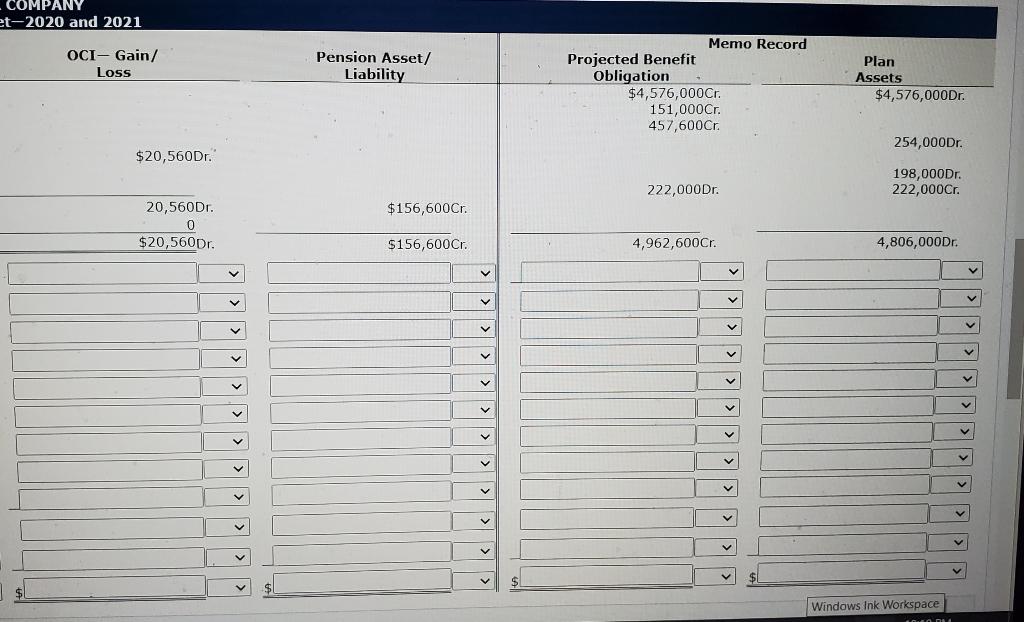

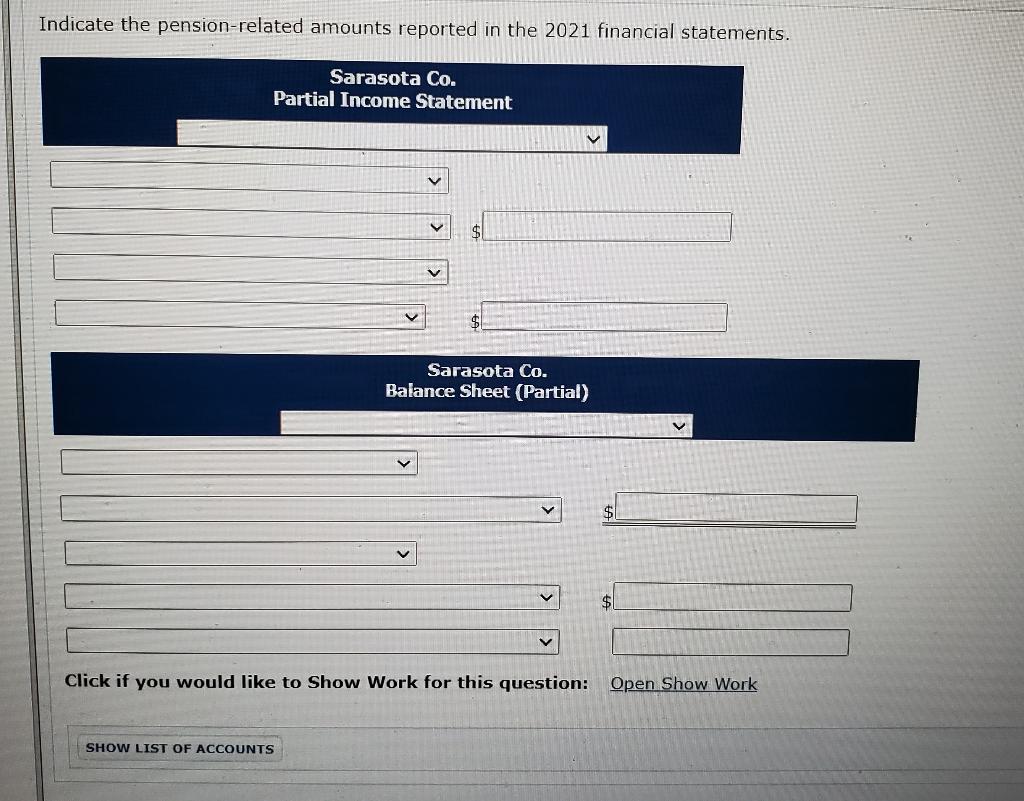

Prepare a pension worksheet for the pension plan in 2020. (Enter all amounts as positive.) SARASOTA COMPANY Pension Worksheet-2020 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Annual Pension Expense Items Balance, lan. 1, 2020 Cash Pension Asset/ Liability v $ Service cost v Interest cost v v Actual return v Y Unexpected loss Contributions v v Benefits v Journal entry for 2020 v S s Accumulated OCI Dec. 31, 2019 Balance, Dec. 31, 2020 SHOW LIST OF ACCOUNTS Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets > $ $ $ V > > $ $ Prepare any journal entries related to the pension plan that would be needed at December 31, 2020. (Credit accoun for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 SHOW LIST OF ACCOUNTS SARASOTA COMPANY Pension Worksheet-2020 and 2021 General Journal Entries OCI-Prior OCI- Gain/ Service Cost Loss Annual Pension Expense Cash $151,000Dr. 457,600Dr. 254,000Cr. 20,560Dr. $20,560Dr. Items Balance, Jan. 1, 2020 Service cost Interest cost Actual return Unexpected loss Contributions Benefits Journal entry for 2020 Accumulated OCI Dec. 31, 2019 Balance, Dec. 31, 2020 Additional PSC, 1/1/2021 $198,000Cr. $334,040Dr. $198,000C. 20,560Dr. C 0 $20,560Dr. V Balance, Jan. 1, 2021 Service cost V Interest cost Actual return Unexpected loss V Amortization of PSC Contribution Benefits Journal entry for 2021 kallas Accumulated OCI, Dec. 31, 2020 Balance, Dec. 31, 2021 LOW MOLIST OF ACCOUNTS COMPANY et-2020 and 2021 OCI - Gain/ Loss Pension Asset/ Liability Memo Record Projected Benefit Obligation $4,576,000Cr. 151,000Cr. 457,600C Plan Assets $4,576,000Dr. 254,000Dr. $20,560Dr. 222,000Dr. 198,000Dr. 222,000Cr. $156,600Cr. 20,560Dr. 0 $20,560Dr. $156,600Cr. 4,962,600Cr. 4,806,000Dr. V V v V v V v v > > V $1 Windows Ink Workspace OD Indicate the pension-related amounts reported in the 2021 financial statements. Sarasota Co. Partial Income Statement V V Sarasota Co. Balance Sheet (Partial) v $ y Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS Prepare a pension worksheet for the pension plan in 2020. (Enter all amounts as positive.) SARASOTA COMPANY Pension Worksheet-2020 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Annual Pension Expense Items Balance, lan. 1, 2020 Cash Pension Asset/ Liability v $ Service cost v Interest cost v v Actual return v Y Unexpected loss Contributions v v Benefits v Journal entry for 2020 v S s Accumulated OCI Dec. 31, 2019 Balance, Dec. 31, 2020 SHOW LIST OF ACCOUNTS Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets > $ $ $ V > > $ $ Prepare any journal entries related to the pension plan that would be needed at December 31, 2020. (Credit accoun for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 SHOW LIST OF ACCOUNTS SARASOTA COMPANY Pension Worksheet-2020 and 2021 General Journal Entries OCI-Prior OCI- Gain/ Service Cost Loss Annual Pension Expense Cash $151,000Dr. 457,600Dr. 254,000Cr. 20,560Dr. $20,560Dr. Items Balance, Jan. 1, 2020 Service cost Interest cost Actual return Unexpected loss Contributions Benefits Journal entry for 2020 Accumulated OCI Dec. 31, 2019 Balance, Dec. 31, 2020 Additional PSC, 1/1/2021 $198,000Cr. $334,040Dr. $198,000C. 20,560Dr. C 0 $20,560Dr. V Balance, Jan. 1, 2021 Service cost V Interest cost Actual return Unexpected loss V Amortization of PSC Contribution Benefits Journal entry for 2021 kallas Accumulated OCI, Dec. 31, 2020 Balance, Dec. 31, 2021 LOW MOLIST OF ACCOUNTS COMPANY et-2020 and 2021 OCI - Gain/ Loss Pension Asset/ Liability Memo Record Projected Benefit Obligation $4,576,000Cr. 151,000Cr. 457,600C Plan Assets $4,576,000Dr. 254,000Dr. $20,560Dr. 222,000Dr. 198,000Dr. 222,000Cr. $156,600Cr. 20,560Dr. 0 $20,560Dr. $156,600Cr. 4,962,600Cr. 4,806,000Dr. V V v V v V v v > > V $1 Windows Ink Workspace OD Indicate the pension-related amounts reported in the 2021 financial statements. Sarasota Co. Partial Income Statement V V Sarasota Co. Balance Sheet (Partial) v $ y Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS