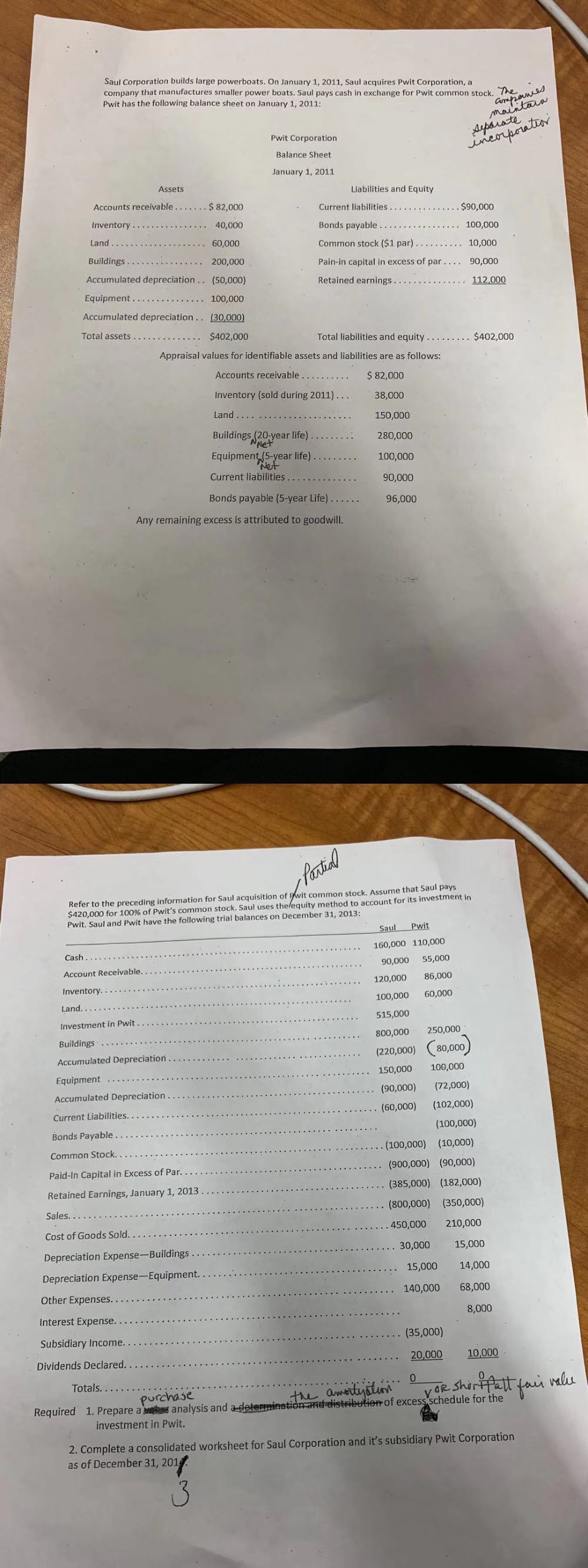

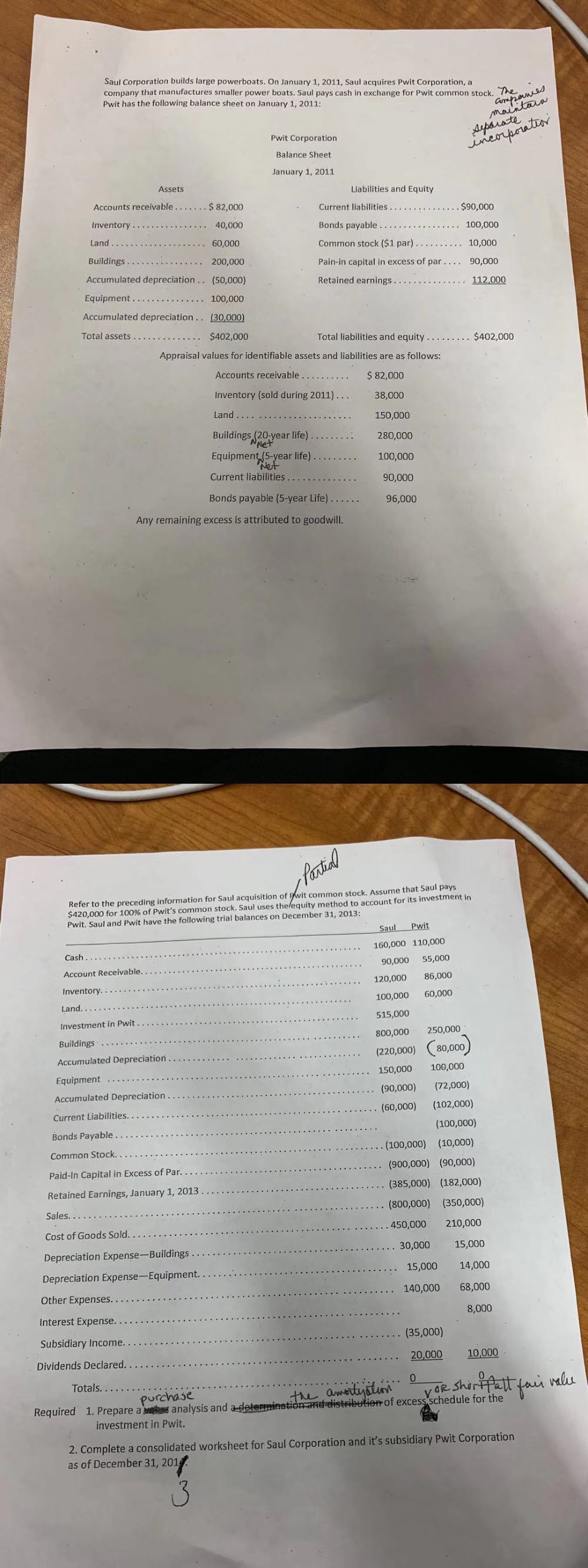

Saul Corporation builds large powerboats. On January 1, 2011, Saul acquires Pwit Corporation, a company that manufactures smaller power boats. Saul pays cash in exchange for Pwit common stock. The we Pwit has the following balance sheet on January 1, 2011: ampanes maintain separate. incorporation Pwit Corporation Balance Sheet January 1, 2011 Assets Liabilities and Equity Accounts receivable....... $ 82,000 Current liabilities............... $90,000 Inventory.. ........ 40,000 Bonds payable ................. 100,000 Land .................... 60,000 Common stock ($1 par).......... 10,000 Buildings................ 200,000 Pain-in capital in excess of par.... 90,000 Accumulated depreciation .. (50,000) Retained earnings ............... 112,000 Equipment ...... 100,000 Accumulated depreciation.. (30,000) Total assets .............. $402,000 Total liabilities and equity ......... $402,000 Appraisal values for identifiable assets and liabilities are as follows: Accounts receivable.......... $ 82,000 Inventory (sold during 2011)... 38,000 Land ....................... 150,000 Buildings (20-year life)......... Net Equipment (5-year life)......... Net Current liabilities. 280,000 100,000 90,000 Bonds payable (5-year Life)...... 96,000 Any remaining excess is attributed to goodwill. Refer to the preceding information for Saul acquisition of wit common stock. Assume that Saul pays $420,000 for 100% of Pwit's common stock. Saul uses thelequity method to account for its investment in Pwit. Saul and Pwit have the following trial balances on December 31, 2013: Saul Pwit Cash................. 160,000 110,000 Account Receivable.... 90,000 55,000 Inventory............... 120,000 86,000 Land............. 100,000 60,000 Investment in Pwit..... 515,000 Buildings 800,000 250,000 Accumulated Depreciation...... (220,000) (80,000) Equipment 150,000 100,000 Accumulated Depreciation .... (90,000) (72,000) Current Liabilities. ..... (60,000) (102,000) Bonds Payable....... (100,000) Common Stock. ........ .. (100,000) (10,000) Paid-In Capital in Excess of Par........ (900,000) (90,000) Retained Earnings, January 1, 2013... . (385,000) (182,000) Sales.......................... ... (800,000) (350,000) Cost of Goods Sold. ............... .......450,000 210,000 Depreciation Expense-Buildings ..... . 30,000 15,000 Depreciation Expense-Equipment. ... ......... 15,000 14,000 Other Expenses......... ........ 140,000 68,000 Interest Expense........ 8,000 Subsidiary Income........ .. (35,000) Dividends Declared........ 20,000 10,000 purchase Bu Totals........ the amortization for shortfall fan value Required 1. Prepare awe analysis and a determination and distribution of excess schedule for the investment in Pwit. 2. Complete a consolidated worksheet for Saul Corporation and it's subsidiary Pwit Corporation as of December 31, 2014 Saul Corporation builds large powerboats. On January 1, 2011, Saul acquires Pwit Corporation, a company that manufactures smaller power boats. Saul pays cash in exchange for Pwit common stock. The we Pwit has the following balance sheet on January 1, 2011: ampanes maintain separate. incorporation Pwit Corporation Balance Sheet January 1, 2011 Assets Liabilities and Equity Accounts receivable....... $ 82,000 Current liabilities............... $90,000 Inventory.. ........ 40,000 Bonds payable ................. 100,000 Land .................... 60,000 Common stock ($1 par).......... 10,000 Buildings................ 200,000 Pain-in capital in excess of par.... 90,000 Accumulated depreciation .. (50,000) Retained earnings ............... 112,000 Equipment ...... 100,000 Accumulated depreciation.. (30,000) Total assets .............. $402,000 Total liabilities and equity ......... $402,000 Appraisal values for identifiable assets and liabilities are as follows: Accounts receivable.......... $ 82,000 Inventory (sold during 2011)... 38,000 Land ....................... 150,000 Buildings (20-year life)......... Net Equipment (5-year life)......... Net Current liabilities. 280,000 100,000 90,000 Bonds payable (5-year Life)...... 96,000 Any remaining excess is attributed to goodwill. Refer to the preceding information for Saul acquisition of wit common stock. Assume that Saul pays $420,000 for 100% of Pwit's common stock. Saul uses thelequity method to account for its investment in Pwit. Saul and Pwit have the following trial balances on December 31, 2013: Saul Pwit Cash................. 160,000 110,000 Account Receivable.... 90,000 55,000 Inventory............... 120,000 86,000 Land............. 100,000 60,000 Investment in Pwit..... 515,000 Buildings 800,000 250,000 Accumulated Depreciation...... (220,000) (80,000) Equipment 150,000 100,000 Accumulated Depreciation .... (90,000) (72,000) Current Liabilities. ..... (60,000) (102,000) Bonds Payable....... (100,000) Common Stock. ........ .. (100,000) (10,000) Paid-In Capital in Excess of Par........ (900,000) (90,000) Retained Earnings, January 1, 2013... . (385,000) (182,000) Sales.......................... ... (800,000) (350,000) Cost of Goods Sold. ............... .......450,000 210,000 Depreciation Expense-Buildings ..... . 30,000 15,000 Depreciation Expense-Equipment. ... ......... 15,000 14,000 Other Expenses......... ........ 140,000 68,000 Interest Expense........ 8,000 Subsidiary Income........ .. (35,000) Dividends Declared........ 20,000 10,000 purchase Bu Totals........ the amortization for shortfall fan value Required 1. Prepare awe analysis and a determination and distribution of excess schedule for the investment in Pwit. 2. Complete a consolidated worksheet for Saul Corporation and it's subsidiary Pwit Corporation as of December 31, 2014