Save A Lot Store is a local discount store with the following information:

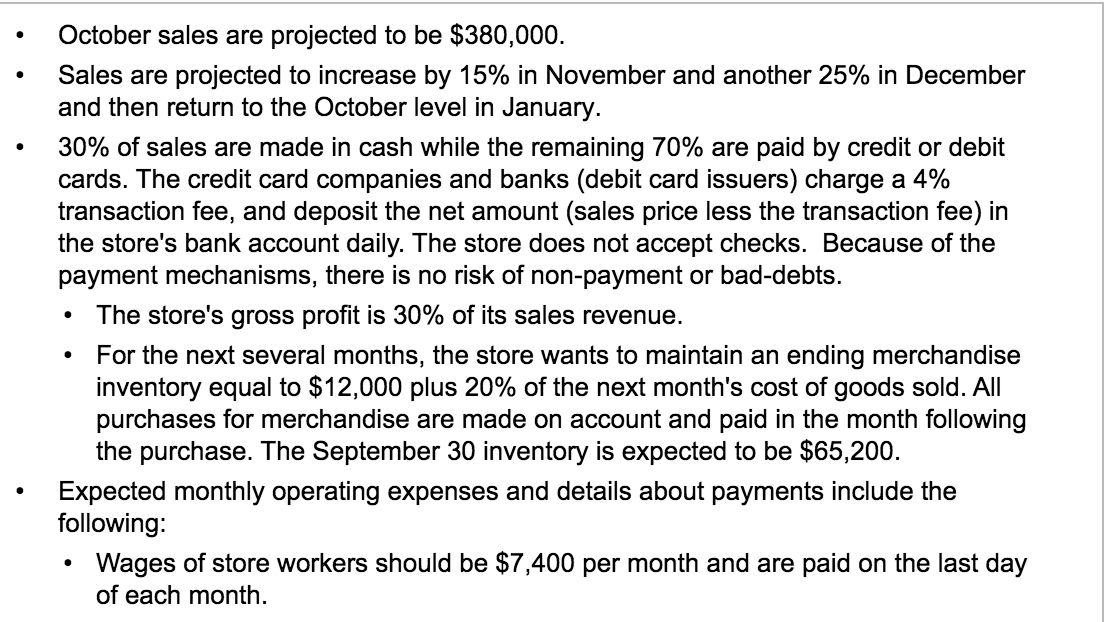

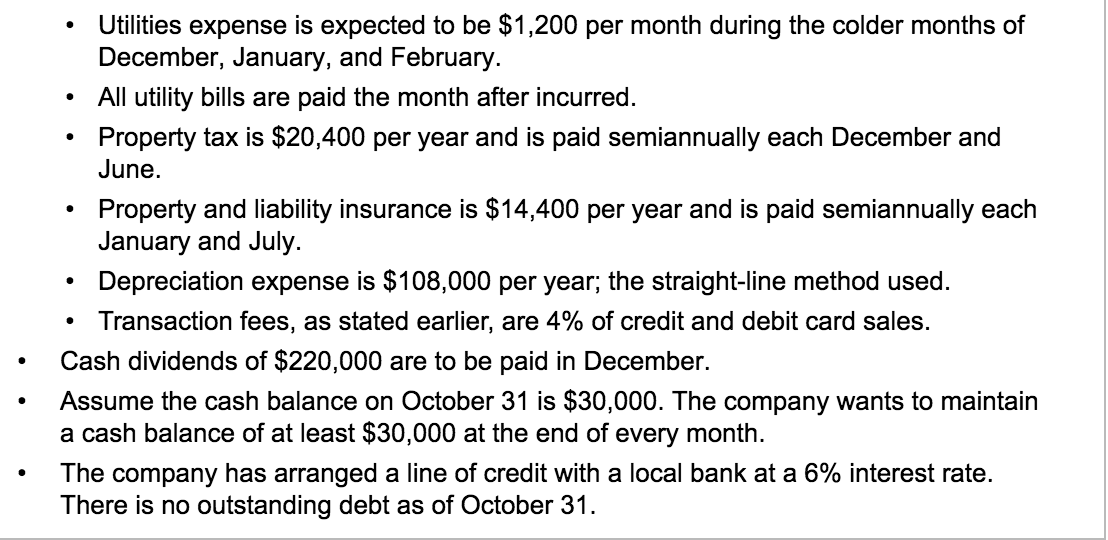

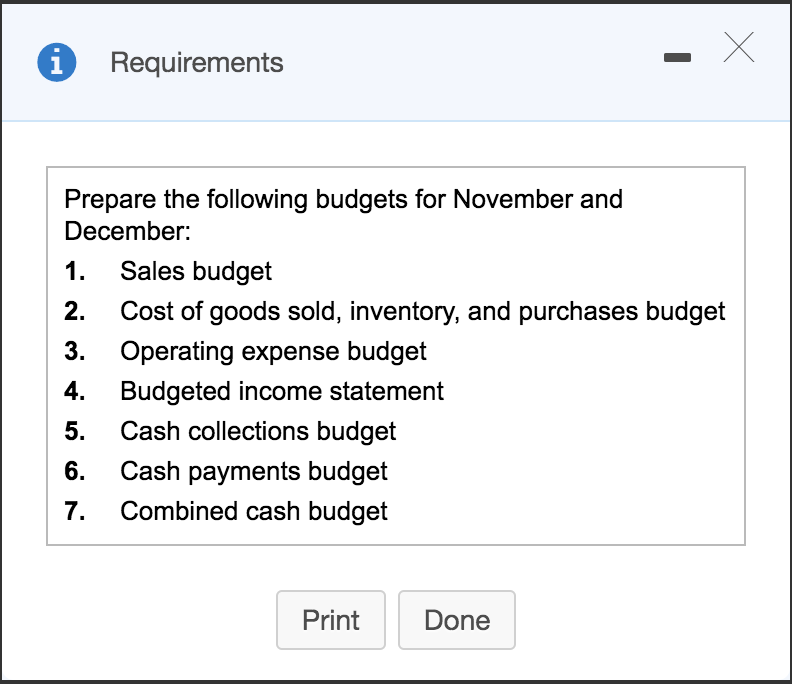

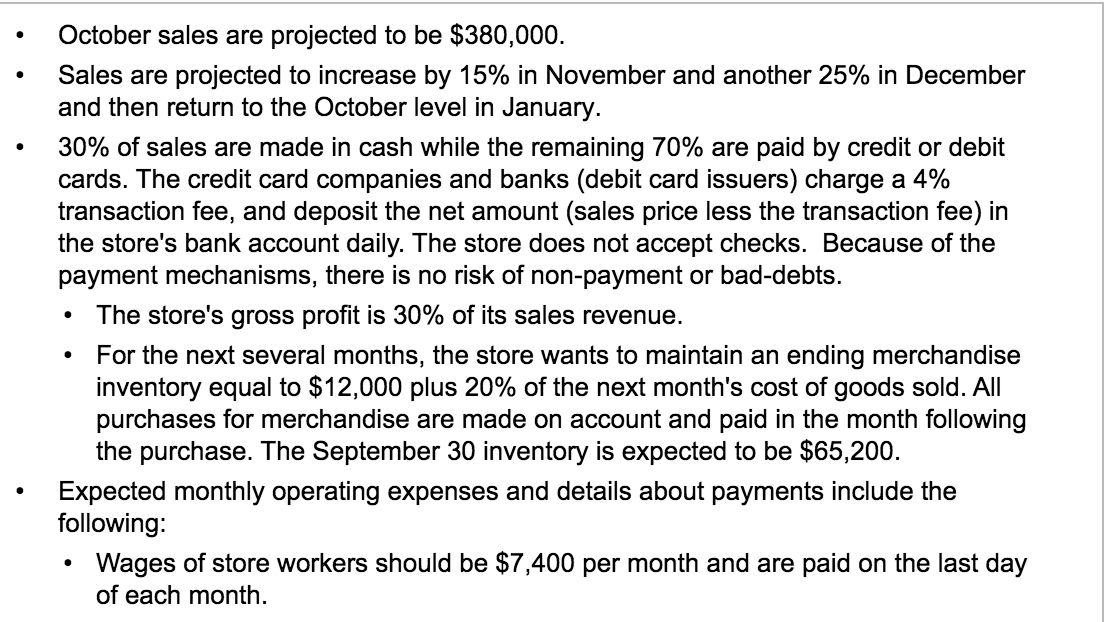

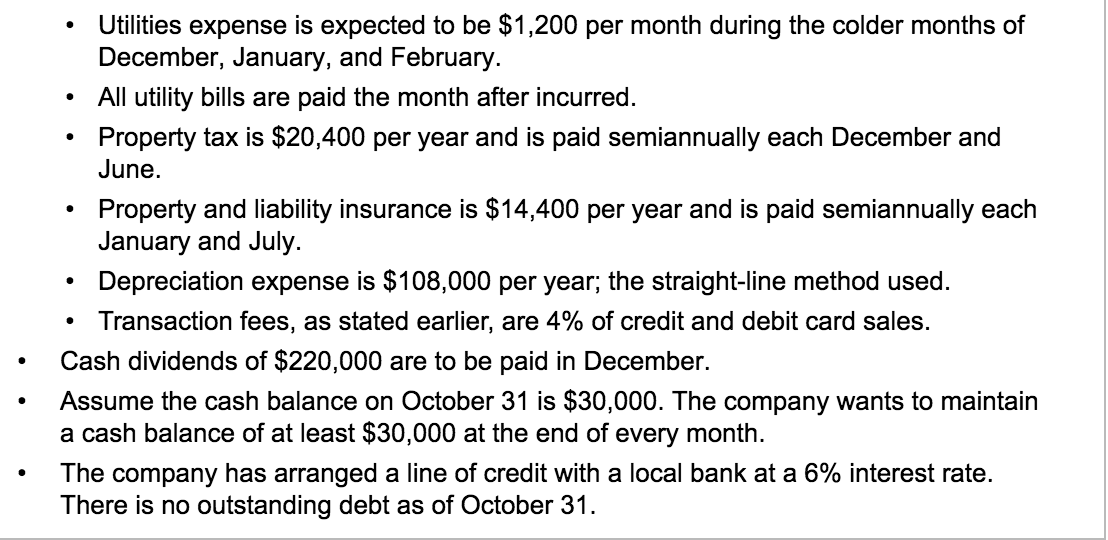

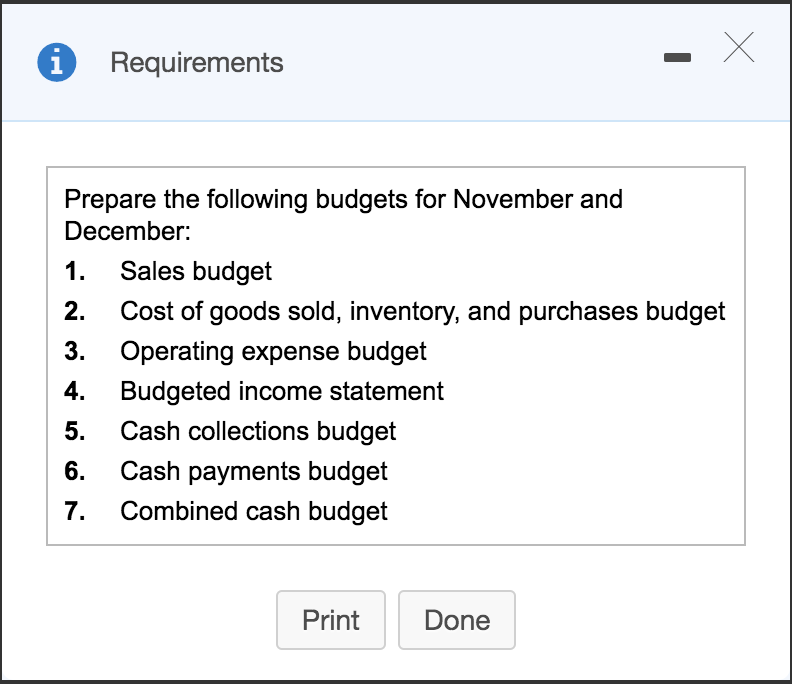

October sales are projected to be $380,000. Sales are projected to increase by 15% in November and another 25% in December and then return to the October level in January. 30% of sales are made in cash while the remaining 70% are paid by credit or debit cards. The credit card a credit card companies and banks (debit card issuers) charge a 4% transaction fee, and deposit the net amount (sales price less the transaction fee) in the store's bank account daily. The store does not accept checks. Because of the payment mechanisms, there is no risk of non-payment or bad-debts. The store's gross profit is 30% of its sales revenue. For the next several months, the store wants to maintain an ending merchandise inventory equal to $12,000 plus 20% of the next month's cost of goods sold. All purchases for merchandise are made on account and paid in the month following the purchase. The September 30 inventory is expected to be $65,200. Expected monthly operating expenses and details about payments include the following: Wages of store workers should be $7,400 per month and are paid on the last day of each month. Utilities expense is expected to be $1,200 per month during the colder months of December, January, and February. All utility bills are paid the month after incurred. Property tax is $20,400 per year and is paid semiannually each December and June. Property and liability insurance is $14,400 per year and is paid semiannually each January and July. Depreciation expense is $108,000 per year; the straight-line method used. Transaction fees, as stated earlier, are 4% of credit and debit card sales. Cash dividends of $220,000 are to be paid in December. Assume the cash balance on October 31 is $30,000. The company wants to maintain a cash balance of at least $30,000 at the end of every month. The company has arranged a line of credit with a local bank at a 6% interest rate. There is no outstanding debt as of October 31. i Requirements Prepare the following budgets for November and December: 1. Sales budget 2. Cost of goods sold, inventory, and purchases budget 3. Operating expense budget 4. Budgeted income statement 5. Cash collections budget 6. Cash payments budget 7. Combined cash budget Print Done