Answered step by step

Verified Expert Solution

Question

1 Approved Answer

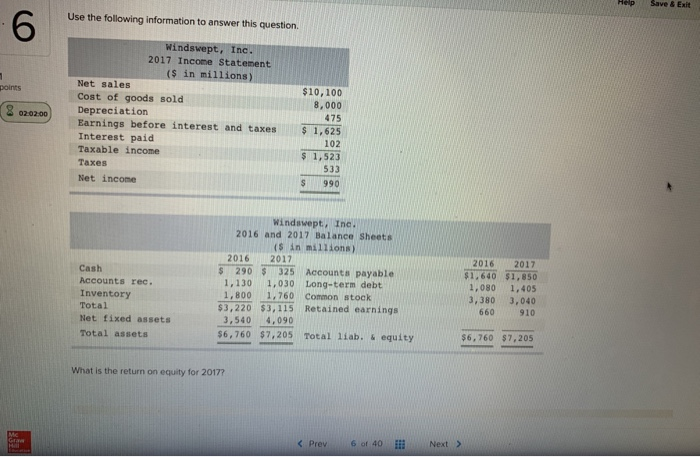

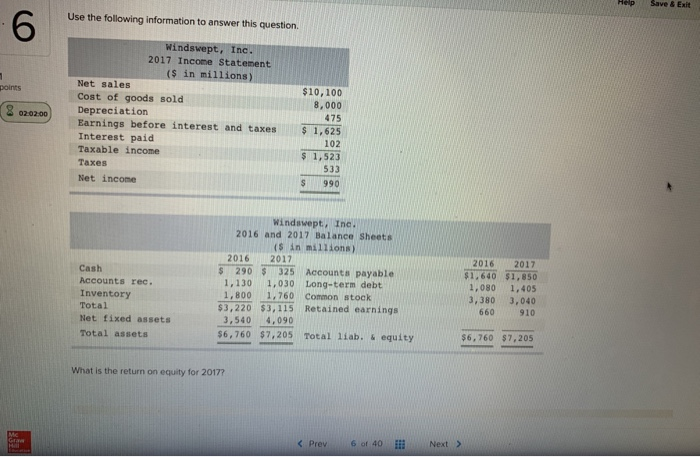

Save & Exit Use the following information to answer this question. 6 points 02:02:00 Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost

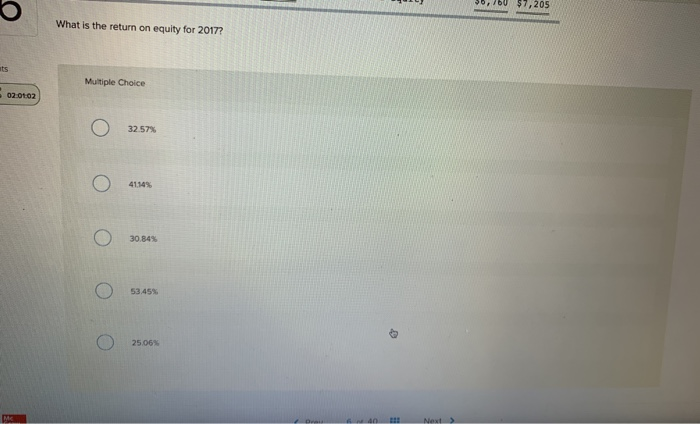

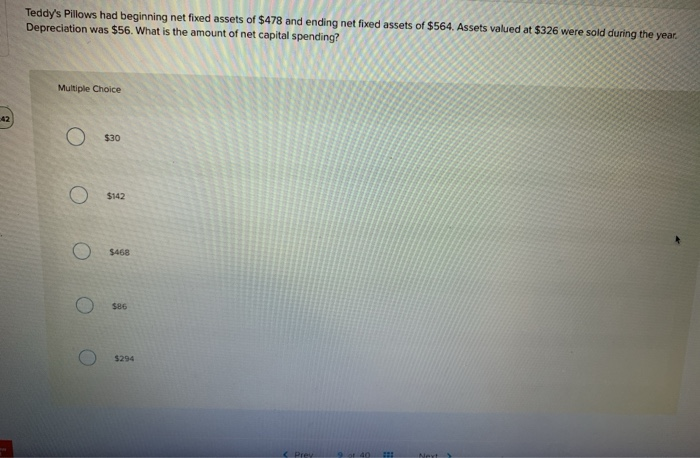

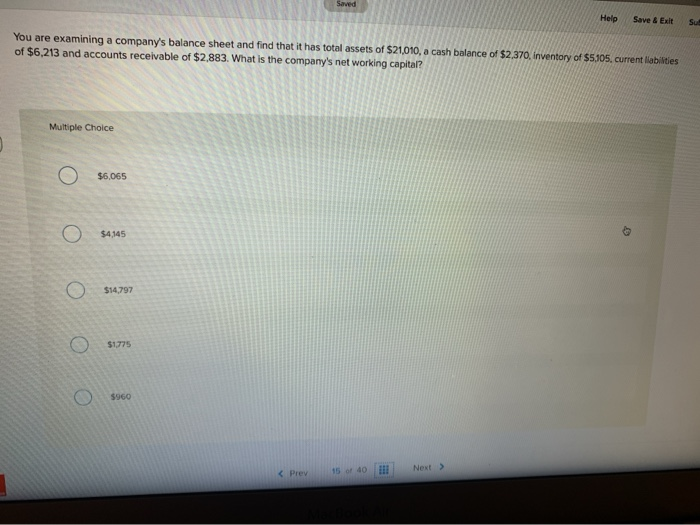

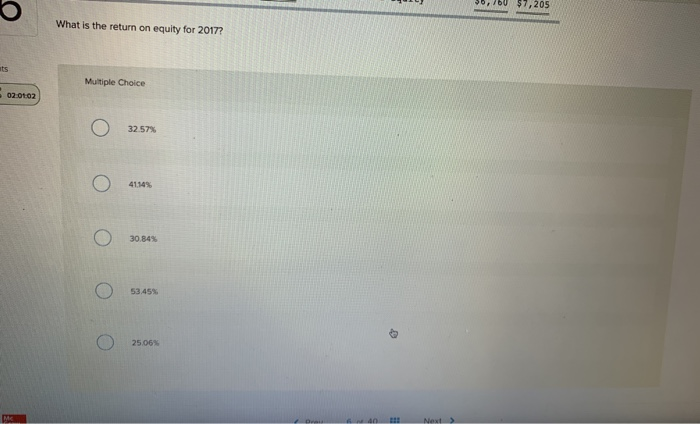

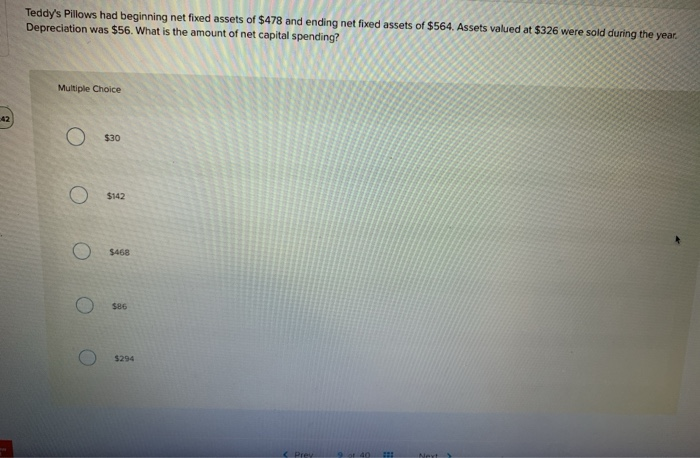

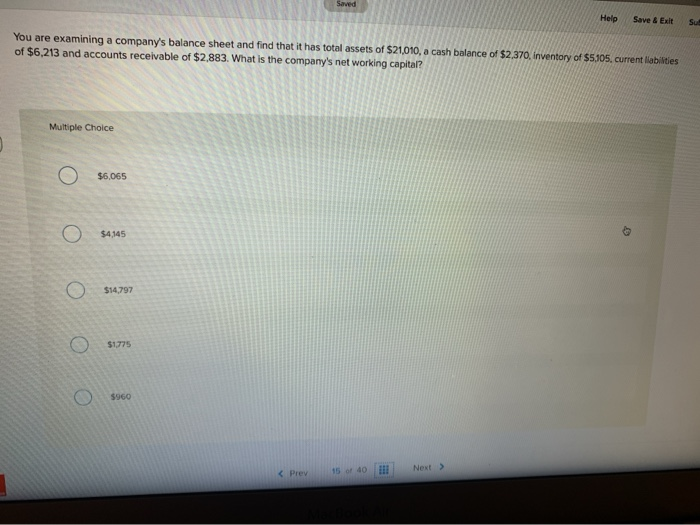

Save & Exit Use the following information to answer this question. 6 points 02:02:00 Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $10,100 8,000 475 $ 1,625 102 $ 1,523 533 $ 990 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Ine. 2016 and 2017 Balance Sheets (s in millions) 2016 2017 $ 290 $ 325 Accounts payable 1,130 1,030 Long-term debt 1,800 1,760 Common stock $3,220 $3,115 Retained earnings 3,540 4,090 $6,760 $7,205 Total liab. & equity 2016 2017 $1,640 $1,850 1,080 1.405 3,380 3,040 660 910 $6,760 $7,205 What is the return on equity for 2017? MC 0,160 O $7,205 What is the return on equity for 2017? ats Multiple Choice 020102 32.57% 41.14% 30.84% 53.45% 25.06% NA Teddy's Pillows had beginning net fixed assets of $478 and ending net fixed assets of $564 Assets valued at $326 were sold during the year. Depreciation was $56. What is the amount of net capital spending? Multiple Choice $30 O $142 $468 O $86 $294 Prey 9 Saved Help Save & Exit Sut You are examining a company's balance sheet and find that it has total assets of $21,010, a cash balance of $2,370, inventory of $5,105. current liabilities of $6.213 and accounts receivable of $2,883. What is the company's net working capital? Multiple Choice $6,065 O $4,345 O $14,797 $1,775 5960

Save & Exit Use the following information to answer this question. 6 points 02:02:00 Windswept, Inc. 2017 Income Statement ($ in millions) Net sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income $10,100 8,000 475 $ 1,625 102 $ 1,523 533 $ 990 Cash Accounts rec. Inventory Total Net fixed assets Total assets Windswept, Ine. 2016 and 2017 Balance Sheets (s in millions) 2016 2017 $ 290 $ 325 Accounts payable 1,130 1,030 Long-term debt 1,800 1,760 Common stock $3,220 $3,115 Retained earnings 3,540 4,090 $6,760 $7,205 Total liab. & equity 2016 2017 $1,640 $1,850 1,080 1.405 3,380 3,040 660 910 $6,760 $7,205 What is the return on equity for 2017? MC 0,160 O $7,205 What is the return on equity for 2017? ats Multiple Choice 020102 32.57% 41.14% 30.84% 53.45% 25.06% NA Teddy's Pillows had beginning net fixed assets of $478 and ending net fixed assets of $564 Assets valued at $326 were sold during the year. Depreciation was $56. What is the amount of net capital spending? Multiple Choice $30 O $142 $468 O $86 $294 Prey 9 Saved Help Save & Exit Sut You are examining a company's balance sheet and find that it has total assets of $21,010, a cash balance of $2,370, inventory of $5,105. current liabilities of $6.213 and accounts receivable of $2,883. What is the company's net working capital? Multiple Choice $6,065 O $4,345 O $14,797 $1,775 5960

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started